Priceline 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

to be performed in a prior period were not performed as contemplated or did not comply with the agency’s requirements,

Booking.com may lose its certificate and, as a result, the Innovation Box Tax benefit may be reduced or eliminated.

After the Initial Period, Booking.com intends to reapply for continued Innovation Box Tax treatment for future

periods. There can be no assurance that Booking.com’s application will be accepted, or that the amount of qualifying earnings

or applicable tax rates will not be reduced at that time. In addition, there can be no assurance that the tax law will not change

in future years resulting in a reduction or elimination of the tax benefit.

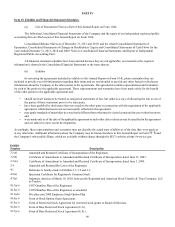

Redeemable Noncontrolling Interests

Net income attributable to noncontrolling interests

Year Ended

December 31,

($000)

2010

$ 601 2009 n/a

Changen/a

Noncontrolling interests for the year ended December 31, 2010, represents the proportionate share of the net income

of TravelJigsaw Holdings Limited for the period of May 18, 2010 through December 31, 2010, applicable to the noncontrolling

interests (refer to Note 13 of the Consolidated Financial Statements).

Liquidity and Capital Resources

As of December 31, 2011, we had $2.7 billion in cash, cash equivalents and short-term investments. Approximately

$1.6 billion of our cash, cash equivalents and short-term investments are held by our international subsidiaries and are

denominated primarily in Euros and, to a lesser extent, in British Pound Sterling. We currently intend to permanently reinvest

this cash in our foreign operations. We could not repatriate this cash to the U.S. without utilizing our net operating loss

carryforwards and potentially incurring additional tax payments in the U.S. Cash equivalents and short-term investments are

primarily comprised of foreign and U.S. government securities and bank deposits.

In October 2011, we entered into a $1 billion five-year unsecured revolving credit facility with a group of lenders.

Borrowings under the revolving credit facility will bear interest, at our option, at a rate per annum equal to either (i) the

adjusted LIBOR for the interest period in effect for such borrowing plus an applicable margin ranging from 1.00% to 1.50%; or

(ii) the greatest of (a) JPMorgan Chase Bank, National Association's prime lending rate, (b) the federal funds rate plus 0.50%,

and (c) an adjusted LIBOR for an interest period of one month plus 1.00%, plus an applicable margin ranging from 0.00% to

0.50%. Undrawn balances available under the revolving credit facility are subject to commitment fees at the applicable rate

ranging from 0.10% to 0.25%.

The revolving credit facility provides for the issuance of up to $100.0 million of letters of credit as well as borrowings

of up to $50 million on same-day notice, referred to as swingline loans. Borrowings under the revolving credit facility may be

made in U.S. dollars, Euros, Pounds Sterling and any other foreign currency agreed to by the lenders. The proceeds of loans

made under the facility will be used for working capital and general corporate purposes. As of December 31, 2011, there were

no borrowings under the facility, and approximately $1.9 million of letters of credit were issued under the facility. Upon

entering into this new revolving credit facility, we terminated our $175.0 million revolving credit facility entered into in 2007

(see Note 11 to the Consolidated Financial Statements).

As of December 31, 2011, we have a remaining authorization from our Board of Directors to repurchase $459.2

million of our common stock. We may from time to time make additional repurchases of our common stock, depending on

prevailing market conditions, alternate uses of capital, and other factors.

Our merchant transactions are structured such that we collect cash up front from our customers and then we pay most

of our suppliers at a subsequent date. We therefore tend to experience significant swings in deferred merchant bookings and

supplier payables depending on the absolute level of our merchant transactions during the last few weeks of every quarter.

Net cash provided by operating activities for the year ended December 31, 2011, was $1.3 billion, resulting from net

income of $1.1 billion and net favorable changes in working capital of $84.8 million, and a favorable impact of $197.9 million

for non-cash items not affecting cash flows. For the year ended December 31, 2011, accounts payable, accrued expenses and

other current liabilities increased by $209.5 million, partially offset by a $125.8 million increase in accounts receivable. The

increase in these working capital balances was primarily related to increases in business volumes. Non-cash items were