Priceline 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

shares in each case at a purchase price reflecting the fair value of the Redeemable Shares at the time of exercise. Subject to

certain exceptions, one-third of the Redeemable Shares will be subject to the put and call options in each of 2011, 2012 and

2013, respectively, during specified option exercise periods. In April 2011, in connection with the exercise of March 2011 call

and put options, PIL purchased a portion of the shares underlying redeemable noncontrolling interests for an aggregate

purchase price of approximately $13.0 million. As a result of the April 2011 purchase, the redeemable noncontrolling interests

in rentalcars.com were reduced from 24.4% to 19.0%.

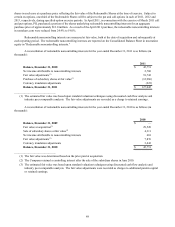

Redeemable noncontrolling interests are measured at fair value, both at the date of acquisition and subsequently at

each reporting period. The redeemable noncontrolling interests are reported on the Consolidated Balance Sheet in mezzanine

equity in "Redeemable noncontrolling interests."

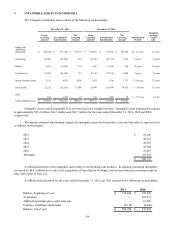

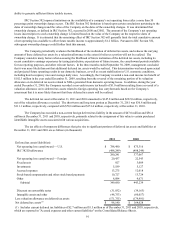

A reconciliation of redeemable noncontrolling interests for the year ended December 31, 2011 is as follows (in

thousands):

Balance, December 31, 2010

Net income attributable to noncontrolling interests

Fair value adjustments(1)

Purchase of subsidiary shares at fair value(1)

Currency translation adjustments

Balance, December 31, 2011

2011

$ 45,751

2,760

91,743

(12,986)

(223)

$ 127,045

_____________________________

(1) The estimated fair value was based upon standard valuation techniques using discounted cash flow analysis and

industry peer comparable analysis. The fair value adjustments are recorded as a charge to retained earnings.

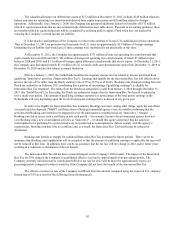

A reconciliation of redeemable noncontrolling interests for the year ended December 31, 2010 is as follows (in

thousands):

Balance, December 31, 2009

Fair value at acquisition(1)

Sale of subsidiary shares at fair value(2)

Net income attributable to noncontrolling interests

Fair value adjustments(3)

Currency translation adjustments

Balance, December 31, 2010

2010

$ —

29,520

4,311

601

7,876

3,443

$ 45,751

_____________________________

(1) The fair value was determined based on the price paid at acquisition.

(2) The Company retained a controlling interest after the sale of the subsidiary shares in June 2010.

(3) The estimated fair value was based upon standard valuation techniques using discounted cash flow analysis and

industry peer comparable analysis. The fair value adjustments were recorded as charges to additional paid-in capital

or retained earnings.