Pfizer 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

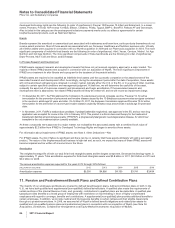

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

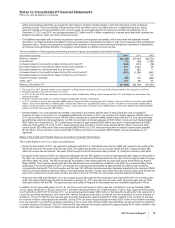

As of December 31, 2011, we estimate that we will reclassify into 2012 income the following pre-tax amounts currently held in

Accumulated other comprehensive income/(loss): $21 million of the unrealized holding gains on derivative financial instruments;

$466 million of actuarial losses related to benefit plan obligations and plan assets and other benefit plan items; and $75 million of

prior service credits primarily related to benefit plan amendments.

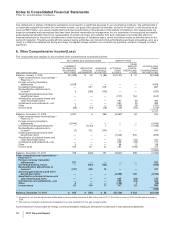

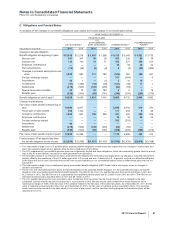

7. Financial Instruments

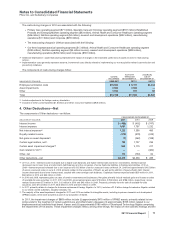

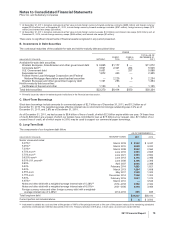

A. Selected Financial Assets and Liabilities

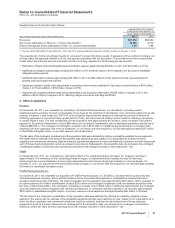

Information about certain of our financial assets and liabilities follows:

AS OF DECEMBER 31,

(MILLIONS OF DOLLARS) 2011 2010

Selected financial assets measured at fair value on a recurring basis(a):

Trading securities(b) $ 154 $ 173

Available-for-sale debt securities(c) 29,179 32,699

Available-for-sale money market funds(d) 1,370 1,217

Available-for-sale equity securities, excluding money market funds(c) 317 230

Derivative financial instruments in receivable positions(e):

Interest rate swaps 1,033 603

Foreign currency forward-exchange contracts 349 494

Foreign currency swaps 17 128

Total 32,419 35,544

Other selected financial assets(f):

Held-to-maturity debt securities, carried at amortized cost(c) 1,155 1,178

Private equity securities, carried as equity method or at cost(g) 1,020 1,134

Short-term loans, carried at cost(h) 51 467

Long-term loans, carried at cost(h) 381 299

Total 2,607 3,078

Total selected financial assets $35,026 $38,622

Financial liabilities measured at fair value on a recurring basis(a):

Derivative financial instruments in a liability position(i):

Foreign currency swaps $ 1,396 $ 623

Foreign currency forward-exchange contracts 355 257

Interest rate swaps 14 4

Total 1,765 884

Other financial liabilities(j):

Short-term borrowings, carried at historical proceeds, as adjusted(f), (k) 4,018 5,603

Long-term debt, carried at historical proceeds, as adjusted(l), (m) 34,931 38,410

Total 38,949 44,013

Total selected financial liabilities $40,714 $44,897

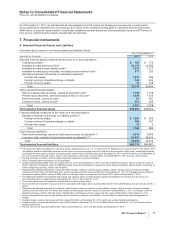

(a) Fair values are determined based on valuation inputs categorized as Level 1, 2 or 3 (see Note 1E. Significant Accounting Policies: Fair Value). All of

our financial assets and liabilities measured at fair value on a recurring basis use Level 2 inputs in the calculation of fair value, except that included

in available-for-sale equity securities, excluding money market funds, are $85 million as of December 31, 2011 and $105 million as of December 31,

2010 of investments that use Level 1 inputs in the calculation of fair value, and $25 million as of December 31, 2011 that use Level 3 inputs.

(b) Trading securities are held in trust for legacy business acquisition severance benefits.

(c) Gross unrealized gains and losses are not significant.

(d) Includes approximately $625 million as of December 31, 2011 and December 31, 2010 of money market funds held in escrow to secure certain of

Wyeth’s payment obligations under its 1999 Nationwide Class Action Settlement Agreement, which relates to litigation against Wyeth concerning its

former weight-loss products, Redux and Pondimin.

(e) Designated as hedging instruments, except for certain foreign currency contracts used as offsets; namely, foreign currency forward-exchange

contracts with fair values of $169 million and interest rate swaps with fair values of $8 million at December 31, 2011; and foreign currency forward-

exchange contracts with fair values of $326 million and foreign currency swaps with fair values of $17 million at December 31, 2010.

(f) The differences between the estimated fair values and carrying values of these financial assets and liabilities not measured at fair value on a

recurring basis were not significant as of December 31, 2011 or December 31, 2010.

(g) Our private equity securities represent investments in the life sciences sector.

(h) Our short-term and long-term loans are due from companies with highly rated securities (Standard & Poor’s (S&P) ratings that are virtually all AA or

better).

(i) Designated as hedging instruments, except for certain foreign currency contracts used as offsets; namely, foreign currency forward-exchange

contracts with fair values of $141 million and foreign currency swaps with fair values of $123 million at December 31, 2011; and foreign currency

forward-exchange contracts with fair values of $186 million and foreign currency swaps with fair values of $93 million at December 31, 2010.

(j) Some carrying amounts may include adjustments for discount or premium amortization or for the effect of interest rate swaps designated as

hedges.

(k) Includes foreign currency borrowings with fair values of $2 billion at December 31, 2010, which are used as hedging instruments.

(l) Includes foreign currency debt with fair values of $919 million at December 31, 2011 and $880 million at December 31, 2010, which are used as

hedging instruments.

(m) The fair value of our long-term debt is $40.1 billion at December 31, 2011 and $42.3 billion at December 31, 2010.

2011 Financial Report 77