Priceline 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

Description of Senior Notes

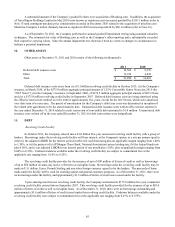

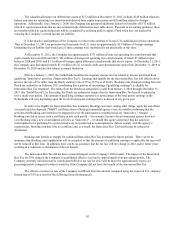

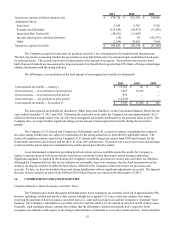

In March 2010, the Company issued in a private placement $575.0 million aggregate principal amount of Convertible

Senior Notes due March 15, 2015, with an interest rate of 1.25% (the "2015 Notes"). The Company paid $13.3 million in debt

financing costs associated with the 2015 Notes for the year ended December 31, 2010. The 2015 Notes are convertible, subject

to certain conditions, into the Company’s common stock at a conversion price of approximately $303.06 per share. The 2015

Notes are convertible, at the option of the holder, prior to March 15, 2015 upon the occurrence of specified events, including,

but not limited to a change in control, or if the closing sales price of the Company’s common stock for at least 20 trading days

in the period of the 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is

more than 150% of the applicable conversion price in effect for the notes on the last trading day of the immediately preceding

quarter. In the event that all or substantially all of the Company’s common stock is acquired on or prior to the maturity of the

2015 Notes in a transaction in which the consideration paid to holders of the Company’s common stock consists of all or

substantially all cash, the Company would be required to make additional payments in the form of additional shares of common

stock to the holders of the 2015 Notes in aggregate value ranging from $0 to approximately $132.7 million depending upon the

date of the transaction and the then current stock price of the Company. As of December 15, 2014, holders will have the right

to convert all or any portion of the 2015 Notes. The 2015 Notes may not be redeemed by the Company prior to maturity. The

holders may require the Company to repurchase the 2015 Notes for cash in certain circumstances. Interest on the 2015 Notes is

payable on March 15 and September 15 of each year.

In 2006, the Company issued in a private placement $172.5 million aggregate principal amount of Convertible Senior

Notes due September 30, 2013, with an interest rate of 0.75% (the "2013 Notes"). The 2013 Notes were convertible, subject to

certain conditions, into the Company’s common stock at a conversion price of approximately $40.38 per share. The 2013

Notes were convertible, at the option of the holder, prior to June 30, 2013 upon the occurrence of specified events, including,

but not limited to a change in control, or if the closing sale price of the Company’s common stock for at least 20 consecutive

trading days in the period of the 30 consecutive trading days ending on the last trading day of the immediately preceding

calendar quarter was more than 120% of the applicable conversion price in effect for the notes on the last trading day of the

immediately preceding quarter. The 2013 Notes could not be redeemed by the Company prior to maturity. As mentioned

above, the remaining outstanding principal amount at December 31, 2010 was converted during the three months ended June

30, 2011.

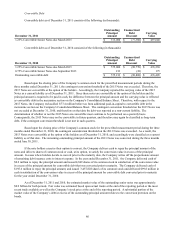

In 2006, the Company entered into hedge transactions relating to potential dilution of the Company’s common stock

upon conversion of the 2013 Notes (the "Conversion Spread Hedges"). Under the Conversion Spread Hedges, the Company is

entitled to purchase from Goldman Sachs and Merrill Lynch approximately 4.3 million shares of the Company’s common stock

(the number of shares underlying the 2013 Notes) at a strike price of $40.38 per share (subject to adjustment in certain

circumstances) in 2013, and the counterparties are entitled to purchase from the Company approximately 4.3 million shares of

the Company’s common stock at a strike price of $50.47 per share (subject to adjustment in certain circumstances) in 2013.

The Conversion Spread Hedges are separate transactions entered into by the Company with the counterparties and are not part

of the terms of the 2013 Notes. The Conversion Spread Hedges did not immediately hedge against the associated dilution from

early conversions of the 2013 Notes prior to their stated maturities. Therefore, upon early conversion of the 2013 Notes, the

Company has delivered any related conversion premium in shares of stock or a combination of shares or cash that would offset

the dilution associated with the early conversion activity. Because of this timing difference, the number of shares, if any, that

the Company receives from the Conversion Spread Hedges can differ materially from the number of shares that it was required

to deliver to the holders of the 2013 Notes upon their early conversion. The actual number of shares to be received will depend

upon the Company's stock price on the date the Conversion Spread Hedges are exercisable, which coincides with the scheduled

maturity of the 2013 Notes.

In 2006, the Company also issued in a private placement $172.5 million aggregate principal amount of Convertible

Senior Notes due September 30, 2011 (the "2011 Notes"). The remaining outstanding principal amount at December 31, 2009

for these 2011 Notes was converted during 2010. Also in 2006, the Company entered into hedge transactions relating to the

potential dilution of the Company's common stock upon conversion of the 2011 Notes. During the year ended December 31,

2010, the Company and the counterparties agreed to terminate the Conversion Spread Hedges associated with 4.3 million

shares underlying the 2011 Notes. The Company recorded the $43 million cash received as an increase to paid-in-capital.

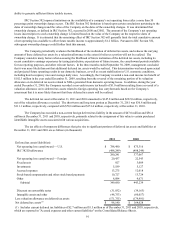

Accounting guidance requires that cash-settled convertible debt, such as the Company’s convertible senior notes, be

separated into debt and equity at issuance and each be assigned a value. The value assigned to the debt component is the

estimated fair value, as of the issuance date, of a similar bond without the conversion feature. The difference between the bond

cash proceeds and this estimated fair value, representing the value assigned to the equity component, is recorded as a debt

discount. Debt discount is amortized using the effective interest method over the period from origination or modification date

through the earlier of the first stated put date or the stated maturity date. The Company estimated the straight debt borrowing