Priceline 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

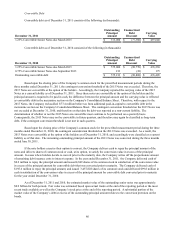

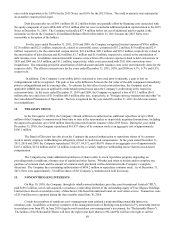

The valuation allowance on deferred tax assets of $172 million at December 31, 2011 includes $145 million related to

federal and state net operating loss carryforwards derived from equity transactions and $20 million related to foreign

operations. Additionally, since January 1, 2006, the Company has generated additional federal tax benefits of $132 million

related to equity transactions that are not included in the deferred tax asset table above. Pursuant to accounting guidance, these

tax benefits related to equity deductions will be recognized by crediting paid in capital, if and when they are realized by

reducing the Company’s current income tax liability.

It is the practice and intention of the Company to reinvest the earnings of its non-U.S. subsidiaries in those operations.

Thus at December 31, 2011, no provision had been made for U.S. taxes on approximately $1.9 billion of foreign earnings.

Estimating the tax liability that would arise if these earnings were repatriated is not practicable at this time.

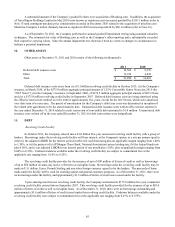

At December 31, 2011, the Company has approximately $371 million of state net operating loss carryforwards that

expire mainly between 2020 and 2021, $81 million of foreign net operating loss carryforwards, of which $5 million expire

between 2028 and 2030, and $3.1 million of foreign capital allowance carryforwards that do not expire. At December 31, 2011,

the Company also had approximately $1.3 million of U.S. research credit carryforwards that expire from December 31, 2019 to

December 31, 2020 and are also subject to annual limitation.

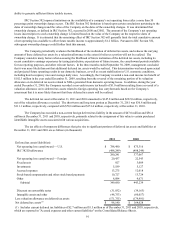

Effective January 1, 2010, the Netherlands modified its corporate income tax law related to income generated from

qualifying "innovative" activities ("Innovation Box Tax"). Earnings that qualify for the Innovation Box Tax will effectively be

taxed at the rate of 5% rather than the Dutch statutory rate of 25% (25.5% as of 2010). Booking.com obtained a ruling from the

Dutch tax authorities in February 2011 confirming that a portion of its earnings ("qualifying earnings") is eligible for

Innovation Box Tax treatment. The ruling from the Dutch tax authorities is valid from January 1, 2010 through December 31,

2013 (the "Initial Period"). In this ruling, the Dutch tax authorities require that the Innovation Box Tax benefit be phased in

over a multi-year period. The amount of qualifying earnings expressed as a percentage of the total pretax earnings in the

Netherlands will vary depending upon the level of total pretax earnings that is achieved in any given year.

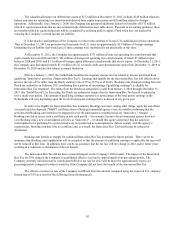

In order to be eligible for Innovation Box Tax treatment, Booking.com must, among other things, apply for and obtain

a research and development ("R&D") certificate from a Dutch governmental agency every six months confirming that the

activities that Booking.com intends to be engaged in over the subsequent six month period are "innovative." Should

Booking.com fail to secure such a certificate in any such period -- for example, because the governmental agency does not

view Booking.com’s new or anticipated activities as "innovative" -- or should this agency determine that the activities

contemplated to be performed in a prior period were not performed as contemplated or did not comply with the agency’s

requirements, Booking.com may lose its certificate and, as a result, the Innovation Box Tax benefit may be reduced or

eliminated.

Booking.com intends to reapply for continued Innovation Box Tax treatment for future periods. There can be no

assurance that Booking.com’s application will be accepted, or that the amount of qualifying earnings or applicable tax rates will

not be reduced at that time. In addition, there can be no assurance that the tax law will not change in 2012 and/or future years

resulting in a reduction or elimination of the tax benefit.

The Innovation Box Tax did not have a material impact on the Company's 2010 results. The impact of the Innovation

Box Tax for 2011 reduced the Company's consolidated effective tax rate by approximately four percentage points. The

Company currently estimates that its consolidated effective tax rate for 2012 will be lower by approximately four to six

percentage points compared to what it would be if the Company did not have the benefit of the Innovation Box Tax.

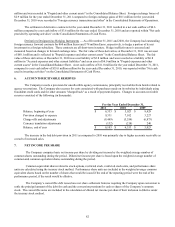

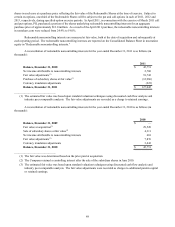

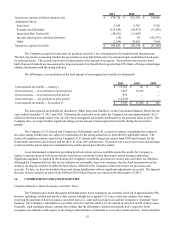

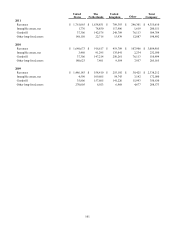

The effective income tax rate of the Company is different from the amount computed using the expected U.S. statutory

federal rate of 35% as a result of the following items (in thousands):