Priceline 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

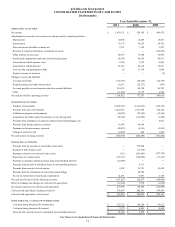

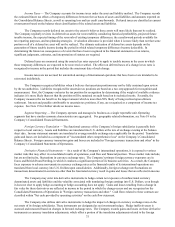

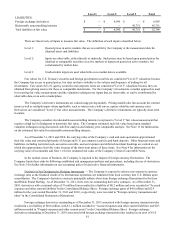

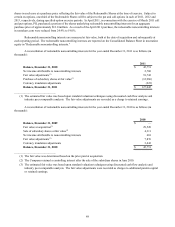

The following table summarizes, by major security type, the Company’s short-term investments as of December 31,

2010 (in thousands):

Foreign government securities

U.S. government securities

U.S. agency securities

U.S. corporate notes

Total

Cost

$ 682,841

469,116

109,920

40,845

$ 1,302,722

Gross

Unrealized

Gains

$ 558

158

15

—

$ 731

Gross

Unrealized

Losses

$(81)

(66)

(30)

(25)

$(202)

Fair Value

$ 683,318

469,208

109,905

40,820

$ 1,303,251

There were no material realized gains or losses related to investments for the years ended December 31, 2011, 2010

and 2009.

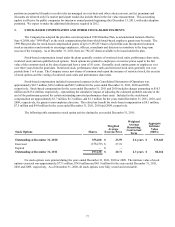

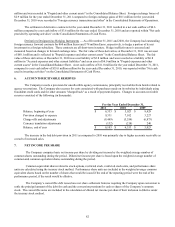

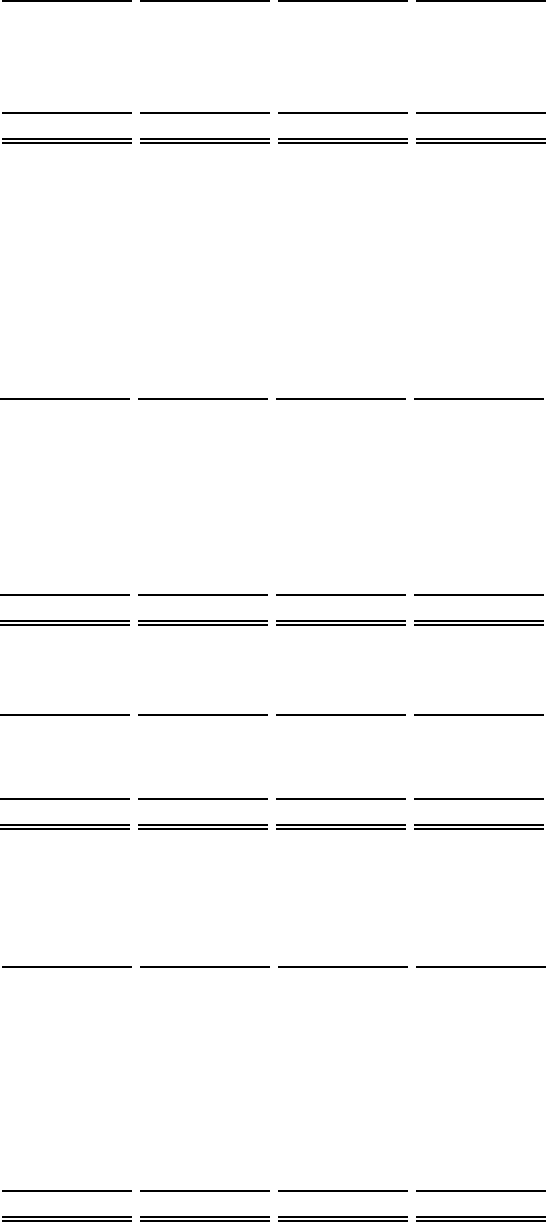

5. FAIR VALUE MEASUREMENTS

Financial assets carried at fair value as of December 31, 2011 are classified in the table below in the categories

described below (in thousands):

ASSETS:

Short-term investments:

Foreign government securities

U.S. government securities

U.S. agency securities

U.S. corporate notes

Foreign exchange derivatives

Total assets at fair value

Level 1

$ —

—

—

—

—

$ —

Level 2

$ 1,074,186

923,322

26,951

368

60,455

$ 2,085,282

Level 3

$ —

—

—

—

—

$ —

Total

$ 1,074,186

923,322

26,951

368

60,455

$ 2,085,282

LIABILITIES:

Foreign exchange derivatives

Redeemable noncontrolling interests

Total liabilities at fair value

Level 1

$ —

—

$ —

Level 2

$ 1,107

—

$ 1,107

Level 3

$ —

127,045

$ 127,045

Total

$ 1,107

127,045

$ 128,152

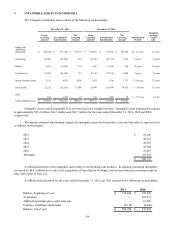

Financial assets and liabilities are carried at fair value as of December 31, 2010 are classified in the tables below in

the categories described below (in thousands):

ASSETS:

Short-term investments:

Foreign government securities

U.S. government securities

U.S. agency securities

U.S. corporate notes

Long-term investments

Foreign exchange derivatives

Total assets at fair value

Level 1

$ —

—

—

—

—

—

$ —

Level 2

$ 683,318

469,208

109,905

40,820

394

4,970

$ 1,308,615

Level 3

$ —

—

—

—

—

—

$ —

Total

$ 683,318

469,208

109,905

40,820

394

4,970

$ 1,308,615