Priceline 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

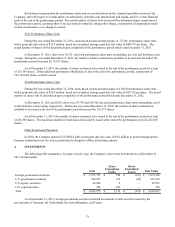

million and was recorded in "Prepaid and other current assets" in the Consolidated Balance Sheet. Foreign exchange losses of

$2.9 million for the year ended December 31, 2011 compared to foreign exchange gains of $0.1 million for the year ended

December 31, 2010 were recorded in "Foreign currency transactions and other" in the Consolidated Statements of Operations.

The settlement of derivative contracts for the year ended December 31, 2011 resulted in a net cash outflow of $0.6

million compared to a net cash inflow of $3.6 million for the year ended December 31, 2010 and are reported within "Net cash

provided by operating activities" on the Consolidated Statements of Cash Flows.

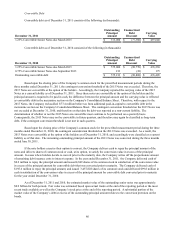

Derivatives Designated as Hedging Instruments — As of December 31, 2011 and 2010, the Company had outstanding

foreign currency forward contracts for 860 million Euros and 378 million Euros, respectively, to hedge a portion of its net

investment in a foreign subsidiary. These contracts are all short-term in nature. Hedge ineffectiveness is assessed and

measured based on changes in forward exchange rates. The fair value of these derivatives at December 31, 2011 was an asset

of $60.1 million and is reflected in "Prepaid expenses and other current assets" in the Consolidated Balance Sheet. The fair

value of these derivatives at December 31, 2010 was a net liability of $2.8 million and was recorded as a liability of $6.8

million in "Accrued expenses and other current liabilities" and as an asset of $4.0 million in "Prepaid expenses and other

current assets" in the Consolidated Balance Sheet. A net cash outflow of $11.0 million for the year ended December 31, 2011,

compared to a net cash inflow of $35.0 million million for the year ended December 31, 2010, was reported within "Net cash

used in investing activities" on the Consolidated Statements of Cash Flows.

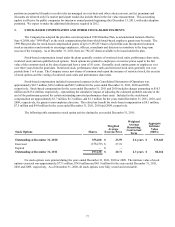

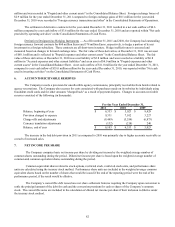

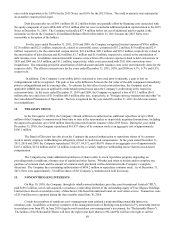

6. ACCOUNTS RECEIVABLE RESERVES

The Company records a provision for uncollectible agency commissions, principally receivables from hotels related to

agency reservations. The Company also accrues for costs associated with purchases made on its websites by individuals using

fraudulent credit cards and for other amounts "charged back" as a result of payment disputes. Changes in accounts receivable

reserves consisted of the following (in thousands):

Balance, beginning of year

Provision charged to expense

Charge-offs and adjustments

Currency translation adjustments

Balance, end of year

For the Year Ended December 31,

2011

$ 6,353

9,331

(9,449)

(132)

$ 6,103

2010

$ 5,023

7,102

(5,554)

(218)

$ 6,353

2009

$ 8,429

3,227

(6,873)

240

$ 5,023

The increase in the bad debt provision in 2011 as compared to 2010 was primarily due to higher accounts receivable as

a result of increased sales.

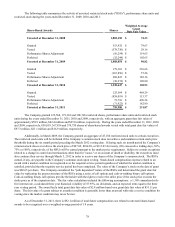

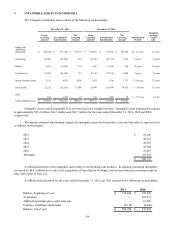

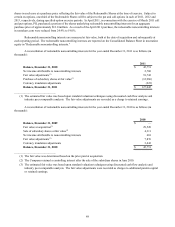

7. NET INCOME PER SHARE

The Company computes basic net income per share by dividing net income by the weighted average number of

common shares outstanding during the period. Diluted net income per share is based upon the weighted average number of

common and common equivalent shares outstanding during the period.

Common equivalent shares related to stock options, restricted stock, restricted stock units, and performance share

units are calculated using the treasury stock method. Performance share units are included in the weighted average common

equivalent shares based on the number of shares that would be issued if the end of the reporting period were the end of the

performance period, if the result would be dilutive.

The Company’s convertible debt issues have net share settlement features requiring the Company upon conversion to

settle the principal amount of the debt for cash and the conversion premium for cash or shares of the Company’s common

stock. The convertible notes are included in the calculation of diluted net income per share if their inclusion is dilutive under

the treasury stock method.