Pfizer 2011 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

If any of our ratios, factors, assessments, experiences or judgments, are not indicative or accurate predictors of our future

experience, our results could be materially affected. Although the amounts recorded for these sales deductions are heavily

dependent on estimates and assumptions, historically, our adjustments to actual have not been material; on a quarterly basis, they

generally have been less than 1.0% of biopharmaceutical net sales and can result in a net increase to income or a net decrease to

income. The sensitivity of our estimates can vary by program, type of customer and geographic location. However, estimates

associated with U.S. Medicaid and contract rebates are most at-risk for material adjustment because of the extensive time delay

between the recording of the accrual and its ultimate settlement, an interval that can range up to one year. Because of this time lag,

in any given quarter, our adjustments to actual can incorporate revisions of several prior quarters.

Amounts recorded for sales deductions can result from a complex series of judgments about future events and uncertainties and

can rely heavily on estimates and assumptions. For further information about the risks associated with estimates and assumptions,

see Notes to Consolidated Financial Statements—Note1C. Significant Accounting Policies: Estimates and Assumptions.

Asset Impairment Reviews––Long-Lived Assets

We review all of our long-lived assets, including goodwill and other intangible assets, for impairment indicators throughout the year

and we perform detailed impairment testing for goodwill and indefinite-lived assets annually and for all other long-lived assets

whenever impairment indicators are present. When necessary, we record charges for impairments of long-lived assets for the

amount by which the fair value is less than the carrying value of these assets.

Our impairment review processes are described in the Notes to Consolidated Financial Statements––Note 1K. Significant

Accounting Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets and, for deferred tax assets, in

Note 1O. Significant Accounting Policies: Deferred Tax Assets and Liabilities and Income Tax Contingencies.

Examples of events or circumstances that may be indicative of impairment include:

•A significant adverse change in legal factors or in the business climate that could affect the value of the asset. For example, a

successful challenge of our patent rights likely would result in generic competition earlier than expected.

•A significant adverse change in the extent or manner in which an asset is used. For example, restrictions imposed by the FDA or other

regulatory authorities could affect our ability to manufacture or sell a product.

•A projection or forecast that demonstrates losses or reduced profits associated with an asset. This could result, for example, from a

change in a government reimbursement program that results in an inability to sustain projected product revenues and profitability. This

also could result from the introduction of a competitor’s product that results in a significant loss of market share or the inability to

achieve the previously projected revenue growth, as well as the lack of acceptance of a product by patients, physicians and payers. For

IPR&D projects, this could result from, among other things, a change in outlook based on clinical trial data, a delay in the projected

launch date or additional expenditures to commercialize the product.

Our impairment reviews of most of our long-lived assets depend heavily on the determination of fair value, as defined by U.S.

GAAP, and these judgments can materially impact our results of operations. A single estimate of fair value can result from a

complex series of judgments about future events and uncertainties and can rely heavily on estimates and assumptions. For

information about the risks associated with estimates and assumptions, see Notes to Consolidated Financial Statements––Note 1C.

Significant Accounting Policies: Estimates and Assumptions.

Intangible Assets Other than Goodwill

As a result of our intangible asset impairment review work, described in detail below, we recognized a number of impairments of

intangible assets other than goodwill.

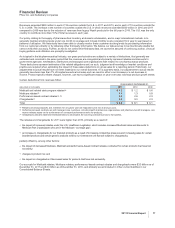

We recorded the following intangible asset impairment charges in Other deductions––net:

•In 2011, $863 million, which includes (i) approximately $475 million of IPR&D assets, primarily related to two compounds for the

treatment of certain autoimmune and inflammatory diseases; (ii) approximately $195 million related to our indefinite-lived

biopharmaceutical brand, Xanax; and (iii) approximately $185 million of Developed Technology Rights comprising the impairments of

five other assets. These impairment charges reflect, among other things, the impact of new scientific findings and the increased

competitive environment. The impairment charges are associated with the following: Worldwide Research and Development ($394

million); Established Products ($193 million); Specialty Care ($135 million); Primary Care ($56 million); Oncology ($56 million); Animal

Health ($17 million); and other ($12 million).

•In 2010, $2.2 billion, which included (i) approximately $950 million of IPR&D assets, primarily Prevnar 13/Prevenar 13 Adult, a

compound for the prevention of pneumococcal disease in adults age 50 and older, and Neratinib, a compound for the treatment of

breast cancer; (ii) approximately $700 million of indefinite-lived Brands, related to Third Age, infant formulas for the first 12-36 months of

age, and Robitussin, a cough suppressant; and (iii) approximately $550 million of Developed Technology Rights, primarily Thelin, a

product that treated pulmonary hypertension and Protonix, a product that treats erosive gastroesophageal reflux disease. These

impairment charges, most of which occurred in the third quarter of 2010, reflect, among other things, the following: for IPR&D assets,

the impact of changes to the development programs, the projected development and regulatory timeframes and the risk associated with

these assets; for Brand assets, the current competitive environment and planned investment support; and, for Developed Technology

Rights, in the case of Thelin, we voluntarily withdrew the product in regions where it was approved and discontinued all clinical studies

worldwide and, for the others, an increased competitive environment. The impairment charges are associated with the following:

Specialty Care ($708 million); Oncology ($396 million); Nutrition ($385 million); Consumer Healthcare ($292 million); Established

Products ($182 million); Primary Care ($145 million); Worldwide Research and Development ($54 million); and other ($13 million).

12 2011 Financial Report