Pep Boys 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

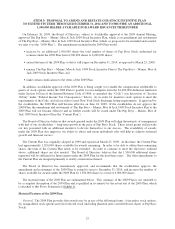

The 2009 Plan will authorize 6,000,000 shares of Pep Boys Stock for issuance, subject to adjustments in certain

circumstances as described below. If a stock option terminates or expires without having being fully exercised for

any reason, or if any shares of Pep Boys Stock with respect to an award of restricted stock or phantom units is

forfeited for any reason, the shares subject to such award may again be the subject of an award under the 2009 Plan.

The 2009 Plan provides that awards covering no more than 500,000 shares of Pep Boys Stock may be granted to

any individual during any calendar year that the 2009 Plan is in effect, subject to adjustment as described below.

Administration. The 2009 Plan is currently administered and interpreted by the Human Resources Committee

(the “Committee”). The Committee has plenary authority and absolute discretion to (i) determine the key

employees and members of the Board of Directors (including directors who are not employees) to whom and the

times and the prices at which awards will be granted, (ii) determine the type of award to be granted and the number

of shares of Pep Boys Stock subject to such awards, (iii) determine the vesting conditions with respect to awards of

restricted stock and phantom units and the time or times after which stock options will become exercisable, (iv)

determine whether or not stock options are intended to qualify as an incentive stock option, (v) determine the

duration of the restricted period and the restrictions and conditions to be imposed with respect to each award, (vi)

adopt guidelines separate from the 2009 Plan that set forth the specific terms and conditions for awards under the

2009 Plan, and (vii) approve the form and terms and condition of the award agreements for awards granted under

the 2009 Plan, all subject to the express provisions of the 2009 Plan. The interpretations and constructions of the

Committee are final, binding and conclusive on all persons having an interest in the 2009 Plan or in any award

granted under the 2009 Plan.

Eligibility for Participation. All of our key employees and those of our affiliates are eligible for grants under

the 2009 Plan. Also, all non-employee members of the Board of Directors are eligible to receive grants under the

2009 Plan. The Committee, in its sole discretion, will determine whether an individual qualifies as a key employee.

As of April 17, 2009, approximately 155 employees and ten non-employee directors would be eligible to receive

awards under the 2009 Plan.

Types of Awards

Stock Options

The Committee may grant stock options intended to qualify as incentive stock options within the meaning of

Section 422 of the Code (“ISOs”) or so-called “nonqualified stock options” that are not so intended to qualify

(“NQSOs”) or any combination of ISOs and NQSOs. Anyone eligible to participate in the 2009 Plan may receive a

grant of NQSOs. Only our employees and those of our affiliates, which qualify as a parent or subsidiary

corporation under Section 424 of the Code, may receive a grant of ISOs.

The Committee fixes the exercise price per share for stock options on the date of grant. The exercise price of an

NQSO or ISO granted under the 2009 Plan will be at least 100% of the fair market value of the underlying shares of

Pep Boys Stock on the date of grant. However, if the grantee of an ISO is a person who holds more than ten percent

of the total combined voting power of all classes of our outstanding stock, the exercise price per share of an ISO

granted to such person must be at least 110 percent of the fair market value of a share of Pep Boys Stock on the date

of grant. To the extent the aggregate fair market value of the shares of Pep Boys Stock, determined on the date of

grant, with respect to which ISOs become exercisable for the first time by a grantee during any calendar year

exceeds $100,000, such ISOs will be treated as NQSOs. The current measure of fair market value on a particular

date, which will continue to be applicable immediately following adoption of the 2009 Plan, is the mean between

the highest and lowest quoted selling prices of the shares of Pep Boys Stock on the day of grant.

The Committee determines the term of each stock option; provided, however, that the term may not exceed ten

years from the date of grant and, if the grantee of an ISO is a person who holds more than ten percent of the

combined voting power of all classes of our outstanding stock, the term for such person may not exceed five years

from the date of grant. The period during which a stock option will become exercisable is determined by the

Committee and specified in the grant agreement. Stock options, once they become exercisable, may be exercised