Priceline 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

by brand mix rather than a change in the fundamental efficiency of our advertising by brand. Our international operations are

growing faster than our priceline.com business in the U.S., and spend a higher percentage of gross profit on online advertising,

a trend which we expect to continue. Furthermore, the priceline.com brand is obtaining an increasing share of its traffic

through online advertising, a trend which we also expect to continue. We recognize advertising expense as incurred at the time

of booking, but recognize the gross profit for price-disclosed hotel room and rental car reservations when the travel is

completed.

Offline advertising expenses are related to our domestic television, print and radio advertising for priceline.com. For

the year ended December 31, 2011, offline advertising was flat compared to the same period in 2010. We recognize expense

for production costs of advertising the first time the advertising takes place.

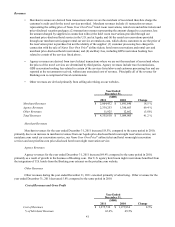

Sales and Marketing

Sales and Marketing

% of Total Gross Profit

Year Ended

December 31,

($000)

2011

$ 162,690

5.3%

2010

$ 116,303

6.1%

Change

39.9%

Sales and marketing expenses consist primarily of (1) credit card processing fees associated with merchant

transactions; (2) fees paid to third-parties that provide call center, website content translations and other services; (3) provisions

for credit card chargebacks; and (4) provisions for bad debt, primarily related to agency hotel commission receivables. For the

year ended December 31, 2011, sales and marketing expenses, which are substantially variable in nature, increased over the

same period in 2010, primarily due to increased gross booking volumes as well as expenses related to increased content

translations. Our U.S. merchant business benefited from the impact of reduced credit card processing fees resulting from

Durbin Amendment to the Dodd-Frank Financial Reform and Consumer Protection Act (which amendment caps the

interchange fee for debit card transactions and went into effect on October 1, 2011), partially offset by the impact of higher

costs resulting from increases in foreign currency transactions and increased cancellation rates from our Agoda business. Costs

associated with our U.S. priceline.com business comprise a large component of sales and marketing expenses. Our U.S.

priceline.com business grew more slowly than our total gross profit, which benefited from the high growth in our international

agency business, and as a result, sales and marketing expenses as a percentage of total gross profit for the year ended December

31, 2011 declined compared to the same period in 2010.

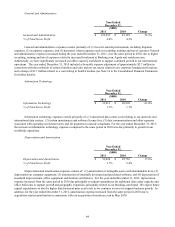

Personnel

Personnel

% of Total Gross Profit

Year Ended

December 31,

($000)

2011

$ 352,295

11.4%

2010

$ 270,071

14.1%

Change

30.4%

Personnel expenses consist of compensation to our personnel, including salaries, bonuses, payroll taxes, employee health

benefits and stock-based compensation. For the year ended December 31, 2011, personnel expenses increased over the same

period in 2010, due primarily to increased headcount to support the growth of our international businesses. Stock-based

compensation expense was approximately $65.7 million for the year ended December 31, 2011 compared to $68.2 million for

the year ended December 31, 2010. Stock-based compensation for the years ended December 31, 2011 and 2010 included

charges amounting to $10.3 million and $13.4 million, respectively, representing the cumulative impact of adjusting the

estimated probable outcome at the end of the performance period for certain outstanding unvested performance share units.