Pfizer 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

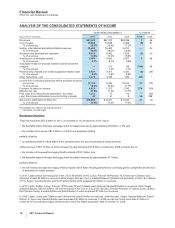

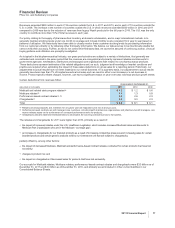

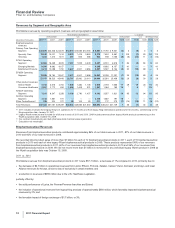

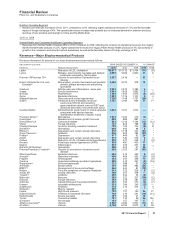

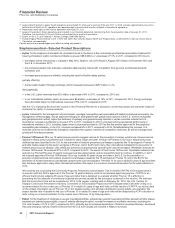

(a) Legacy Wyeth product. Legacy Wyeth operations are included for a full year in each of 2010 and 2011. In 2009, includes approximately two-and-a-

half months of Wyeth’s U.S. operations and approximately one-and-a-half months of Wyeth’s international operations.

(b) Represents direct sales under license agreement with Eisai Co., Ltd.

(c) Legacy King product. King’s operations are included in our financial statements commencing from the acquisition date of January 31, 2011.

Therefore, our results for 2010 and 2009 do not include King’s results of operations.

(d) Enbrel (in the U.S. and Canada)(a), Aricept, Exforge, Rebif and Spiriva.

(e) Includes legacy Pfizer products in 2011, 2010 and 2009. Also includes legacy Wyeth and King products, as described in notes (a) and (c) above.

* Calculation not meaningful.

Certain amounts and percentages may reflect rounding adjustments.

Biopharmaceutical—Selected Product Descriptions

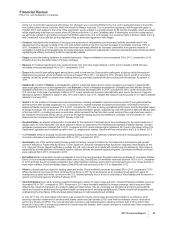

•Lipitor, for the treatment of elevated LDL-cholesterol levels in the blood, is the most widely used branded prescription treatment for

lowering cholesterol. Lipitor recorded worldwide revenues of $9.6 billion, or a decrease of 11%, in 2011, compared to 2010 due to:

Othe impact of loss of exclusivity in Canada in May 2010, Spain in July 2010, Brazil in August 2010, Mexico in December 2010 and

the U.S. in November 2011;

Othe continuing impact of an intensely competitive lipid-lowering market with competition from generics and branded products

worldwide; and

Oincreased payer pressure worldwide, including the need for flexible rebate policies,

partially offset by:

Othe favorable impact of foreign exchange, which increased revenues by $257 million, or 2%.

Geographically,

Oin the U.S., Lipitor revenues were $5.0 billion, a decrease of 6% in 2011, compared to 2010; and

Oin our international markets, Lipitor revenues were $4.6 billion, a decrease of 15%, in 2011, compared to 2010. Foreign exchange

had a favorable impact on international revenues of 5% in 2011, compared to 2010.

See the “Our Operating Environment” section of this Financial Review for a discussion concerning losses and expected losses of

exclusivity for Lipitor in various markets.

•Lyrica, indicated for the management of post-herpetic neuralgia, neuropathic pain associated with diabetic peripheral neuropathy, the

management of fibromyalgia, and as adjunctive therapy for adult patients with partial onset seizures in the U.S., and for neuropathic

pain (peripheral and central), adjunctive treatment of epilepsy and general anxiety disorder in certain countries outside the U.S.,

recorded an increase in worldwide revenues of 21% in 2011, compared to 2010. Lyrica had a strong operational performance in

international markets in 2011, including Japan, where Lyrica was launched in 2010 as the first product approved for the peripheral

neuropathic pain indication. In the U.S., revenues increased 6% in 2011, compared to 2010. Notwithstanding this increase, U.S.

revenues continue to be affected by increased competition from generic versions of competitive medicines, as well as managed care

pricing and formulary pressures.

•Prevnar 13/Prevenar 13 is our 13-valent pneumococcal conjugate vaccine for the prevention of various syndromes of pneumococcal

disease in infants and young children and in adults 50 years of age and older. Prevnar 13/Prevenar 13 for use in infants and young

children has been launched in the U.S. for the prevention of invasive pneumococcal disease caused by the 13 serotypes in Prevnar 13

and otitis media caused by the seven serotypes in Prevnar, and in the EU and many other international markets for the prevention of

invasive pneumococcal disease, otitis media and pneumococcal pneumonia caused by the vaccine serotypes. Worldwide revenues for

Prevnar 13/Prevenar 13 increased 51% in 2011, compared to 2010. The launch of the Prevnar 13/Prevenar 13 pediatric indication has

reduced our Prevnar/Prevenar (7-valent) revenues (see discussion below), and we expect this trend to continue. In addition, in 2011,

we received approval of Prevnar 13/Prevenar 13 for use in adults 50 years of age and older in the U.S. for the prevention of

pneumococcal pneumonia and invasive pneumococcal disease caused by the 13 serotypes in Prevnar 13, and in the EU for the

prevention of invasive pneumococcal disease caused by the vaccine serotypes. Prevenar 13 for use in adults 50 years of age and older

also has been approved in many other international markets. We expect to commence commercial launches for the adult indication in

2012.

We currently are conducting the Community-Acquired Pneumonia Immunization Trial in Adults (CAPiTA) to fill requirements in

connection with the FDA’s approval of the Prevnar 13 adult indication under its accelerated approval program. CAPiTA is an

efficacy trial involving subjects 65 years of age and older that is designed to evaluate whether Prevnar 13 is effective in

preventing the first episode of community-acquired pneumonia caused by the serotypes contained in the vaccine. We estimate

that this event-driven trial will be completed in 2013. At its regular meeting held on February 22, 2012, the U.S. Centers for

Disease Control and Prevention’s Advisory Committee on Immunization Practices (ACIP) indicated that it will defer voting on a

recommendation for the routine use of Prevnar 13 in adults 50 years of age and older until the results of CAPiTA, as well as data

on the impact of pediatric use of Prevnar 13 on the disease burden and serotype distribution among adults, are available. We

expect that the rate of uptake for the use of Prevnar 13 in adults 50 years of age and older will be impacted by ACIP’s decision to

defer voting on a recommendation for the routine use of Prevnar 13 by that population.

•Enbrel, for the treatment of moderate-to-severe rheumatoid arthritis, polyarticular juvenile rheumatoid arthritis, psoriatic arthritis, plaque

psoriasis and ankylosing spondylitis, a type of arthritis affecting the spine, recorded increases in worldwide revenues, excluding the

U.S. and Canada, of 12% in 2011, compared to 2010, primarily due to increased penetration of Enbrel in developed Europe, developed

Asia and emerging markets. Enbrel revenues from the U.S. and Canada are included in Alliance revenues.

22 2011 Financial Report