Pfizer 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

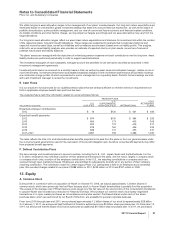

All derivative contracts used to manage interest rate risk are measured at fair value and reported as assets or liabilities on the

consolidated balance sheet. Changes in fair value are reported in earnings, as follows:

•We recognize the gains and losses on interest rate swaps that are designated as fair value hedges in earnings upon the recognition of

the change in fair value of the hedged risk. We recognize the offsetting earnings impact of fixed-rate debt attributable to the hedged risk

also in earnings.

Any ineffectiveness is recognized immediately into earnings. There was no significant ineffectiveness for any period presented.

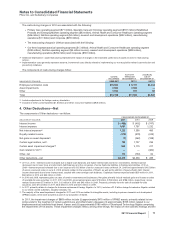

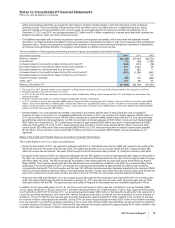

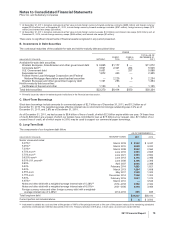

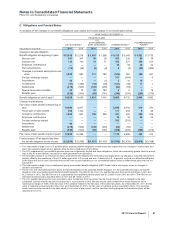

Information about the gains/(losses) incurred to hedge or offset operational foreign exchange or interest rate risk follows:

AMOUNT OF

GAINS/(LOSSES)

RECOGNIZED IN OID(a), (b), (c)

AMOUNT OF

GAINS/(LOSSES)

RECOGNIZED IN OCI

(EFFECTIVE PORTION)(a), (d)

AMOUNT OF

GAINS/(LOSSES)

RECLASSIFIED FROM

OCI INTO OID

(EFFECTIVE PORTION)(a), (d)

(MILLIONS OF DOLLARS)

Dec. 31,

2011

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2010

Derivative Financial Instruments in Cash

Flow Hedge Relationships

Foreign currency swaps $–– $–– $ (496) $(1,054) $(243) $(704)

Derivative Financial Instruments in Net

Investment Hedge Relationships

Foreign currency swaps 7(1) (1,059) (97) –– ––

Derivative Financial Instruments Not

Designated as Hedges

Foreign currency forward-exchange

contracts (260) (454) –– —–– ––

Foreign currency swaps 106 20 –– –– –– ––

Non-Derivative Financial Instruments in

Net Investment Hedge Relationships

Foreign currency short-term

borrowings –– –– 940 (241) –– ––

Foreign currency long-term debt –– –– (41) (91) –– ––

All other, net 15 1(4) (6) 42

Total $(132) $(434) $ (660) $(1,489) $(239) $(702)

(a) OID = Other (income)/deductions––net, included in the income statement account, Other deductions—net. OCI = Other comprehensive income/

(loss), included in the balance sheet account Accumulated other comprehensive loss.

(b) Also includes gains and losses attributable to the hedged risk in fair value hedged relationships.

(c) There was no significant ineffectiveness for any of the periods presented.

(d) Amounts presented represent the effective portion of the gain or loss. For derivative financial instruments in cash flow hedge relationships, the

effective portion is included in Other comprehensive income/(loss)–derivative financial instruments. For derivative financial instruments in net

investment hedge relationships and for foreign currency debt designated as hedging instruments, the effective portion is included in Other

comprehensive income/(loss)––currency translation adjustment and other.

For information about the fair value of our derivative financial instruments, and the impact on our consolidated balance sheet, see

Note 7A. Financial Instruments: Selected Financial Assets and Liabilities. Certain of our derivative instruments are covered by

associated credit-support agreements that have credit-risk-related contingent features designed to reduce our counterparties’

exposure to our risk of defaulting on amounts owed. The aggregate fair value of these derivative instruments that are in a liability

position is $502 million, for which we have posted collateral of $555 million in the normal course of business. These features include

the requirement to pay additional collateral in the event of a downgrade in our debt ratings. If there had been a downgrade to below

an A rating by S&P or the equivalent rating by Moody’s Investors Service, on December 31, 2011, we would have been required to

post an additional $46 million of collateral to our counterparties. The collateral advanced receivables are reported in Cash and cash

equivalents.

F. Credit Risk

On an ongoing basis, we review the creditworthiness of counterparties to our foreign exchange and interest rate agreements and do

not expect to incur a significant loss from failure of any counterparties to perform under the agreements. There are no significant

concentrations of credit risk related to our financial instruments with any individual counterparty. As of December 31, 2011, we had

$2.8 billion due from a well-diversified, highly rated group (S&P ratings of mostly A+ or better) of bank counterparties around the

world. See Note 7B. Financial Instruments: Investment in Debt Securities for a distribution of our investments.

In general, there is no requirement for collateral from customers. However, derivative financial instruments are executed under

master netting agreements with financial institutions. These agreements contain provisions that provide for the ability for collateral

payments, depending on levels of exposure, our credit rating and the credit rating of the counterparty. As of December 31, 2011, we

received cash collateral of $491 million against various counterparties. The collateral primarily supports the approximate fair value of

our derivative contracts. With respect to the collateral received, the obligations are reported in Short-term borrowings, including

current portion of long-term debt.

2011 Financial Report 81