Pfizer 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

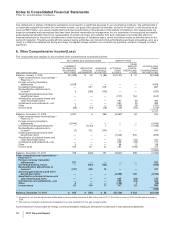

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

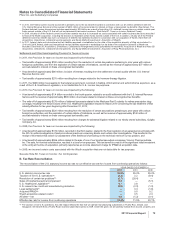

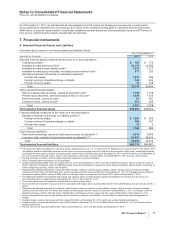

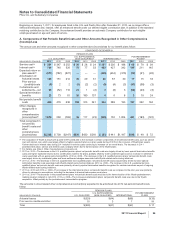

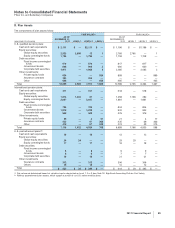

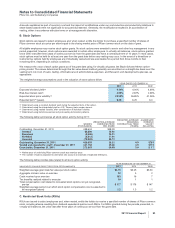

B. Other Intangible Assets

The components of identifiable intangible assets follow:

AS OF DECEMBER 31,

2011 2010

(MILLIONS OF DOLLARS)

GROSS

CARRYING

AMOUNT

ACCUMULATED

AMORTIZATION

IDENTIFIABLE

INTANGIBLE

ASSETS, LESS

ACCUMULATED

AMORTIZATION

GROSS

CARRYING

AMOUNT

ACCUMULATED

AMORTIZATION

IDENTIFIABLE

INTANGIBLE

ASSETS, LESS

ACCUMULATED

AMORTIZATION

Finite-lived intangible assets:

Developed technology rights(a) $73,088 $(32,013) $41,075 $68,432 $(26,223) $42,209

Brands 1,678 (687) 991 1,626 (607) 1,019

License agreements 425 (215) 210 637 (248) 389

Other 623 (362) 261 533 (324) 209

Total finite-lived intangible assets 75,814 (33,277) 42,537 71,228 (27,402) 43,826

Indefinite-lived intangible assets:

Brands 10,027 — 10,027 10,219 — 10,219

In-process research and development(a) 1,197 — 1,197 3,438 — 3,438

Trademarks 72 — 72 72 — 72

Total indefinite-lived intangible assets 11,296 — 11,296 13,729 — 13,729

Total identifiable intangible assets(b) $87,110 $(33,277) $53,833 $84,957 $(27,402) $57,555

(a) In the fourth quarter of 2011, Prevenar 13 Adult and Vyndaqel (tafamidis meglumine) received regulatory approval in a major market, and as a

result, we reclassified these assets, with a combined book value of approximately $2.3 billion, from IPR&D to Developed Technology Rights and

began to amortize the assets.

(b) The decrease is primarily related to amortization and impairment charges (see Note 4. Other Deductions—Net), partially offset by assets acquired

as part of the acquisition of King (see Note 2B. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Acquisition

of King Pharmaceuticals, Inc.) and the impact of foreign exchange.

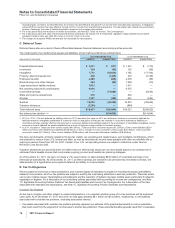

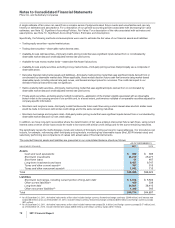

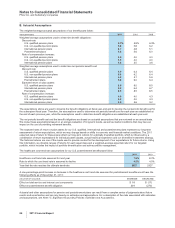

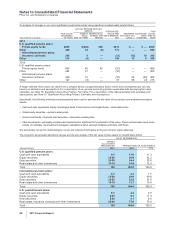

At December 31, 2011, our identifiable intangible assets are associated with the following, as a percentage of identifiable intangible

assets, less accumulated amortization:

•Developed technology rights: Specialty Care (64%); Established Products (17%); Primary Care (15%); Animal Health (2%); Oncology

(1%); and Nutrition (1%)

•Brands, finite-lived: Consumer Healthcare (57%); Established Products (29%); and Animal Health (14%)

•Brands, indefinite-lived: Consumer Healthcare (51%); Established Products (26%); and Nutrition (23%)

•IPR&D: Worldwide Research and Development (57%); Specialty Care (14%); Primary Care (14%); Established Products (8%);

Oncology (5%); and Animal Health (2%)

There are no percentages for our Emerging Markets business unit as it is a geographic-area unit, not a product-based unit. The

carrying value of the assets associated with our Emerging Markets business unit is included within the assets associated with the

other four biopharmaceutical business units.

For information about intangible asset impairments, see Note 4. Other Deductions––Net.

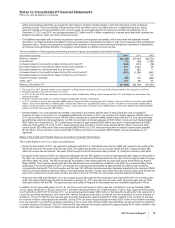

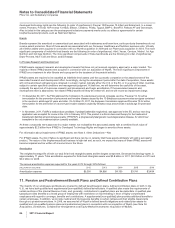

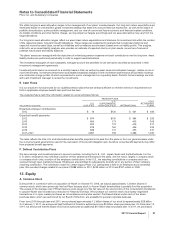

Developed Technology Rights

Developed technology rights represent the amortized cost associated with developed technology, which has been acquired from

third parties and which can include the right to develop, use, market, sell and/or offer for sale the product, compounds and

intellectual property that we have acquired with respect to products, compounds and/or processes that have been completed. We

possess a well-diversified portfolio of hundreds of developed technology rights across therapeutic categories, primarily representing

the commercialized products included in our five biopharmaceutical business units. Virtually all of these assets were acquired in

connection with our Wyeth acquisition in 2009 and our Pharmacia acquisition in 2003. The more significant components of

2011 Financial Report 83