Pfizer 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

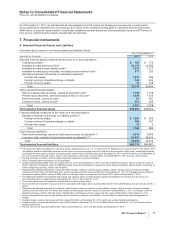

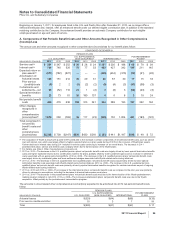

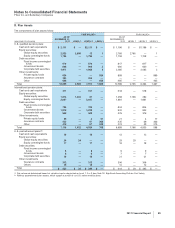

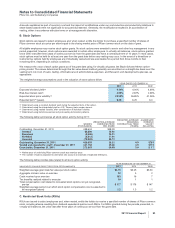

C. Obligations and Funded Status

An analysis of the changes in our benefit obligations, plan assets and funded status of our benefit plans follow:

YEAR ENDED DECEMBER 31,

PENSION PLANS

U.S. QUALIFIED(a)

U.S.

SUPPLEMENTAL

(NON-QUALIFIED)(b) INTERNATIONAL(c)

POSTRETIREMENT

PLANS(d)

(MILLIONS OF DOLLARS) 2011 2010 2011 2010 2011 2010 2011 2010

Change in benefit obligation:

Benefit obligation at beginning of year $13,035 $12,578 $ 1,401 $ 1,368 $ 9,132 $ 9,049 $ 3,582 $ 3,733

Service cost 351 347 36 28 251 230 68 79

Interest cost 734 740 72 77 453 427 195 211

Employee contributions ————16 18 45 22

Plan amendments (73) (46) (9) (6) 4(3) (28) (495)

Changes in actuarial assumptions and

other 1,808 980 111 180 (536) 361 300 281

Foreign exchange impact ————311 (504) —4

Acquisitions 56 1—(1) 210 14 —

Curtailments (97) (233) (10) (29) (121) (33) 17 1

Settlements (476) (905) (128) (235) (64) (53) ——

Special termination benefits 23 73 26 180 46319

Benefits paid (526) (500) (68) (161) (398) (376) (296) (273)

Benefit obligation at end of year(e) 14,835 13,035 1,431 1,401 9,054 9,132 3,900 3,582

Change in plan assets:

Fair value of plan assets at beginning of

year 10,596 9,977 ——6,699 6,516 414 370

Actual gain on plan assets 398 1,123 ——171 454 946

Company contributions 1,969 901 196 396 491 455 250 249

Employee contributions ————16 18 45 22

Foreign exchange impact ————203 (315) ——

Acquisitions 44 ———————

Settlements (476) (905) (128) (235) (64) (53) ——

Benefits paid (526) (500) (68) (161) (398) (376) (296) (273)

Fair value of plan assets at end of year(f) 12,005 10,596 ——7,118 6,699 422 414

Funded status—Plan assets less than

the benefit obligation at end of year $ (2,830) $ (2,439) $(1,431) $(1,401) $(1,936) $(2,433) $(3,478) $(3,168)

(a) The unfavorable change in our U.S. qualified plans’ projected benefit obligations funded status was largely driven by changes in interest rates and

lower than expected asset returns, partially offset by plan contributions of $2.0 billion.

(b) The U.S. supplemental (non-qualified) pension plans are not generally funded and these obligations, which are substantially greater than the annual

cash outlay for these liabilities, are paid from cash generated from operations.

(c) The favorable change in our international plans’ projected benefit obligations funded status was largely driven by changes in actuarial assumptions,

partially offset by the weakening of the U.S. dollar against the U.K. pound and euro. Outside the U.S., in general, we fund our defined benefit plans

to the extent that tax or other incentives exist and we have accrued liabilities on our consolidated balance sheet to reflect those plans that are not

fully funded.

(d) The unfavorable change in our postretirement plans’ accumulated benefit obligations (ABO) funded status was largely driven by changes in

actuarial assumptions.

(e) For the U.S. and international pension plans, the benefit obligation is the projected benefit obligation. For the postretirement plans, the benefit

obligation is the accumulated postretirement benefit obligation. The ABO for all of our U.S. qualified pension plans was $13.8 billion in 2011 and

$12.0 billion in 2010. The ABO for our U.S. supplemental (non-qualified) pension plans was $1.2 billion in both 2011 and 2010. The ABO for our

international pension plans was $8.3 billion in 2011 and $8.1 billion in 2010.

(f) The U.S. qualified pension plans loan securities to other companies. Such securities may be onward loaned, sold or pledged by the other

companies, but they may be required to be returned in a short period of time. We also require cash collateral from these companies and a

maintenance margin of 103% of the fair value of the collateral relative to the fair value of the loaned securities. As of December 31, 2011, the fair

value of collateral received was $2 million and, as of December 31, 2010, the fair value of collateral received was $581 million. The securities

loaned continue to be included in the table above in Fair value of plan assets, and the securities-lending program for the pension plans will be

discontinued in 2012.

2011 Financial Report 87