Priceline 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

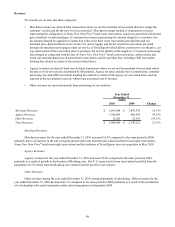

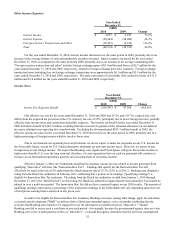

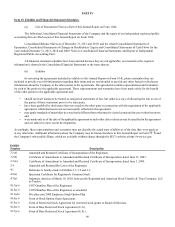

Other Income (Expense)

Interest Income

Interest Expense

Foreign Currency Transactions and Other

Total

Year Ended

December 31,

($000)

2010

$ 3,857

(29,944)

(14,427)

$(40,514)

2009

$ 2,223

(24,084)

(6,672)

$(28,533)

Change

73.5%

24.3%

116.2%

42.0%

For the year ended December 31, 2010, interest income increased over the same period in 2009, primarily due to an

increase in the average balance of cash and marketable securities invested. Interest expense increased for the year ended

December 31, 2010, as compared to the same period in 2009, primarily due to an increase in the average outstanding debt.

"Foreign currency transactions and other" includes foreign exchange gains of $3.0 million and losses of $2.7 million for the

years ended December 31, 2010 and 2009, respectively, related to foreign exchange derivative contracts. Foreign exchange

transaction losses including fees on foreign exchange transactions were approximately $6.1 million and $2.9 million for the

years ended December 31, 2010 and 2009, respectively. The early conversion of convertible debt resulted in losses of $11.3

million and $1.0 million for the years ended December 31, 2010 and 2009, respectively.

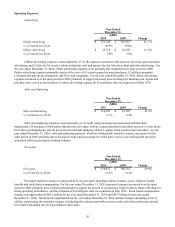

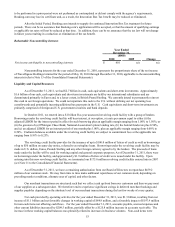

Income Taxes

Income Tax (Expense) Benefit

Year Ended

December 31,

($000)

2010

$(218,141)2009

$ 47,168

Change

(562.5)%

Our effective tax rate for the years ended December 31, 2010 and 2009 was 29.2% and (10.7)%, respectively, and

differs from the expected tax provision at the U.S. statutory tax rate of 35%, principally due to lower foreign tax rates, partially

offset by state income taxes and certain non-deductible expenses. The income tax benefit for the year ended December 31,

2009 included a benefit of $183.3 million, resulting from the reversal of a portion of the valuation allowance on our deferred

tax assets relating to net operating loss carryforwards. Excluding the aforementioned $183.3 million benefit in 2009, the

effective income tax rates for the year ended December 31, 2010 decreased over the same period in 2009, primarily due to a

higher percentage of foreign income which is taxed at lower rates.

Due to our domestic net operating loss carryforwards, we do not expect to make tax payments on our U.S. income for

the foreseeable future, except for U.S. federal alternative minimum tax and state income taxes. However, we expect to pay

foreign taxes on our foreign income. We expect that Booking.com, Agoda and TravelJigsaw will grow their pretax income at

higher rates than the U.S. over the long term and, therefore, it is our expectation that our cash tax payments will continue to

increase as our international operations generate an increasing share of our pretax income.

Effective January 1, 2010, the Netherlands modified its corporate income tax law related to income generated from

qualifying "innovative" activities (the "Innovation Box Tax"). Earnings that qualify for the Innovation Box Tax will

effectively be taxed at the rate of 5% rather than the Dutch statutory rate of 25.5% (25% as of 2011). Booking.com obtained a

ruling from the Dutch tax authorities in February 2011 confirming that a portion of its earnings ("qualifying earnings") is

eligible for Innovation Box Tax treatment. The ruling from the Dutch tax authorities is valid from January 1, 2010 through

December 31, 2013 (the "Initial Period"). In this ruling, the Dutch tax authorities require that the Innovation Box Tax benefit be

phased in over a multi-year period. The Innovation Box Tax did not have a material impact on our 2010 results. The amount of

qualifying earnings expressed as a percentage of the total pretax earnings in the Netherlands will vary depending upon the level

of total pretax earnings that is achieved in any given year.

In order to be eligible for Innovation Box Tax treatment, Booking.com must, among other things, apply for and obtain

a research and development ("R&D”) certificate from a Dutch governmental agency every six months confirming that the

activities that Booking.com intends to be engaged in over the subsequent six month period are "innovative." Should

Booking.com fail to secure such a certificate in any such period - for example, because the governmental agency does not view

Booking.com’s new or anticipated activities as "innovative" - or should this agency determine that the activities contemplated