Priceline 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

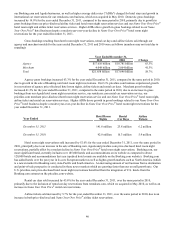

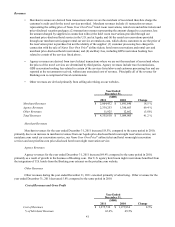

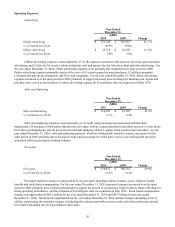

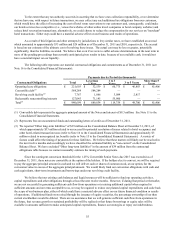

Other Income (Expense)

Interest Income

Interest Expense

Foreign Currency Transactions and Other

Total

Year Ended

December 31,

($000)

2011

$ 8,119

(31,721)

(7,526)

$(31,128)

2010

$ 3,857

(29,944)

(14,427)

$(40,514)

Change

110.5 %

5.9 %

(47.8)%

(23.2)%

For the year ended December 31, 2011, interest income on cash and marketable securities increased over the same

period in 2010, primarily due to an increase in the average balance invested. Interest expense increased for the year ended

December 31, 2011, as compared to the same period in 2010, primarily due to an increase in the average outstanding debt

resulting from the March 2010 issuance of $575.0 million aggregate principal amount of convertible senior notes, and fees on

the undrawn $1 billion revolving credit facility entered into in October 2011.

Derivative contracts that hedge our exposure to the impact of currency fluctuations on the translation of our

international operations into U.S. dollars upon consolidation resulted in foreign exchange gains of $4.0 million for the year

ended December 31, 2011 compared to foreign exchange gains of $2.9 million for the year ended December 31, 2010, and are

recorded in "Foreign currency transactions and other."

Foreign exchange transaction losses, including costs related to foreign exchange transactions, resulted in losses of

$11.3 million for the year ended December 31, 2011, compared to losses of $6.0 million for the year ended December 31, 2010,

and are recorded in "Foreign currency transactions and other."

In addition, losses of $11.3 million for the year ended December 31, 2010 resulted from convertible debt conversions

during 2010, and are recorded in "Foreign currency transactions and other."

During the fourth quarter of 2011, we began classifying certain foreign currency processing fees, amounting to $2.2

million, as an offset to revenue earned from the third party that processes the payments for merchant hotel transactions.

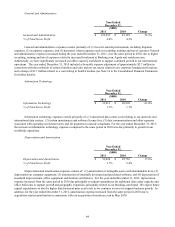

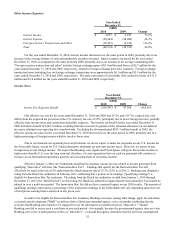

Income Taxes

Income Tax Expense

Year Ended

December 31,

($000)

2011

$ 308,663 2010

$ 218,141

Change

41.5%

Our effective tax rate for the years ended December 31, 2011 and 2010 were 22.6% and 29.2%, respectively. Our

effective tax rate differs from the expected tax provision at the U.S. statutory tax rate of 35% principally due to lower foreign

tax rates, the Innovation Box Tax benefit discussed below, and the resolution of an uncertain tax position during the second

quarter of 2011. Following the conclusion of an audit, we reversed a reserve of approximately $12.5 million in the three

months ended June 30, 2011 for unrecognized tax benefits attributable to tax positions taken in 2010. We do not expect further

significant changes in the amount of unrecognized tax benefits during 2012.

The effective tax rate for the year ended December 31, 2011 is lower compared to 2010 primarily due to a higher

percentage of foreign income, which is taxed at lower rates, the Innovation Box Tax benefit discussed below, and the reversal

of the reserve for unrecognized tax benefits referred to above.

Effective January 1, 2010, the Netherlands modified its corporate income tax law related to income generated from

qualifying "innovative" activities (the "Innovation Box Tax"). Earnings that qualify for the Innovation Box Tax will

effectively be taxed at the rate of 5% rather than the Dutch statutory rate of 25.0%. Booking.com obtained a ruling from the

Dutch tax authorities in February 2011 confirming that a portion of its earnings ("qualifying earnings") is eligible for

Innovation Box Tax treatment. The ruling from the Dutch tax authorities is valid from January 1, 2010 through December 31,

2013 (the "Initial Period"). In this ruling, the Dutch tax authorities require that the Innovation Box Tax benefit be phased in