Pfizer 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

Adjusted income, as shown above, excludes the following items:

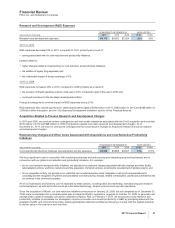

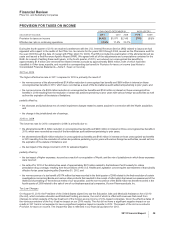

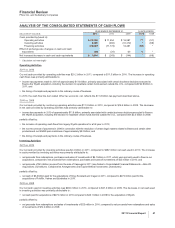

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2011 2010 2009

Purchase accounting adjustments:

Amortization, depreciation and other(a) $ 5,563 $ 5,228 $ 2,743

Cost of sales, primarily related to fair value adjustments of acquired inventory 1,238 2,904 976

In-process research and development charges(b) —125 68

Total purchase accounting adjustments, pre-tax 6,801 8,257 3,787

Income taxes (1,769) (2,148) (1,154)

Total purchase accounting adjustments—net of tax 5,032 6,109 2,633

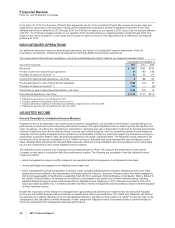

Acquisition-related costs:

Transaction costs(c) 30 22 768

Integration costs(c) 730 1,004 569

Restructuring charges(c) 598 2,175 2,607

Additional depreciation—asset restructuring(d) 625 788 81

Total acquisition-related costs, pre-tax 1,983 3,989 4,025

Income taxes (525) (1,092) (1,167)

Total acquisition-related costs—net of tax 1,458 2,897 2,858

Discontinued operations:

Loss/(income) from operations—net of tax (8) (88) (97)

(Gain)/loss on sale of discontinued operations (1,304) 11 (17)

Total discontinued operations—net of tax (1,312) (77) (114)

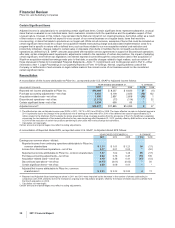

Certain significant items:

Restructuring charges(e) 1,576 — 386

Implementation costs and additional depreciation—asset restructuring(f) 961 — 410

Certain legal matters(g) 828 1,703 294

Net interest expense(h) —— 589

Certain asset impairment charges(i) 848 2,151 294

Inventory write-off(j) 8212 —

Gain related to ViiV(k) —— (482)

Other 133 (102) 20

Total certain significant items, pre-tax 4,354 3,964 1,511

Income taxes(l) (1,324) (3,265) (1,428)

Total certain significant items—net of tax 3,030 699 83

Total purchase accounting adjustments, acquisition-related costs, discontinued

operations and certain significant items—net of tax $ 8,208 $ 9,628 $ 5,460

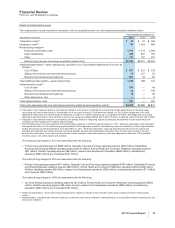

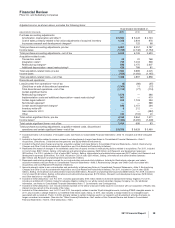

(a) Included primarily in Amortization of intangible assets (see Notes to Consolidated Financial Statements—Note 10. Goodwill and Other Intangible

Assets).

(b) Included in Acquisition-related in-process research and development charges (see Notes to Consolidated Financial Statements—Note 2.

Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments).

(c) Included in Restructuring charges and certain acquisition-related costs (see Notes to Consolidated Financial Statements—Note 3. Restructuring

Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives).

(d) Represents the impact of changes in the estimated useful lives of assets involved in restructuring actions related to acquisitions. For 2011, included

in Cost of sales ($557 million), Selling, informational and administrative expenses ($45 million) and Research and development expenses

($23 million). For 2010, included in Cost of sales ($527 million), Selling, informational and administrative expenses ($227 million) and Research and

development expenses ($34 million). For 2009, included in Cost of sales ($31 million), Selling, informational and administrative expenses

($37 million) and Research and development expenses ($13 million).

(e) Represents restructuring charges incurred for our cost-reduction and productivity initiatives. Included in Restructuring charges and certain

acquisition-related costs (see Notes to Consolidated Financial Statements—Note 3. Restructuring Charges and Other Costs Associated with

Acquisitions and Cost-Reduction/Productivity Initiatives).

(f) Amounts primarily relate to our cost-reduction and productivity initiatives (see Notes to Consolidated Financial Statements—Note 3. Restructuring

Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives). For 2011, included in Cost of sales ($250

million), Selling, informational and administrative expenses ($55 million), Research and development expenses ($656 million). For 2009, included in

Cost of sales ($148 million), Selling, informational and administrative expenses ($175 million), Research and development expenses ($78 million)

and Other deductions—net ($9 million).

(g) Included in Other deductions—net. For 2011, includes approximately $700 million related to hormone-replacement therapy litigation. For 2010,

includes an additional $1.3 billion charge for asbestos litigation related to our wholly owned subsidiary Quigley Company, Inc. (for additional

information, see Notes to Consolidated Financial Statements Note 17. Commitments and Contingencies).

(h) Included in Other deductions—net. Includes interest expense on the senior unsecured notes issued in connection with our acquisition of Wyeth, less

interest income earned on the proceeds of the notes.

(i) Included in Other deductions—net. In 2011 and 2010, the majority relates to certain Wyeth intangible assets, including IPR&D intangible assets. In

2011, also includes a charge related to our indefinite-lived brand asset, Xanax. In 2010, also includes a charge related to an intangible asset

associated with our product, Thelin.In 2009, primarily relates to certain materials used in our research and development activities that were no

longer considered recoverable. (See also the “Other (Income)/Deductions—Net” section of this Financial Review and Notes to Consolidated

Financial Statements—Note 4. Other Deductions—Net.)

2011 Financial Report 39