Pfizer 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

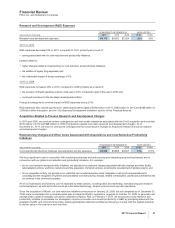

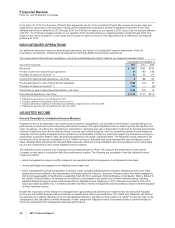

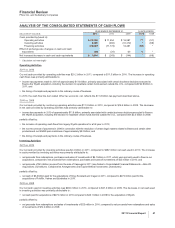

(j) Included in Cost of sales (see also the “Costs and Expenses––Cost of Sales” section of this Financial Review).

(k) Included in Other deductions––net and represents a gain related to ViiV, an equity method investment (see Notes to Consolidated Financial

Statements—Note 2F. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Equity-Method Investments).

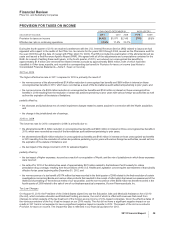

(l) Included in Provision for taxes on income. In 2011, primarily includes the tax impacts and jurisdictional mix of restructuring, implementation and

impairment charges. Amounts in 2010 include a $2.0 billion tax benefit recorded in the fourth quarter as a result of a settlement of certain audits

covering the years 2002-2005 (see Notes to Consolidated Financial Statements––Note 5D. Taxes on Income: Tax Contingencies). Amounts in 2009

include tax benefits of approximately $556 million related to the sale of one of our biopharmaceutical companies, Vicuron, which were recorded in

the fourth quarter of 2009, and tax benefits of approximately $174 million related to the final resolution of investigations concerning Bextra and

various other products, which were recorded in the third quarter of 2009. This resolution resulted in the receipt of information that raised our

assessment of the likelihood of prevailing on the technical merits of our tax position.

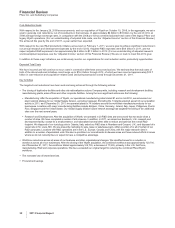

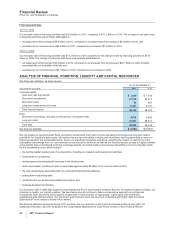

ANALYSIS OF THE CONSOLIDATED BALANCE SHEETS

Discussion of Changes

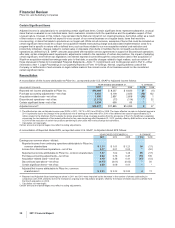

Virtually all changes in our asset and liability accounts as of December 31, 2011, compared to December 31, 2010, reflect, among

other things, increases associated with our acquisition of King (see Notes to Consolidated Financial Statements—Note 2B.

Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Acquisition of King Pharmaceuticals, Inc.)

and increases due to the impact of foreign exchange.

For information about certain of our financial assets and liabilities, including cash and cash equivalents, short-term investments,

short-term loans, long-term investments and loans, short-term borrowings, including current portion of long-term debt, and long-term

debt, see “Analysis of Financial Condition, Liquidity and Capital Resources” below.

For Accounts Receivable, net, see “Selected Measures of Liquidity and Capital Resources: Accounts Receivable” below.

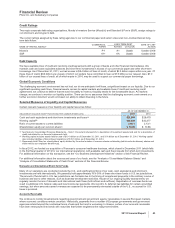

For Inventories, the change also reflects inventory sold during 2011 that was acquired from Wyeth and that had been recorded at

fair value.

For Assets of discontinued operations and other assets held for sale, the decrease reflects the sale of Capsugel (see Notes to

Consolidated Financial Statements—Note 2D. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method

Investments: Divestitures).

For Identifiable intangible assets, less accumulated amortization, the change also includes the impact of impairments of certain

assets (see Notes to Consolidated Financial Statements—Note 4. Other Deductions—Net).

For Other current liabilities, the change also includes the charges recorded for hormone-replacement therapy litigation (see Notes to

Consolidated Financial Statements—Note 4. Other Deductions––Net and Note 17. Commitments and Contingencies).

For Pension benefit obligations, the change also reflects the impact of $2.9 billion of company contributions in 2011 (see Notes to

Consolidated Financial Statements—Note 11. Pension and Postretirement Benefit Plans and Defined Contribution Plans).

For Other noncurrent liabilities, the change also reflects an increase in the fair value of derivative financial instruments in a liability

position (see Notes to Consolidated Financial Statements – Note 7A. Financial Instruments: Selected Financial Assets and

Liabilities).

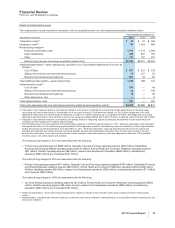

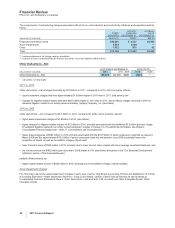

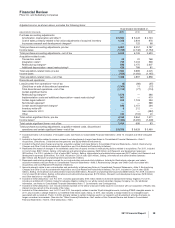

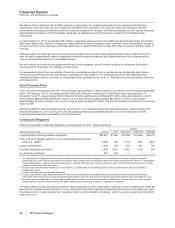

Goodwill

Goodwill – Our company was previously managed through two operating segments (Biopharmaceutical and Diversified), and is now

managed through five operating segments (see Notes to Consolidated Financial Statements – Note 18. Segment, Geographic and

Other Revenue Information for further information). As a result of this change, the goodwill previously associated with our

Biopharmaceutical operating segment has been allocated among the Primary Care, Specialty Care and Oncology, and Established

Products and Emerging Markets operating segments.

While all reporting units can confront events and circumstances that can lead to impairments (such as, among other things,

unanticipated competition, an adverse action or assessment by a regulator, a significant adverse change in legal matters or in the

business climate and/or a failure to replace the contributions of products that lose exclusivity), in general, the increased number of

biopharmaceutical reporting units significantly increases our risk of goodwill impairment charges as smaller reporting units are

inherently less able to absorb negative developments that might affect certain operating assets but not others. However, as a result

of our goodwill impairment review work, we concluded that none of our goodwill is impaired as of December 31, 2011, and we do not

believe the risk of impairment is significant at this time (see also the “Significant Accounting Policies and Application of Critical

Accounting Estimates” section of this Financial Review).

The allocation of biopharmaceutical goodwill and goodwill impairment testing depend heavily on the determination of fair value, as

defined by U.S. GAAP, and these judgments can materially impact our results of operations. A single estimate of fair value can

result from a complex series of judgments about future events and uncertainties and can rely heavily on estimate and assumptions.

For information about the risks associated with estimates and assumptions, see Notes to Consolidated Financial Statements—Note

1C. Significant Accounting Policies: Estimates and Assumptions.

40 2011 Financial Report