Priceline 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

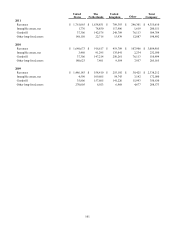

100

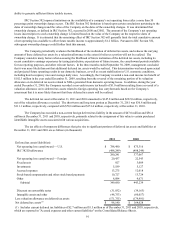

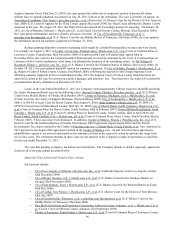

as follows (in thousands):

2012

$32,539

2013

$34,457

2014

$26,318

2015

$25,042

2016

$21,841

After

2016

$81,406

Total

$221,603

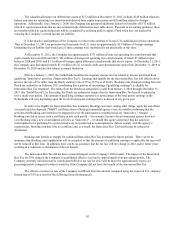

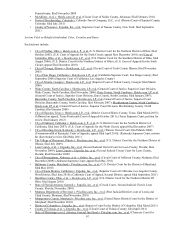

Contingent Purchase Price

On November 6, 2007, the Company and a newly-formed, indirect wholly-owned subsidiary of the Company,

acquired 100% of the total share capital of priceline.com Mauritius Company Limited (formerly known as the Agoda

Company, Ltd.) ("Agoda") and AGIP LLC. The purchase price for the acquisition, including acquisition costs, consisted of an

initial purchase price paid by the Company in cash of approximately $16 million. In addition, contingent consideration was

payable by the Company if Agoda achieved specified "gross bookings" and earnings targets from January 1, 2008 through

December 31, 2010. Based upon actual results for the three year period ended December 31, 2010, the Company recorded a

liability and increased goodwill by $60.1 million in 2010, which did not impact the Consolidated Statement of Cash Flows for

2010. This amount is reflected as an investing cash outflow in 2011.

On December 21, 2007, the Company acquired 100% of the total issued share capital of an online advertising

company for approximately $4.1 million in cash, including acquisition costs. The Company could have been required to pay an

additional amount of up to $3.8 million in cash each year from 2008 through 2010, if the acquired company achieved certain

performance targets. Based upon 2010, 2009 and 2008 results, the Company recorded a liability and increased goodwill by

$1.5 million, $2.5 million and $1.5 million in December 2010, December 2009, and December 2008, respectively, to reflect

this purchase price adjustment.

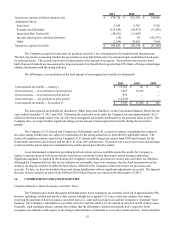

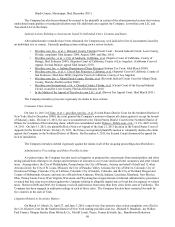

17. BENEFIT PLAN

Priceline.com has a defined contribution 401(k) savings plan (the "Plan") covering certain U.S. employees who are at

least 21 years old. The Plan allows eligible employees to contribute up to 75% of their eligible earnings, subject to a statutorily

prescribed annual limit. All participants are fully vested in their contributions and investment earnings. The Company makes a

50% match of employee contributions up to 6% of qualified compensation. The Company also maintains certain other defined

contribution plans outside of the United States for which it provides 50% of the contributions for participating employees. The

Company’s matching contributions during the years ended December 31, 2011, 2010 and 2009 were approximately $2.8

million, $1.8 million and $1.5 million, respectively.

18. GEOGRAPHIC INFORMATION

The geographic information is based upon the location of Company’s subsidiaries (in thousands).