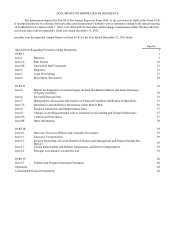

Priceline 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

Marketing and Brand Awareness

Booking.com, priceline.com and Agoda have established widely used and recognized e-commerce brands through

aggressive marketing and promotion campaigns. In late 2011, we re-branded our international rental car business as

rentalcars.com, and intend to market that brand worldwide through online advertising. During 2011, our total online

advertising expenses were approximately $919.2 million, a substantial portion of which was spent internationally through

Internet search engines and online affiliate marketing. We also invested approximately $35.5 million in priceline.com-branded

offline advertising in the United States. We intend to continue a marketing strategy to aggressively promote brand awareness,

primarily through online means.

As our international operations have become more meaningful contributors to our results, we have seen, and expect to

continue to see, changes in our advertising expense. Specifically, online advertising as a percentage of gross profit increased

for the year ended December 31, 2011, compared to the same period in 2010. The increase is driven primarily by brand mix

rather than a change in the fundamental efficiency of our advertising by brand. Our international operations are growing faster

than our priceline.com business in the U.S., and spend a higher percentage of gross profit on online advertising, a trend which

we expect to continue. Furthermore, the priceline.com brand in the U.S. is obtaining an increasing share of its traffic through

online advertising, a trend which we also expect to continue. We recognize advertising expense as incurred at the time of

booking, but recognize the gross profit for price-disclosed hotel room and rental car reservations when the travel is completed.

Competition

We compete with both online and traditional sellers of the services we offer. The market for the services we offer is

intensely competitive, and current and new competitors can launch new sites at a relatively low cost. We may not be able to

effectively compete with industry conglomerates such as Google, Microsoft or Expedia, each of which may have access to

significantly greater and more diversified resources than we do.

We currently or potentially compete with a variety of companies with respect to each service we offer. With respect to

our travel services, these competitors include, but are not limited to:

• Internet travel services such as Expedia, Hotels.com, Hotwire, Elong, CarRentals.com and Venere, which are owned

by Expedia; Travelocity, lastminute.com, Holiday Auto and Zuji, which are owned by the Sabre Group; Orbitz.com,

Cheaptickets, ebookers, HotelClub and RatesToGo, which are owned by Orbitz Worldwide; laterooms and asiarooms,

which are owned by Tui Travel; and Gullivers, octopustravel, Superbreak, hotel.de, Hotel Reservation Service,

AutoEurope, Car Trawler, Ctrip, MakeMyTrip, Rakuten, Jalan and Wotif;

• travel suppliers such as hotel companies, airlines and rental car companies, many of which have their own branded

websites to which they drive business, including without limitation Room Key, a recently launched hotel search engine

owned by several major hotel companies;

• large online portal, social networking, group buying and search companies, such as Google, Yahoo! (including Yahoo!

Travel), Bing (including Bing Travel), Facebook, Groupon and Living Social;

• traditional travel agencies, wholesalers and tour operators;

• online travel search sites such as Kayak.com, Trivago.com, Mobissimo.com, FareChase.com and HotelsCombined

(each sometimes referred to as a "meta-search" site) and travel research sites that have search functionality, such as

TripAdvisor, Travelzoo and Cheapflights.com; and

• operators of travel industry reservation databases such as Galileo, Travelport, Amadeus and Sabre.

Large, established Internet search engines with substantial resources and expertise in developing online commerce and

facilitating Internet traffic are creating - and intend to further create - inroads into online travel, both in the U.S. and

internationally. For example, following its acquisition of ITA Software, Inc., a major flight information software company,

Google recently launched a new flight search tool that enables users to find fares, schedules and availability directly on Google

and excludes online travel agent ("OTA") participation within the search results. Google has also invested in HomeAway, a

publicly traded vacation home rental service, and launched "Hotel Finder," a utility that allows users to search and compare

hotel accommodations based on parameters set by the user. In addition, Microsoft has launched Bing Travel, which searches

for airfare and hotel reservations online and predicts the best time to purchase them. "Meta-search" sites leverage their search

technology to aggregate travel search results for the searcher's specific itinerary across supplier, travel agent and other websites