Pfizer 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

In addition:

•Individual Mandate—The financial impact of U.S. healthcare reform may be affected by certain additional developments over the next

few years, including pending implementation guidance relating to the U.S. Healthcare Legislation and certain healthcare reform

proposals. In addition, the U.S. Healthcare Legislation requires that, except in certain circumstances, individuals obtain health

insurance beginning in 2014, and it also provides for an expansion of Medicaid coverage in 2014. It is expected that, as a result of

these provisions, there will be a substantial increase in the number of Americans with health insurance beginning in 2014, a significant

portion of whom will be eligible for Medicaid. We anticipate that this will increase demand for pharmaceutical products overall. However,

because of the substantial mandatory rebates we pay under the Medicaid program, we do not anticipate that implementation of the

coverage expansion will generate significant additional revenues for Pfizer. The individual mandate is currently the subject of a legal

challenge before the U.S. Supreme Court. If the Supreme Court strikes down the mandate, but allows the other provisions of the U.S.

Healthcare Legislation to remain in force, the benefits of the U.S. Healthcare Legislation to Pfizer will diminish. However, we do not

expect the impact on us of any such decision to be material because we anticipate that many Americans will choose coverage even in

the absence of a mandate as a result of the government subsidies that will make purchasing coverage more affordable.

•Biotechnology Products—The U.S. Healthcare Legislation provides an abbreviated legal pathway to approve biosimilars (also referred

to as “follow-on biologics”). Innovator biologics were granted 12 years of exclusivity, with a potential six-month pediatric extension. After

the exclusivity period expires, the U.S. Food and Drug Administration (FDA) could approve biosimilar versions of innovator biologics.

The regulatory implementation of these provisions is ongoing and expected to take several years. However, the FDA has begun to

clarify its expectations for approval via the biosimilar pathway with the recent issuance of three draft guidance documents. Among other

things, these draft guidance documents confirm that the FDA will allow biosimilar applicants to use a non-U.S. licensed comparator in

certain studies to support a demonstration of biosimilarity to a U.S.-licensed reference product. If competitors are able to obtain

marketing approval for biosimilars referencing our biotechnology products, our biotechnology products may become subject to

competition from biosimilars, with the attendant competitive pressures. Concomitantly, a better-defined biosimilars approval pathway

will assist us in pursuing approval of our own biosimilar products in the U.S.

The budget proposal submitted to Congress by President Obama in February 2012 includes a provision that would reduce the

base exclusivity period for a biologics product from 12 years to seven years. There is no corresponding pending bill designed to

amend the U.S. Healthcare Legislation to alter the biologics provisions.

The Loss or Expiration of Intellectual Property Rights

As is inherent in the biopharmaceutical industry, the loss or expiration of intellectual property rights can have a significant adverse

effect on our revenues. Many of our products have multiple patents that expire at varying dates, thereby strengthening our overall

patent protection. However, once patent protection has expired or has been lost prior to the expiration date as a result of a legal

challenge, we lose exclusivity on these products, and generic pharmaceutical manufacturers generally produce similar products and

sell them for a lower price. This price competition can substantially decrease our revenues for products that lose exclusivity, often in

a very short period of time. While small molecule products are impacted in such a manner, biologics currently have additional

barriers to entry related to the manufacture of such products and, unlike small molecule generics, biosimilars are not necessarily

identical to the reference products. Therefore, generic competition with respect to biologics may not be as significant. A number of

our current products are expected to face significantly increased generic competition over the next few years.

Our financial guidance for 2012 reflects the anticipated impact of the loss of exclusivity of various products and the expiration of

certain alliance product contract rights discussed below (see the “Our Financial Guidance for 2012” section of this Financial

Review). Specifically:

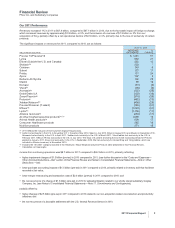

•Lipitor overview—In 2011, worldwide revenues from Lipitor were approximately $9.6 billion, or approximately 14% of total Pfizer

revenues. Of this amount, approximately $5.0 billion was generated in the U.S. and approximately $4.6 billion was generated in

international markets, including approximately $859 million in emerging markets. We expect that the losses of exclusivity for Lipitor in

the U.S. and various international markets discussed below will have a significant adverse impact on our revenues in 2012 and

subsequent years.

•Lipitor in the U.S.—In November 2011, we lost exclusivity in the U.S. for Lipitor.

Pfizer announced in June 2008 that we entered into an agreement providing a license to Ranbaxy to sell generic versions of

Lipitor and Caduet in the U.S effective November 30, 2011. In addition, the agreement provides a license for Ranbaxy to sell a

generic version of Lipitor beginning on varying dates in several additional countries. (See Notes to Consolidated Financial

Statements—Note 17. Commitments and Contingencies for a discussion of certain litigation relating to this agreement.) We also

granted Watson Pharmaceuticals, Inc. (Watson) the exclusive right to sell the authorized generic version of Lipitor in the U.S. for a

period of five years, which commenced on November 30, 2011. As Watson’s exclusive supplier, we manufacture and sell generic

atorvastatin tablets to Watson. We expect the entry of multi-source generic competition in the U.S., with attendant increased

competitive pressures, following the end of Ranbaxy’s 180-day generic exclusivity period in late May 2012.

Through the end of 2011, sales of Lipitor in the U.S. were reported in our Primary Care business unit. Beginning in 2012, sales of

Lipitor in the U.S. will be reported in our Established Products business unit.

2011 Financial Report 5