Pfizer 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

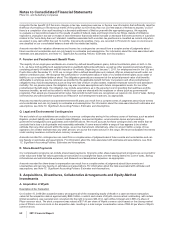

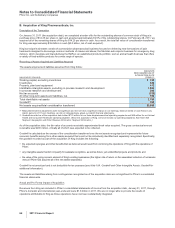

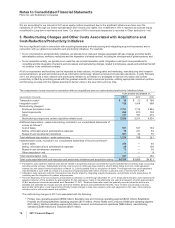

increased competitive environment. The impairment charges are associated with the following: Worldwide Research and

Development ($394 million); Established Products ($193 million); Specialty Care ($135 million); Primary Care ($56 million);

Oncology ($56 million); Animal Health ($17 million); and other ($12 million).

In 2010, the impairment charges of $2.2 billion include (i) approximately $950 million of IPR&D assets, primarily Prevnar

13/Prevenar 13 Adult, a compound for the prevention of pneumococcal disease in adults age 50 and older, and Neratinib, a

compound for the treatment of breast cancer; (ii) approximately $700 million of indefinite-lived Brands, related to Third Age, infant

formulas for the first 12-36 months of age, and Robitussin, a cough suppressant; and (iii) approximately $550 million of Developed

Technology Rights, primarily Thelin, a product that treated pulmonary hypertension, and Protonix, a product that treats erosive

gastroesophageal reflux disease. These impairment charges, most of which occurred in the third quarter of 2010, reflect, among

other things, the following: for IPR&D assets, the impact of changes to the development programs, the projected development

and regulatory timeframes and the risk associated with these assets; for Brand assets, the current competitive environment and

planned investment support; and, for Developed Technology Rights, in the case of Thelin, we voluntarily withdrew the product in

regions where it was approved and discontinued all clinical studies worldwide, and for the others, an increased competitive

environment. The impairment charges are generally associated with the following: Specialty Care ($708 million); Oncology ($396

million); Nutrition ($385 million); Consumer Healthcare ($292 million); Established Products ($182 million); Primary Care ($145

million); Worldwide Research and Development ($54 million); and other ($13 million).

In 2009, the impairment charge of $417 million primarily relates to certain materials used in our research and development

activities that were no longer considered recoverable.

(e) Represents a gain related to ViiV, an equity method investment, which is focused solely on research, development and commercialization of HIV

medicines (see Note 2F. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Equity-Method Investments).

5. Taxes on Income

A. Taxes on Income

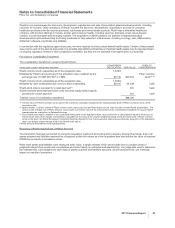

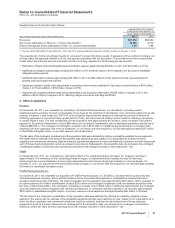

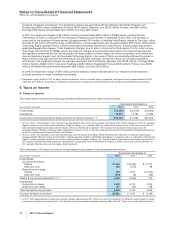

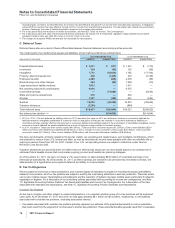

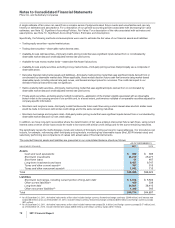

The components of Income from continuing operations before provision for taxes on income follow:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2011 2010 2009

United States $ (2,254) $ (2,513) $ (3,694)

International 15,016 11,795 14,368

Income from continuing operations before provision for taxes on income(a), (b) $12,762 $ 9,282 $10,674

(a) 2011 vs. 2010—The decrease in the domestic loss was primarily due to the non-recurrence of a charge of $1.3 billion (pre-tax) in 2010 for asbestos

litigation related to our wholly owned subsidiary, Quigley Company, Inc., partially offset by a reduction in revenues due to the loss of exclusivity for

several biopharmaceutical products and the impact of the U.S. Healthcare Legislation. The increase in international income was due to the

favorable impact of foreign exchange, higher impairment charges in 2010, as well as increased revenues from the biopharmaceutical products such

as the Prevnar/Prevenar franchise, Enbrel and Celebrex.

(b) 2010 vs. 2009—The decrease in the domestic loss was due to revenues from legacy Wyeth products and a reduction in domestic restructuring

charges partially offset by increased amortization charges primarily related to identifiable intangibles in connection with our acquisition of Wyeth and

litigation charges primarily related to our wholly owned subsidiary Quigley Company, Inc. The decrease in international income was due primarily to

an increase in international restructuring and amortization charges plus the non-recurrence of the gain in 2009 in connection with the formation of

ViiV, partially offset by revenues from legacy Wyeth products.

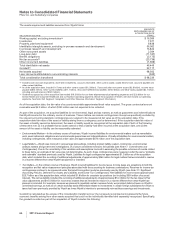

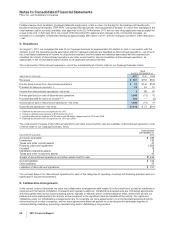

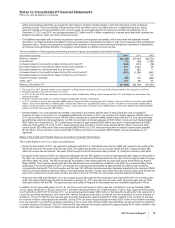

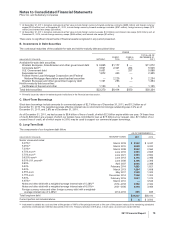

The components of Provision for taxes on income based on the location of the taxing authorities follow:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2011 2010 2009

United States:

Current income taxes:

Federal $1,349 $(2,763) $ 10,151

State and local 208 (315) 68

Deferred income taxes:

Federal 349 2,010 (10,005)

State and local (242) (6) (93)

Total U.S. tax provision/(benefit)(a), (b), (c) 1,664 (1,074) 121

International:

Current income taxes 2,202 2,212 1,516

Deferred income taxes 157 (67) 508

Total international tax provision 2,359 2,145 2,024

Provision for taxes on income(d) $4,023 $ 1,071 $ 2,145

(a) In 2011, the Federal deferred income tax expense includes approximately $2.1 billion as a result of providing U.S. deferred income taxes on certain

current-year funds earned outside of the U.S. that will not be permanently reinvested overseas. (See Note 5C. Taxes on Income: Deferred Taxes.)

72 2011 Financial Report