Priceline 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

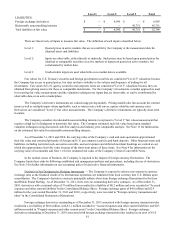

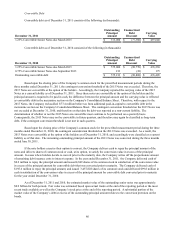

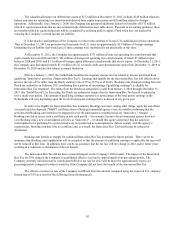

14. ACCUMULATED OTHER COMPREHENSIVE LOSS

The table below provides the balances for each classification of accumulated other comprehensive loss as of

December 31, 2011 and 2010 (in thousands):

Foreign currency translation adjustments (1)

Net unrealized gain on investment securities (2)

Accumulated other comprehensive loss

December 31,

2011

$(88,312)

730

$(87,582)

December 31,

2010

$(33,407)

518

$(32,889)

_____________________________

(1) Includes net gains from fair value adjustments at December 31, 2011 and 2010 associated with net investment hedges

of $46.2 million after tax ($79.1 million before tax) and $15.8 million after tax ($27.1 million before tax), respectively.

The remaining balance in currency translation adjustments excludes income taxes due to the Company’s practice and

intention to reinvest the earnings of its foreign subsidiaries in those operations.

(2) The unrealized gains before tax at December 31, 2011 and 2010 were $1.0 million and $0.7 million, respectively.

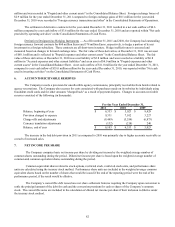

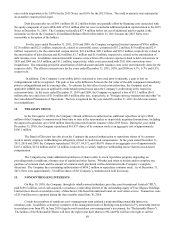

15. INCOME TAXES

Domestic pre-tax income was $144.9 million, $136.3 million and $113.9 million for the years ended December 31,

2011, 2010 and 2009, respectively. Foreign pre-tax income was $1,222.9 million, $610.0 million and $328.4 million for the

years ended December 31, 2011, 2010 and 2009, respectively.

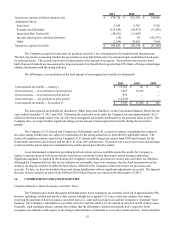

The income tax expense (benefit) for the year ended December 31, 2011 is as follows (in thousands):

Federal

State

Foreign

Total

Current

$ 2,699

9,675

251,542

$ 263,916

Deferred

$ 53,547

(1,389)

(7,411)

$ 44,747

Total

$ 56,246

8,286

244,131

$ 308,663

The income tax expense (benefit) for the year ended December 31, 2010 is as follows (in thousands):

Federal

State

Foreign

Total

Current

$ 4,510

1,114

174,977

$ 180,601

Deferred

$ 37,481

9,368

(9,309)

$ 37,540

Total

$ 41,991

10,482

165,668

$ 218,141

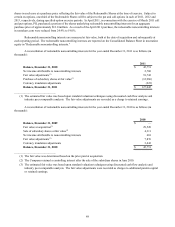

The income tax expense (benefit) for the year ended December 31, 2009 is as follows (in thousands):

Federal

State

Foreign

Total

Current

$ 2,802

1,107

101,205

$ 105,114

Deferred

$(150,935)

6,803

(8,150)

$(152,282)

Total

$(148,133)

7,910

93,055

$(47,168)

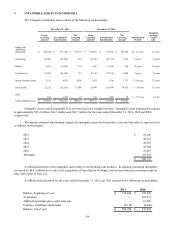

At December 31, 2011, the Company had approximately $2.6 billion of net operating loss carryforwards for U.S.

federal income tax purposes ("NOLs"), comprised of $0.4 billion of NOLs generated from operating losses and approximately

$2.2 billion of NOL tax benefits generated from equity-related transactions, including equity-based compensation and stock

warrants. The NOLs mainly expire from December 31, 2019 to December 31, 2021. The utilization of these NOLs is subject

to limitation under Section 382 of the Internal Revenue Code ("IRC Section 382") and is also dependent upon the Company’s