Pep Boys 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

‘‘whether instruments granted in share-based payment transactions are participating securities prior to

vesting and, therefore, need to be included in the earnings allocation in computing EPS under the

two-class method outlined in SFAS No. 128, ‘‘Earnings per Share.’’ The FASB concluded that all

outstanding unvested share-based payment awards that contain rights to non-forfeitable dividends

participate in undistributed earnings with common shareholders. Under SFAS No. 128, restricted shares

are better termed non-vested and are accounted for under SFAS No. 123(R) ‘‘Share-Based Payment’’

which requires accounting for the non-vested shares under the treasury stock method. This statement is

effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim

periods within those years. The adoption of EITF 03-6-1 will not have a material impact on the

Company.

In September 2008, the EITF reached a consensus on Issue Number 08-5, ‘‘Issuer’s Accounting for

Liabilities Measured at Fair Value with a Third-Party Credit Enhancement’’ (EITF 08-05). The Task

Force reached a consensus that an issuer of a liability with a third-party credit enhancement that is

inseparable from the liability must treat the liability and the credit enhancement as two units of

accounting. Under the consensus, the fair value measurement of the liability does not include the effect

of the third-party credit enhancement; therefore, changes in the issuer’s credit standing without the

support of the credit enhancement affect the fair value measurement of the issuer’s liability. Entities

will need to disclose the existence of any third-party credit enhancements related to their liabilities that

are within the scope of this Issue (i.e., that are measured at fair value). We do not expect the adoption

of EITF No. 08-5 to have a material impact on our financial condition, results of operations or cash

flows.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company has market rate exposure in its financial instruments due to changes in interest

rates.

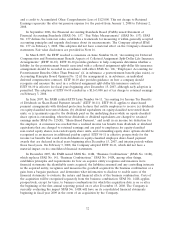

Variable Rate Debt

The Company’s revolving credit agreement bears interest at LIBOR or Prime plus 2.75% to 3.25%

based upon the then current availability under the facility. At January 31, 2009, the Company had

outstanding borrowings of $23,862,000 under the revolving credit agreement. Additionally, the Company

has a Senior Secured Term Loan facility with a balance of $150,794,000 at January 31, 2009, that bears

interest at three month LIBOR plus 2.00%, and $1,809,000 of equipment operating leases which have

lease payments that vary based on changes in LIBOR. A one percent change in the LIBOR rate would

have affected net loss by approximately $1.5 million for the fiscal year ended January 31, 2009.

Fixed Rate Debt

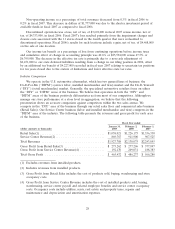

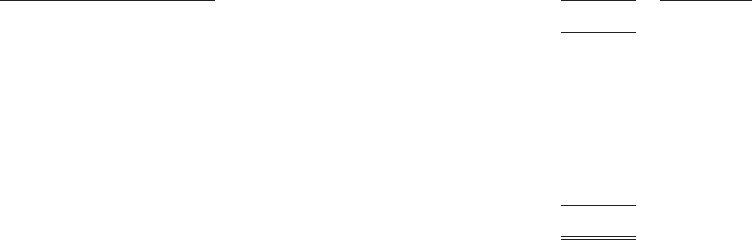

The table below summarizes the fair value and contract terms of fixed rate debt instruments,

principally the 7.5% Senior Subordinated notes, held by the Company at January 31, 2009:

Average

(dollar amounts in thousands) Amount Interest Rate

Fair value at January 31, 2009 ....................... $ 84,301

Expected maturities:

2009 ......................................... $ 247 3.90%

2010 ......................................... 258 3.90

2011 ......................................... 269 3.90

2012 ......................................... 281 3.90

2013 ......................................... 294 3.90

Thereafter ..................................... 177,701 7.45

Total Carrying Amount ............................ $179,050

34