Pep Boys 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expected return on plan assets of 6.7% and a discount rate of 6.5%. In developing the expected return

on asset assumptions, we evaluated input from our actuaries, including their review of asset class return

expectations. The discount rate utilized for the pension plans is based on a model bond portfolio with

durations that match the expected payment patterns of the plans. We continue to evaluate our actuarial

assumptions and make adjustments as necessary for the existing plans. In fiscal year 2008, we

contributed an aggregate of $19,918,000 to our pension plans to fund the retirement obligations and for

the termination of the defined benefit portion of the SERP. Based upon the current funded status of

the defined benefit pension plan, we do not expect to make any cash contributions in fiscal year 2009.

See Note 10 of Notes to Consolidated Financial Statements in ‘‘Item 8. Financial Statements and

Supplementary Data’’ for further discussion of our pension plans.

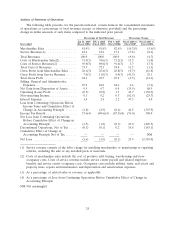

RESULTS OF OPERATIONS

The following discussion explains the material changes in our results of operations for the fifty-two

weeks ended January 31, 2009, the fifty-two weeks ended February 2, 2008 and fifty-three weeks ended

February 3, 2007.

Discontinued Operations

In the third quarter of fiscal year 2007, we adopted our long-term strategic plan. One of the initial

steps in this plan was the identification of 31 low-return stores for closure. We have accounted for

these store closures in accordance with the provisions of SFAS No.146 ‘‘Accounting for Costs

Associated with Exit or Disposal Activities’’ and SFAS No.144, ‘‘Accounting for Impairment or Disposal

of Long-Lived Assets’’ (SFAS No.144). In accordance with SFAS No.144, our discontinued operations

for all periods presented reflect the operating results for 11 of the 31 closed stores because we do not

believe that the customers of these stores are likely to become customers of other Pep Boys stores due

to geographical considerations. The operating results for the other 20 closed stores are included in

continuing operations because we believe that the customers of these stores are likely to become

customers of other Pep Boys stores that are in close proximity.

The following analysis of our results of continuing operations excludes the operating results of the

above-referenced 11 stores which have been classified as discontinued operations for all periods

presented.

23