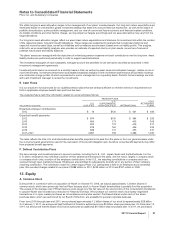

Pfizer 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

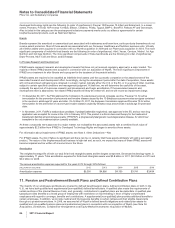

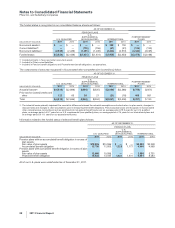

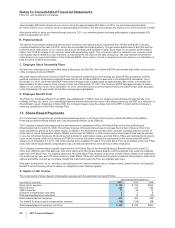

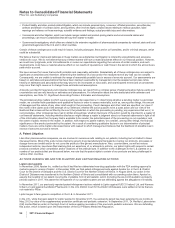

An analysis of changes in our more significant investments valued using significant unobservable inputs follows:

(MILLIONS OF DOLLARS)

FAIR VALUE

BEGINNING

OF YEAR

ACTUAL RETURN ON PLAN

ASSETS PURCHASES,

SALES AND

SETTLEMENTS,

NET

TRANSFER

INTO/(OUT OF)

LEVEL 3

EXCHANGE

RATE

CHANGES

FAIR

VALUE,

END OF

YEAR

ASSETS

HELD,

END OF YEAR

ASSETS SOLD

DURING THE

PERIOD

2011

U.S. qualified pension plans:

Private equity funds $899 $(246) $55 $212 $ — $ — $920

Other 465 24 (6) 173 — — 656

International pension plans:

Insurance contracts 366 8 — (12) (15) 19 366

Other 215 (4) — 120 12 6 349

2010

U.S. qualified pension plans:

Private equity funds 843 45 42 (31) — — 899

Other 454 21 — (10) — — 465

International pension plans:

Insurance contracts 346 12 — (10) 52 (34) 366

Other 127 (3) — 37 58 (4) 215

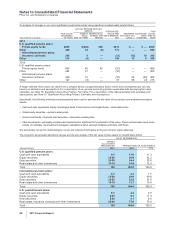

A single estimate of fair value can result from a complex series of judgments about future events and uncertainties and can rely

heavily on estimates and assumptions. For a description of our general accounting policies associated with developing fair value

estimates, see Note 1E. Significant Accounting Policies: Fair Value. For a description of the risks associated with estimates and

assumptions, see Note 1C. Significant Accounting Policies: Estimates and Assumptions.

Specifically, the following methods and assumptions were used to estimate the fair value of our pension and postretirement plans’

assets:

•Cash and cash equivalents, Equity commingled funds, Fixed-income commingled funds––observable prices.

•Global equity securities—quoted market prices.

•Government bonds, Corporate debt securities—observable market prices.

•Other investments—principally unobservable inputs that are significant to the estimation of fair value. These unobservable inputs could

include, for example, the investment managers’ assumptions about earnings multiples and future cash flows.

We periodically review the methodologies, inputs and outputs of third-party pricing services for reasonableness.

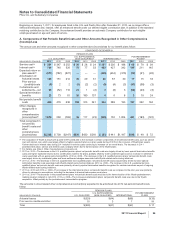

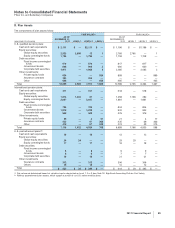

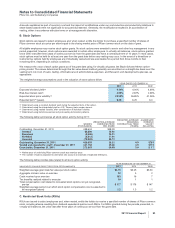

The long-term target asset allocations ranges and the percentage of the fair value of plan assets for benefit plans follow:

AS OF DECEMBER 31,

TARGET

ALLOCATION

PERCENTAGE PERCENTAGE OF PLAN ASSETS

(PERCENTAGES) 2011 2011 2010

U.S. qualified pension plans:

Cash and cash equivalents 0-5 17.6 11.3

Equity securities 25-50 36.0 42.2

Debt securities 30-55 30.4 33.6

Real estate and other investments 10-15 16.0 12.9

Total 100 100.0 100.0

International pension plans:

Cash and cash equivalents 0-5 4.4 7.7

Equity securities 25-50 50.0 49.8

Debt securities 30-55 32.9 31.6

Real estate and other investments 10-15 12.7 10.9

Total 100 100.0 100.0

U.S. postretirement plans:

Cash and cash equivalents 0-5 4.6 2.9

Equity securities 5-20 9.7 11.3

Debt securities 5-20 8.1 8.9

Real estate, insurance contracts and other investments 65-80 77.6 76.9

Total 100 100.0 100.0

90 2011 Financial Report