Pfizer 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

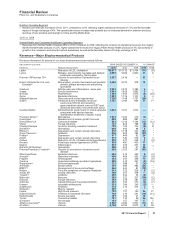

Financial Review

Pfizer Inc. and Subsidiary Companies

•In 2009, the impairment charge of $417 million primarily relates to certain materials used in our research and development activities

that were no longer considered recoverable.

Accounting Policy and Specific Procedures

For a description of our accounting policy, see Notes to Consolidated Financial Statements––Note 1K. Significant Accounting

Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets.

When we are required to determine the fair value of intangible assets other than goodwill, we use an income approach, specifically

the multi-period excess earnings method, also known as the discounted cash flow method. We start with a forecast of all the

expected net cash flows associated with the asset, which includes the application of a terminal value for indefinite-lived assets, and

then we apply an asset-specific discount rate to arrive at a net present value amount. Some of the more significant estimates and

assumptions inherent in this approach include: the amount and timing of the projected net cash flows, which includes the expected

impact of competitive, legal and/or regulatory forces on the projections and the impact of technological risk associated with

in-process research and development assets, as well as the selection of a long-term growth rate; the discount rate, which seeks to

reflect the various risks inherent in the projected cash flows; and the tax rate, which seeks to incorporate the geographic diversity of

the projected cash flows.

Future Impairment Risks

While all intangible assets other than goodwill can confront events and circumstances that can lead to impairment, in general,

intangible assets other than goodwill that are most at risk of impairment include in-process research and development assets ($1.2

billion as of December 31, 2011) and newly acquired or recently impaired indefinite-lived brand assets ($1.2 billion as of

December 31, 2011). In-process research and development assets are high-risk assets, as research and development is an

inherently risky activity. Newly acquired and recently impaired indefinite-lived assets are more vulnerable to impairment as the

assets are recorded at fair value and are then subsequently measured at the lower of fair value or carrying value at the end of each

reporting period. As such, immediately after acquisition or impairment, even small declines in the outlook for these assets can

negatively impact our ability to recover the carrying value and can result in an impairment charge.

•One of our indefinite-lived biopharmaceutical brands, Xanax, was written down to its fair value of $1.2 billion at the end of 2011. This

asset continues to be at risk for future impairment. Any negative change in the undiscounted cash flows, discount rate and/or tax rate

could result in an impairment charge. Xanax, which was launched in the mid 1980’s and acquired in 2003, must continue to remain

competitive against its generic challengers or the associated asset may become impaired again. We re-considered and confirmed the

classification of this asset as indefinite-lived. We will continue to closely monitor this asset.

•One of our indefinite-lived Consumer Healthcare brands, Robitussin, has a fair value that approximates its carrying value of about $500

million, which reflects an impairment charge that was taken in the third quarter of 2010. This asset continues to be at risk for future

impairment. Any negative change in the undiscounted cash flows, discount rate and/or tax rate could result in an impairment charge.

Robitussin, launched in the mid 1950’s, enjoys strong brand recognition, and is one of the leading over-the-counter cold and cough

remedies in the world. Robitussin must continue to remain competitive against its market challengers or the associated asset may

become impaired again. We re-considered and confirmed the classification of this asset as indefinite-lived. We will continue to closely

monitor this asset.

Goodwill

As a result of our goodwill impairment review work, described in detail below, we concluded that none of our goodwill is impaired as

of December 31, 2011, and we do not believe the risk of impairment is significant at this time.

Accounting Policy and Specific Procedures

For a description of our accounting policy, see Notes to Consolidated Financial Statements—Note 1K. Significant Accounting

Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets.

In determining the fair value of a reporting unit, as appropriate for the individual reporting unit, we may use the market approach, the

income approach or a weighted-average combination of both approaches.

•The market approach is a historical approach to estimating fair value and relies primarily on external information. Within the market

approach are two methods that we may use:

OGuideline public company method—this method employs market multiples derived from market prices of stocks of companies that

are engaged in the same or similar lines of business and that are actively traded on a free and open market and the application of

the identified multiples to the corresponding measure of our reporting unit’s financial performance.

OGuideline transaction method—this method relies on pricing multiples derived from transactions of significant interests in companies

engaged in the same or similar lines of business and the application of the identified multiples to the corresponding measure of our

reporting unit’s financial performance.

2011 Financial Report 13