Priceline 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

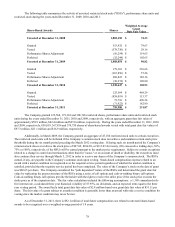

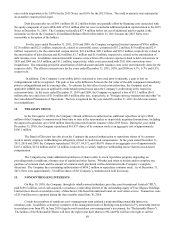

Stock-based compensation for performance share units is recorded based on the estimated probable outcome if the

Company, and with respect to certain grants, its subsidiaries, priceline.com International and Agoda, achieve certain financial

goals at the end of the performance period. The actual number of shares to be issued will be determined upon completion of

the performance period, assuming there is no accelerated vesting for, among other things, a termination of employment under

certain circumstances, or a change in control.

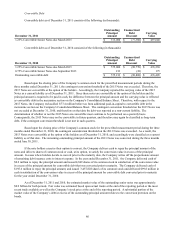

2011 Performance Share Units

During the year ended December 31, 2011, stock-based awards included grants of 77,144 performance share units

with a grant date fair value of $35.9 million, based on a weighted average grant date fair value of $464.79 per share. The

actual number of shares will be determined upon completion of the performance period which ends December 31, 2013.

At December 31, 2011, there were 76,552 unvested performance share units outstanding, net of actual forfeitures and

vesting. During the year ended December 31, 2011, the number of shares estimated as probable to be issued at the end of the

performance period increased by 76,817 shares.

As of December 31, 2011, the number of shares estimated to be issued at the end of the performance period is a total

of 153,369 shares. If the maximum performance thresholds are met at the end of the performance period, a maximum of

163,324 total shares could be issued.

2010 Performance Share Units

During the year ended December 31, 2010, stock-based awards included grants of 110,430 performance share units

with a grant date fair value of $26.0 million, based on a weighted average grant date fair value of $235.34 per share. The actual

number of shares will be determined upon completion of the performance period which ends December 31, 2012.

At December 31, 2011 and 2010, there were 93,745 and 108,702 unvested performance share units outstanding, net of

actual forfeitures and vesting, respectively. During the year ended December 31, 2010, the number of shares estimated as

probable to be issued at the end of the performance period increased by 154,177 shares.

As of December 31, 2011, the number of shares estimated to be issued at the end of the performance period is a total

of 226,505 shares. The maximum number of total shares that could be issued at the end of the performance period is 226,505

shares.

Other Stock-based Payments

In 2010, the Company granted 5,555 RSUs with a total grant date fair value of $1.6 million to an advertising partner.

Expense is amortized over the service period and is charged to offline advertising expense.

4. INVESTMENTS

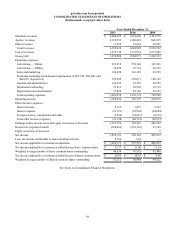

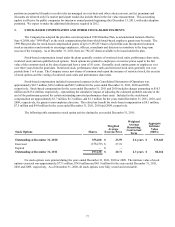

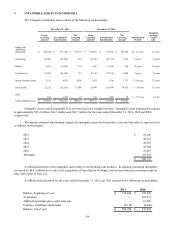

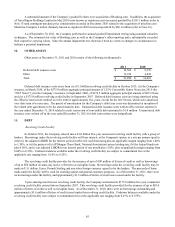

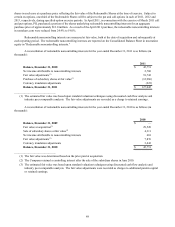

The following table summarizes, by major security type, the Company’s short-term investments as of December 31,

2011 (in thousands):

Foreign government securities

U.S. government securities

U.S. agency securities

U.S. corporate notes

Total

Cost

$ 1,073,731

922,997

26,942

205

$ 2,023,875

Gross

Unrealized

Gains

$ 588

353

9

163

$ 1,113

Gross

Unrealized

Losses

$(133)

(28)

—

—

$(161)

Fair Value

$ 1,074,186

923,322

26,951

368

$ 2,024,827

As of December 31, 2011, foreign government securities included investments in debt securities issued by the

governments of Germany, the Netherlands, the United Kingdom, and France.