Pfizer 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

Pricing and Access Pressures

Governments, managed care organizations and other payer groups continue to seek increasing discounts on our products through a

variety of means such as leveraging their purchasing power, implementing price controls, and demanding price cuts (directly or by

rebate actions). In particular, as a result of the economic environment, the industry has experienced significant pricing pressures in

certain European and emerging market countries. There were government-mandated price reductions for certain biopharmaceutical

products in certain European and emerging market countries in 2011, and we anticipate continuing pricing pressures in Europe and

emerging markets in 2012. Also, health insurers and benefit plans continue to limit access to certain of our medicines by imposing

formulary restrictions in favor of the increased use of generics. In prior years, Presidential advisory groups tasked with reducing

healthcare spending have recommended and legislative changes have been proposed that would allow the U.S. government to

directly negotiate prices with pharmaceutical manufacturers on behalf of Medicare beneficiaries, which we expect would restrict

access to and reimbursement for our products. There have also been a number of legislative proposals seeking to allow importation

of medicines into the U.S. from countries whose governments control the price of medicines, despite the increased risk of counterfeit

products entering the supply chain. If importation of medicines is allowed, an increase in cross-border trade in medicines subject to

foreign price controls in other countries could occur and negatively impact our revenues.

In August 2011, the federal Budget Control Act of 2011 (the Act) was enacted in the U.S. The Act includes provisions to raise the

U.S. Treasury Department’s borrowing limit, known as the debt ceiling, and provisions to reduce the federal deficit by $2.4 trillion

between 2012 and 2021. Deficit-reduction targets include $900 billion of discretionary spending reductions associated with the

Department of Health and Human Services and various agencies charged with national security, but those discretionary spending

reductions do not include programs such as Medicare and Medicaid or direct changes to pharmaceutical pricing, rebates or

discounts. A Joint Select Committee of Congress (the Committee) was appointed to identify the remaining $1.5 trillion of deficit

reductions by November 23, 2011, but no recommendations were made by the Committee prior to the deadline. As a result, the

Office of Management and Budget (OMB) is now responsible for identifying the remaining $1.5 trillion of deficit reductions, which will

be divided evenly between defense and non-defense spending. Under this OMB fallback review process, Social Security, Medicaid,

Veteran Benefits and certain other spending categories are excluded from consideration, but reductions in payments to Medicare

providers may be made, although any such reductions are prohibited by law from exceeding 2%. Additionally, certain payments to

Medicare Part D plans, such as low-income subsidy payments, are exempt from reduction. While we do not know the specific nature

of the spending reductions under the Act that will affect Medicare, we do not expect that those reductions will have a material

adverse impact on our results of operations. However, any significant spending reductions affecting Medicare, Medicaid or other

publicly funded or subsidized health programs that may be implemented, and/or any significant additional taxes or fees that may be

imposed on us, as part of any broader deficit-reduction effort could have an adverse impact on our results of operations.

Competition Among Branded Products

Many of our products face competition in the form of branded products, which treat similar diseases or indications. These

competitive pressures can have an adverse impact on our future revenues.

The Global Economic Environment

In addition to the industry-specific factors discussed above, we, like other businesses, continue to face the effects of the challenging

economic environment, which have impacted our biopharmaceutical operations in the U.S. and Europe, affecting the performance of

products such as Lipitor, Celebrex and Lyrica. We believe that patients, experiencing the effects of the challenging economic

environment, including high unemployment levels, and increases in co-pays, sometimes are switching to generics, delaying

treatments, skipping doses or using less effective treatments to reduce their costs. Challenging economic conditions in the U.S. also

have increased the number of patients in the Medicaid program, under which sales of pharmaceuticals are subject to substantial

rebates and, in many states, to formulary restrictions limiting access to brand-name drugs, including ours. In addition, during 2011,

we continued to experience pricing pressure as a result of the economic environment in Europe and in a number of emerging

markets, with government-mandated reductions in prices for certain biopharmaceutical products in certain European and emerging

market countries.

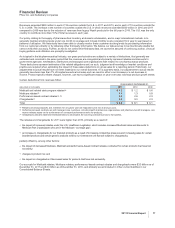

Significant portions of our revenues and earnings are exposed to changes in foreign exchange rates. We seek to manage our

foreign exchange risk in part through operational means, including managing same-currency revenues in relation to same-currency

costs and same-currency assets in relation to same-currency liabilities. Depending on market conditions, foreign exchange risk also

is managed through the use of derivative financial instruments and foreign currency debt. As we operate in multiple foreign

currencies, including the euro, the U.K. pound, the Japanese yen, the Canadian dollar and approximately 100 other currencies,

changes in those currencies relative to the U.S. dollar will impact our revenues and expenses. If the U.S. dollar weakens against a

specific foreign currency, our revenues will increase, having a positive impact, and our overall expenses will increase, having a

negative impact, on net income. Likewise, if the U.S. dollar strengthens against a specific foreign currency, our revenues will

decrease, having a negative impact, and our overall expenses will decrease, having a positive impact on net income. Therefore,

significant changes in foreign exchange rates can impact our results and our financial guidance.

Despite the challenging financial markets, Pfizer maintains a strong financial position. Due to our significant operating cash flows,

financial assets, access to capital markets and available lines of credit and revolving credit agreements, we continue to believe that

we have the ability to meet our liquidity needs for the foreseeable future. Our long-term debt is rated high quality by both Standard &

Poor’s and Moody’s Investors Service. As market conditions change, we continue to monitor our liquidity position. We have taken

and will continue to take a conservative approach to our financial investments. Both short-term and long-term investments consist

primarily of high-quality, highly liquid, well-diversified, available-for-sale debt securities. For further discussion of our financial

condition, see the “Analysis of Financial Condition, Liquidity and Capital Resources” section of this Financial Review.

2011 Financial Report 7