Priceline 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

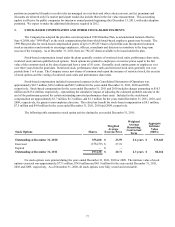

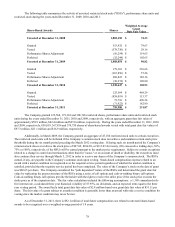

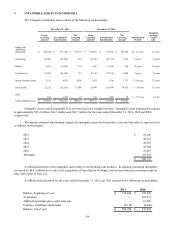

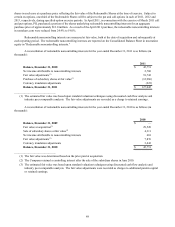

A reconciliation of the weighted average number of shares outstanding used in calculating diluted earnings per share is as

follows (in thousands):

Weighted average number of basic common shares outstanding

Weighted average dilutive stock options, restricted stock,

restricted stock units and performance share units

Assumed conversion of Convertible Senior Notes

Weighted average number of diluted common and common

equivalent shares outstanding

Anti-dilutive potential common shares

For the Year Ended December 31,

2011

49,654

828

729

51,211

1,453

2010

47,955

1,628

1,405

50,988

2,487

2009

42,406

1,336

5,780

49,522

2,843

Anti-dilutive potential common shares for the years ended December 31, 2011, 2010 and 2009 include

approximately 1.2 million, 1.9 million shares and 1.5 million shares, respectively, that could be issued under the Company’s

convertible debt if the Company experiences substantial increases in its common stock price. Under the treasury stock method,

the convertible notes will generally have a dilutive impact on net income per share if the Company’s average stock price for the

period exceeds the conversion price for the convertible notes.

The Company has Conversion Spread Hedges outstanding at December 31, 2011, which were designed to reduce

potential dilution of the Company's 0.75% Convertible Senior Notes due 2013 at their stated maturity date (see Note 11). Since

the beneficial impact of the Conversion Spread Hedges is anti-dilutive, it is excluded from the calculation of net income per

share.

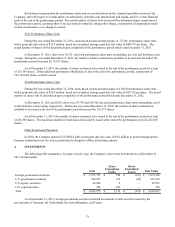

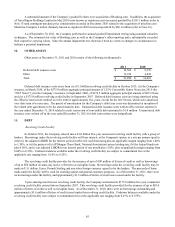

8. PROPERTY AND EQUIPMENT

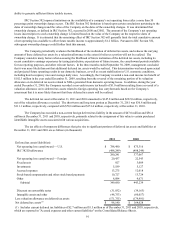

Property and equipment at December 31, 2011 and 2010 consists of the following (in thousands):

Computer equipment and software

Office equipment, furniture, fixtures &leasehold improvements

Total

Less: accumulated depreciation and amortization

Property and equipment, net

2011

$ 146,926

30,031

176,957

(112,635)

$ 64,322

2010

$ 115,718

18,428

134,146

(94,407)

$ 39,739

Estimated

Useful Lives

(years)

3 to 5

3 to 10

Fixed asset depreciation and amortization expense are approximately $20.6 million, $16.2 million and $14.5 million

for the years ended December 31, 2011, 2010 and 2009, respectively.