Pep Boys 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

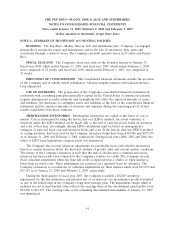

LEASES The Company amortizes leasehold improvements over the lesser of the lease term or

the economic life of those assets. Generally, for the stores the lease term is the base lease term and for

distribution centers the lease term includes the base lease term plus certain renewal option periods for

which renewal is reasonably assured and for which failure to exercise the renewal option would result

in an economic penalty to the Company. The calculation of straight-line rent expense is based on the

same lease term with consideration for step rent provisions, escalation clauses, rent holidays and other

lease concessions. The Company expenses rent during the construction or build-out phase of the lease.

SERVICE REVENUE Service revenue consists of the labor charge for installing merchandise or

maintaining or repairing vehicles, excluding the sale of any installed parts or materials.

COSTS OF REVENUES Costs of merchandise sales include the cost of products sold, buying,

warehousing and store occupancy costs. Costs of service revenue include service center payroll and

related employee benefits, service center occupancy costs and cost of providing free or discounted

towing services to our customers. Occupancy costs include utilities, rents, real estate and property taxes,

repairs and maintenance and depreciation and amortization expenses.

PENSION AND RETIREMENT PLANS The Company reports all information on its pension and

savings plan benefits in accordance with FASB Statement of Financial Accounting Standards (SFAS)

No. 87, ‘‘Employers’ Accounting for Pensions’’ and SFAS No. 88, ‘‘Employers’ Accounting for

Settlements and Curtailments of Defined Benefit Pension Plans and for Termination Benefits’’, as

amended by SFAS No. 132, ‘‘Employers’ Disclosure about Pensions and Other Postretirement

Benefits—an Amendment of FASB Statements No. 87, 88 and 106 (revised 2003)’’ (SFAS 132R), as

amended by SFAS No. 158 ‘‘Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans—an Amendment of FASB Statements No. 87, 88, 106 and 132(R).

INCOME TAXES The Company uses the asset and liability method of accounting for income

taxes in accordance with SFAS No. 109, ‘‘Accounting for Income Taxes.’’ Under this method, deferred

income taxes are determined based upon enacted tax laws and rates applied to the differences between

the financial statement and tax bases of assets and liabilities.

The accounting for our uncertain tax positions changed with the adoption of Financial Accounting

Standards Board Interpretation (FIN) No. 48, ‘‘Accounting for Uncertainty in Income Taxes’’ (FIN 48),

on February 4, 2007. Refer to Note 14 for further discussion of the impact of adopting FIN 48 and

change in unrecognized tax benefit during fiscal year 2008.

In evaluating our income tax positions, we record liabilities for potential exposures. These tax

liabilities are adjusted in the period actual developments give rise to such change. Those developments

could be, but are not limited to, settlement of tax audits, expiration of the statute of limitations, and

changes in the tax code and regulations, along with varying application of tax policy and administration

within those jurisdictions.

The temporary differences between the book and tax treatment of income and expenses result in

deferred tax assets and liabilities, which are included within the Company’s consolidated balance sheets.

The Company must assess the likelihood that any recorded deferred tax assets will be recovered against

future taxable income. To the extent the Company believes that recovery is not more likely than not, a

valuation allowance must be established. In this regard when determining whether or not a valuation

allowance should be established, the Company considers various tax planning strategies, including

44