Pfizer 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

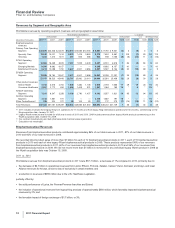

Geographically,

•in the U.S., biopharmaceutical revenues increased 30% in 2010, compared to 2009, reflecting the inclusion of revenues from legacy

Wyeth products of $6.6 billion, which had a favorable impact of 33%, partially offset by lower overall revenues from legacy Pfizer

products, including Lipitor, Detrol/Detrol LA, Celebrex, Lyrica, Chantix and Caduet and the impact of increased rebates in 2010 as a

result of the U.S. Healthcare Legislation, all of which had an unfavorable impact of $664 million, or 3%; and

•in our international markets, biopharmaceutical revenues increased 28% in 2010, compared to 2009, reflecting the inclusion of

operational revenues from legacy Wyeth products of $7.1 billion, which had a favorable impact of 28%, and the favorable impact of

foreign exchange on international biopharmaceutical revenues of approximately $900 million, or 3%, partially offset by lower operational

revenues from legacy Pfizer products of $819 million, or 3%. The decrease in operational revenues of legacy Pfizer products was due

to lower operational revenues from, among other products, Lipitor, Norvasc and Camptosar, all of which were impacted by the loss of

exclusivity in certain international markets.

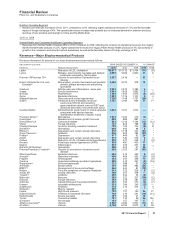

Primary Care Operating Segment

•Primary Care unit revenues increased 3% in 2010 compared to 2009, due to higher operational revenues of 2% and the favorable

impact of foreign exchange of 1%. Primary Care unit revenues were favorably impacted by the addition of legacy Wyeth products,

primarily Premarin and Pristiq. Operational revenues in 2010 were negatively impacted by the loss of exclusivity of Lipitor in Canada in

May 2010 and Spain in July 2010, which reduced Primary Care unit revenues by approximately $534 million, or 2%, in comparison

2009. Additionally, legacy Pfizer Primary Care revenues were negatively impacted by developed Europe pricing pressures and the U.S.

Healthcare Legislation and positively impacted by growth from select brands, including Lyrica, Champix and Celebrex, among others, in

key international markets, most notably Japan.

Specialty Care and Oncology Operating Segment

•Specialty Care unit revenues increased 103% in 2010 compared to 2009, due to higher operational revenues of 103%. Foreign

exchange was flat. Specialty Care unit revenues in 2010 were favorably impacted by the addition of legacy Wyeth products, primarily

Enbrel and the Prevnar/Prevenar franchise and were negatively impacted by developed Europe pricing pressures and the U.S.

Healthcare Legislation, as well as an overall decline in certain therapeutic markets.

•Oncology unit revenues decreased 6% in 2010, compared to 2009, due to lower operational revenues of 6%. Foreign exchange was

flat. Legacy Pfizer Oncology unit revenues in 2010 do not include Camptosar’s European revenues due to Camptosar’s loss of

exclusivity in Europe in July 2009. The reclassification of those revenues to the Established Products unit effective January 1, 2010

negatively impacted the Oncology unit performance by 17% in 2010 compared to 2009.

Established Products and Emerging Markets Operating Segment

•Established Products unit revenues increased 30% in 2010 compared to 2009 due to higher operational revenues of 28% and the

favorable impact of foreign exchange of 2%. The increase in Established Products unit operational revenues in 2010 was mainly due to

the addition of legacy Wyeth products, primarily Protonix, and was negatively impacted by 4% due to the loss of exclusivity of Norvasc

in Canada in July 2009.

•Emerging Markets unit revenues increased 41%, compared to 2009, due to higher operational revenues of 35%, as well as a 6%

favorable impact of foreign exchange. The increases in Emerging Markets unit operational revenues in 2010 was due to the addition of

legacy Wyeth products, most notably Enbrel and the Prevenar franchise, as well as growth in key markets, including China and Brazil.

These increases were partially offset by the impact of price reductions for certain products in certain emerging market countries.

Total revenues from established products in both the Established Products and Emerging Markets units were $13.8 billion, with $3.7

billion generated in emerging markets in 2010.

Effective July 1, 2011, January 1, 2011, July 1, 2010, January 1, 2010, August 14, 2009, and January 3, 2009, we increased the

published prices for certain U.S. biopharmaceutical products. These price increases had no material effect on wholesaler inventory

levels in comparison to the prior year.

Other Product Revenues

2011 vs. 2010

Animal Health and Consumer Healthcare Operating Segment

•Animal Health unit revenues increased 17% in 2011, compared to 2010, reflecting higher operational revenues of 14% and the

favorable impact of foreign exchange of 3%. Operational revenues from Animal Health products were favorably impacted by

approximately $329 million, or 9%, due to the addition of revenues from legacy King animal health products. Legacy Pfizer products

grew 7% primarily driven by improving market conditions and resulting increased demand for products across the livestock business,

as well as deeper market penetration in emerging markets. This was partially offset by the adverse impact of required product

divestitures in 2010 related to the acquisition of Wyeth.

•Consumer Healthcare unit revenues increased 10% in 2011, compared to 2010, reflecting higher operational revenues of 8% and the

favorable impact of foreign exchange of 2%. The operational revenue increase in 2011 was primarily driven by increased sales of core

brands including Advil, Caltrate and Robitussin, as well as the temporary voluntary withdrawal of Centrum in Europe in the third quarter

of 2010.

20 2011 Financial Report