Pfizer 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

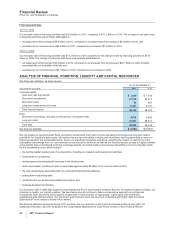

Our financial instrument holdings at year-end were analyzed to determine their sensitivity to interest rate changes. The fair values of

these instruments were determined using various methodologies. For additional details, see Notes to Consolidated Financial

Statements—Note 7A. Financial Instruments: Selected Financial Assets and Liabilities. In this sensitivity analysis, we used a one

hundred basis point parallel shift in the interest rate curve for all maturities and for all instruments; all other factors were held

constant. If there were a one hundred basis point decrease in interest rates, the expected adverse impact on net income related to

our financial instruments would be immaterial.

Contingencies

Legal Matters

We and certain of our subsidiaries are subject to numerous contingencies arising in the ordinary course of business, such as patent

litigation, product liability and other product-related litigation, commercial litigation, environmental claims and proceedings,

government investigations and guarantees and indemnifications (see Notes to Consolidated Financial Statements—Note 17.

Commitments and Contingencies).

Certain of these contingencies could result in losses, including damages, fines and/or civil penalties, and/or criminal charges, which

could be substantial.

We believe that our claims and defenses in these matters are substantial, but litigation is inherently unpredictable and excessive

verdicts do occur. We do not believe that any of these matters will have a material adverse effect on our financial position. However,

we could incur judgments, enter into settlements or revise our expectations regarding the outcome of certain matters, and such

developments could have a material adverse effect on our results of operations or cash flows in the period in which the amounts are

paid and/or accrued.

We have accrued for losses that are both probable and reasonably estimable. Substantially all of these contingencies are subject to

significant uncertainties and, therefore, determining the likelihood of a loss and/or the measurement of any loss can be complex.

Consequently, we are unable to estimate the range of reasonably possible loss in excess of amounts accrued. Our assessments are

based on estimates and assumptions that have been deemed reasonable by management, but the assessment process relies

heavily on estimates and assumptions that may prove to be incomplete or inaccurate, and unanticipated events and circumstances

may occur that might cause us to change those estimates and assumptions.

Tax Matters

We account for income tax contingencies using a benefit recognition model. If our initial assessment fails to result in the recognition

of a tax benefit, we regularly monitor our position and subsequently recognize the tax benefit: (i) if there are changes in tax law,

analogous case law or there is new information that sufficiently raise the likelihood of prevailing on the technical merits of the

position to more likely than not; (ii) if the statute of limitations expires; or (iii) if there is a completion of an audit resulting in a

favorable settlement of that tax year with the appropriate agency. We regularly re-evaluate our tax positions based on the results of

audits of federal, state and foreign income tax filings, statute of limitations expirations, changes in tax law or receipt of new

information that would either increase or decrease the technical merits of a position relative to the “more-likely-than-not” standard.

Our assessments are based on estimates and assumptions that have been deemed reasonable by management, but our estimates

of unrecognized tax benefits and potential tax benefits may not be representative of actual outcomes, and variation from such

estimates could materially affect our financial statements in the period of settlement or when the statutes of limitations expire, as we

treat these events as discrete items in the period of resolution. Finalizing audits with the relevant taxing authorities can include

formal administrative and legal proceedings, and, as a result, it is difficult to estimate the timing and range of possible changes

related to our uncertain tax positions, and such changes could be significant.

48 2011 Financial Report