Pfizer 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

Impairment reviews can involve a complex series of judgments about future events and uncertainties and can rely heavily on

estimates and assumptions. For information about the risks associated with estimates and assumptions, see Note 1C. Significant

Accounting Policies: Estimates and Assumptions.

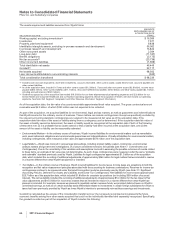

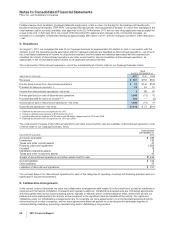

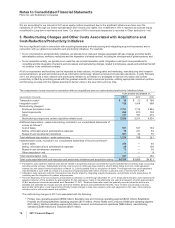

L. Restructuring Charges and Certain Acquisition-Related Costs

We may incur restructuring charges in connection with acquisitions when we implement plans to restructure and integrate the

acquired operations or in connection with our cost-reduction and productivity initiatives. Included in Restructuring charges and

certain acquisition-related costs are all restructuring charges and certain costs associated with acquiring and integrating an acquired

business. (If the restructuring action results in a change in the estimated useful life of an asset, that incremental impact is classified

in Cost of sales, Selling, informational and administrative expenses and Research and development expenses, as appropriate).

Termination costs are a significant component of our restructuring charges and are generally recorded when the actions are

probable and estimable. Transaction costs, such as banking, legal, accounting and other costs incurred in connection with an

acquisition are expensed as incurred.

Amounts recorded for restructuring charges and other associated costs can result from a complex series of judgments about future

events and uncertainties and can rely heavily on estimates and assumptions. For information about the risks associated with

estimates and assumptions, see Note 1C. Significant Accounting Policies: Estimates and Assumptions.

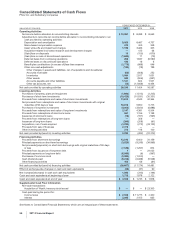

M. Cash Equivalents and Statement of Cash Flows

Cash equivalents include items almost as liquid as cash, such as certificates of deposit and time deposits with maturity periods of

three months or less when purchased. If items meeting this definition are part of a larger investment pool, we classify them as Short-

term investments.

Cash flows associated with financial instruments designated as fair value or cash flow hedges may be included in operating,

investing or financing activities, depending on the classification of the items being hedged. Cash flows associated with financial

instruments designated as net investment hedges are classified according to the nature of the hedge instrument. Cash flows

associated with financial instruments that do not qualify for hedge accounting treatment are classified according to their purpose and

accounting nature.

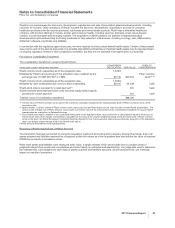

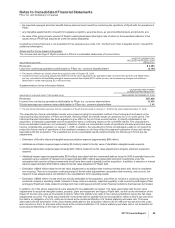

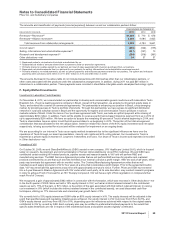

N. Investments, Loans and Derivative Financial Instruments

Many, but not all, of our financial instruments are carried at fair value. For example, substantially all of our cash equivalents, short-

term investments and long-term investments are classified as available-for-sale securities and are carried at fair value, with changes

in unrealized gains and losses, net of tax, reported in Other comprehensive/(loss) (see Note 6. Other Comprehensive Income/

(Loss)). Derivative financial instruments are carried at fair value in various balance sheet categories (see Note 7A. Financial

Instruments: Selected Financial Assets and Liabilities), with changes in fair value reported in current earnings or deferred for

qualifying hedging relationships. Virtually all of our valuation measurements for investments, loans and derivative financial

instruments are based on the use of quoted prices for similar instruments in active markets or quoted prices for identical or similar

instruments in markets that are not active or are directly or indirectly observable.

Realized gains or losses on sales of investments are determined by using the specific identification cost method.

Investments where we have significant influence over the financial and operating policies of the investee are accounted for under

the equity method. Under the equity method, we record our share of the investee’s income and expenses in our income statements.

The excess of the cost of the investment over our share in the equity of the investee on acquisition date is allocated to the

identifiable assets of the investee, with any remainder allocated to goodwill. Such investments are initially recorded at cost, which

typically does not include amounts of contingent consideration.

We regularly evaluate all of our financial assets for impairment. For investments in debt and equity securities, when a decline in fair

value, if any, is determined to be other-than-temporary, an impairment charge is recorded, and a new cost basis in the investment is

established. For loans, an impairment charge is recorded if it is probable that we will not be able to collect all amounts due according

to the loan agreement.

Impairment reviews can involve a complex series of judgments about future events and uncertainties and can rely heavily on

estimates and assumptions. For information about the risks associated with estimates and assumptions, see Note 1C. Significant

Accounting Policies: Estimates and Assumptions.

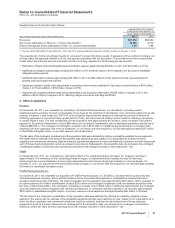

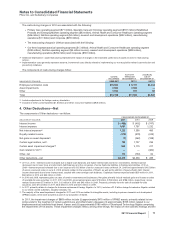

O. Deferred Tax Assets and Liabilities and Income Tax Contingencies

Deferred tax assets and liabilities are recognized for the expected future tax consequences of differences between the financial

reporting and tax bases of assets and liabilities using enacted tax rates and laws. We provide a valuation allowance when we

believe that our deferred tax assets are not recoverable based on an assessment of estimated future taxable income that

incorporates ongoing, prudent and feasible tax-planning strategies.

We account for income tax contingencies using a benefit recognition model. If we consider that a tax position is more likely than not

to be sustained upon audit, based solely on the technical merits of the position, we recognize the benefit. We measure the benefit by

determining the amount that is greater than 50% likely of being realized upon settlement, presuming that the tax position is

examined by the appropriate taxing authority that has full knowledge of all relevant information. Under the benefit recognition model,

if our initial assessment fails to result in the recognition of a tax benefit, we regularly monitor our position and subsequently

2011 Financial Report 61