Pep Boys 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

quarterly, and adjusted as necessary. Specific accounts are written off against the allowance when

management determines the account is uncollectible.

TRADE PAYABLE PROGRAM LIABILITY In the third quarter of fiscal year 2004, we entered

into a vendor financing program. Under this program, our factor makes accelerated and discounted

payments to our vendors and we, in turn, make our regularly-scheduled full vendor payments to the

factor. On June 29, 2007, we replaced the vendor financing program with a new lender and increased

availability from $20,000 to $65,000. This availability was subsequently reduced to $40,000. There was

an outstanding balance of $31,930 and $14,254 under this program as of January 31, 2009 and

February 2, 2008 respectively, which is classified as trade payable program liability in the consolidated

balance sheet.

VENDOR SUPPORT FUNDS The Company receives various incentives in the form of discounts

and allowances from its vendors based on the volume of purchases or for services that the Company

provides to the vendors. These incentives received from vendors include rebates, allowances and

promotional funds. Typically, these funds are dependent on purchase volumes. The amounts received

are subject to changes in market conditions, vendor marketing strategies and changes in the

profitability or sell-through of the related merchandise for the Company.

The Company accounts for vendor support funds in accordance with Financial Accounting

Standards Board (FASB) Emerging Issues Task Force (EITF) Issue No. 02-16, ‘‘Accounting by a

Customer (Including a Reseller) for Cash Consideration Received from a Vendor’’ (EITF 02-16).

Rebates and other miscellaneous incentives are earned based on purchases or product sales. These

incentives are treated as a reduction of inventories and are recognized as a reduction to cost of sales as

the inventories are sold. Certain vendor allowances are used exclusively for promotions and to partially

or fully offset certain other direct expenses. Such allowances would be offset against the appropriate

expenses they offset, if the Company determines the allowances are for specific, identifiable

incremental expenses.

WARRANTY RESERVE The Company provides warranties for both its merchandise sales and

service labor. Warranties for merchandise are generally covered by the respective vendors, with the

Company covering any costs above the vendor’s stipulated allowance. Service labor is warranted in full

by the Company for a limited specific time period. The Company establishes its warranty reserves

based on experience. These costs are included in either our costs of merchandise sales or costs of

service revenue in the consolidated statement of operations.

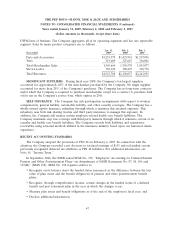

The reserve for warranty activity for the years ended January 31, 2009 and February 2, 2008,

respectively, is as follows:

Balance at February 3, 2007 ........................................ $ 645

Additions related to sales in the current year ........................... 7,937

Warranty costs incurred in the current year ............................ (8,335)

Balance at February 2, 2008 ........................................ 247

Additions related to sales in the current year ........................... 13,439

Warranty costs incurred in the current year ............................ (12,889)

Balance at January 31, 2009 ........................................ $ 797

43