Pfizer 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

Wyeth’s core business was the discovery, development, manufacture and sale of prescription pharmaceutical products, including

vaccines, for humans. Other operations of Wyeth included the discovery, development, manufacture and sale of consumer

healthcare products (over-the-counter products), nutritionals and animal health products. Wyeth was a diversified healthcare

company, with product offerings in human, animal, and consumer health, including vaccines, biologics, small molecules and

nutrition, across developed and emerging markets. The acquisition of Wyeth added to our pipeline of biopharmaceutical

development projects endeavoring to develop medicines to help patients in critical areas, including oncology, pain, inflammation,

Alzheimer’s disease, psychoses and diabetes.

In connection with the regulatory approval process, we were required to divest certain animal health assets. Certain of these assets

were sold in each of the periods presented. It is possible that additional divestitures of animal health assets may be required based

on ongoing regulatory reviews in other jurisdictions worldwide, but they are not expected to be significant to our business.

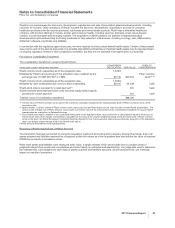

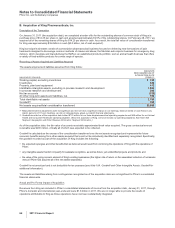

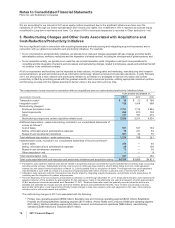

Fair Value of Consideration Transferred

The consideration transferred to acquire Wyeth follows:

(IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

CONVERSION

CALCULATION FAIR VALUE

FORM OF

CONSIDERATION

Wyeth common stock outstanding as of the acquisition date 1,339.6

Multiplied by Pfizer’s stock price as of the acquisition date multiplied by the

exchange ratio of 0.985 ($17.66(a) x 0.985) $17.40 $23,303

Pfizer common

stock(a), (b)

Wyeth common stock outstanding as of the acquisition date 1,339.6

Multiplied by cash consideration per common share outstanding $33.00 44,208 Cash

Wyeth stock options canceled for a cash payment(c) 405 Cash

Wyeth restricted stock/restricted stock units and other equity-based awards

canceled for a cash payment 320 Cash

Total fair value of consideration transferred $68,236

(a) The fair value of Pfizer’s common stock used in the conversion calculation represents the closing market price of Pfizer’s common stock on the

acquisition date.

(b) Approximately 1.3 billion shares of Pfizer common stock, previously held as Pfizer treasury stock, were issued to former Wyeth shareholders. The

excess of the average cost of Pfizer treasury stock issued over the fair value of the stock portion of the consideration transferred to acquire Wyeth

was recorded as a reduction to Retained earnings.

(c) Each Wyeth stock option, whether or not vested and exercisable on the acquisition date, was canceled for a cash payment equal to the excess of

the per share value of the merger consideration (calculated on the basis of the volume-weighted average of the per share price of Pfizer common

stock on the New York Stock Exchange Transaction Reporting System for the five consecutive trading days ending two days prior to the acquisition

date) over the per share exercise price of the Wyeth stock option.

Certain amounts may reflect rounding adjustments.

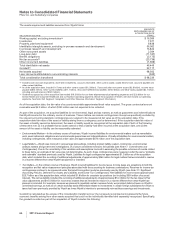

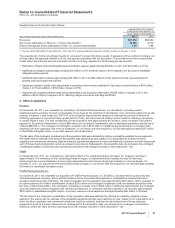

Recording of Assets Acquired and Liabilities Assumed

The transaction has been accounted for using the acquisition method of accounting which requires, among other things, that most

assets acquired and liabilities assumed be recognized at their fair values as of the acquisition date and that the fair value of acquired

IPR&D be recorded on the balance sheet.

While most assets and liabilities were measured at fair value, a single estimate of fair value results from a complex series of

judgments about future events and uncertainties and relies heavily on estimates and assumptions. Our judgments used to determine

the estimated fair value assigned to each class of assets acquired and liabilities assumed, as well as asset lives, can materially

impact our results of operations.

2011 Financial Report 63