Pep Boys 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009, we had a $300,000,000 line of credit, with an availability of approximately $182,115,000. Our

current portion of long term debt was $1,453,000 at January 31, 2009.

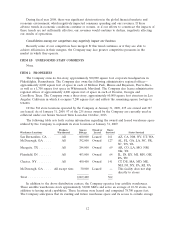

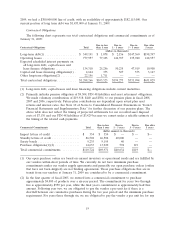

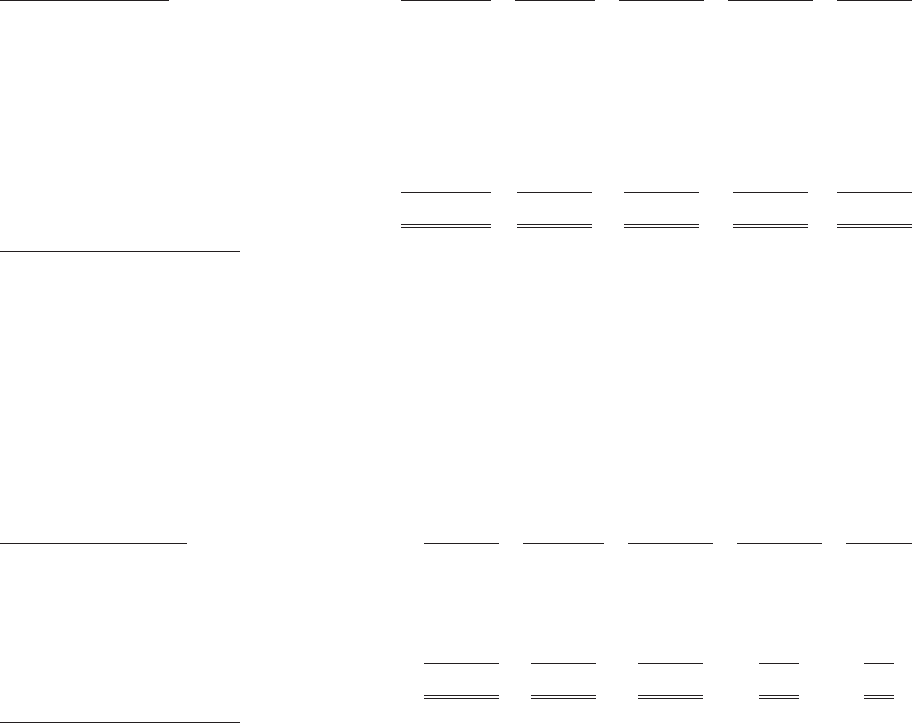

Contractual Obligations

The following chart represents our total contractual obligations and commercial commitments as of

January 31, 2009:

Due in less Due in Due in Due after

Contractual Obligations Total than 1 year 1 - 3 years 3 - 5 years 5 years

(dollars in thousands)

Long-term debt(1) .................. $ 349,191 $ 1,078 $ 2,156 $147,560 $198,397

Operating leases ................... 777,957 77,103 146,357 135,940 418,557

Expected scheduled interest payments on

all long-term debt, capital leases and

lease finance obligations ............ 134,318 25,256 50,235 47,919 10,908

Capital and lease financing obligations(1) . 4,644 375 527 575 3,167

Other long-term obligations(2) ......... 22,156 1,711 — — —

Total contractual obligations ........... $1,288,266 $105,523 $199,275 $331,994 $631,029

(1) Long-term debt, capital leases and lease financing obligations include current maturities.

(2) Primarily includes pension obligation of $9,304, FIN 48 liabilities and asset retirement obligations.

We made voluntary contributions of $19,918; $440 and $504, to our pension plans in fiscal 2008,

2007 and 2006, respectively. Future plan contributions are dependent upon actual plan asset

returns and interest rates. See Note 10 of Notes to Consolidated Financial Statements in ‘‘Item 8

Financial Statements and Supplementary Data’’ for further discussion of our pension plans. The

above table does not reflect the timing of projected settlements for our recorded asset disposal

costs of $7,130 and our FIN 48 liabilities of $3,429 because we cannot make a reliable estimate of

the timing of the related cash payments.

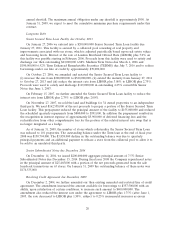

Due in less Due in Due in Due after

Commercial Commitments Total than 1 year 1 - 3 years 3 - 5 years 5 years

(dollar amounts in thousands)

Import letters of credit ................ $ 354 $ 354 $ — $ — $—

Standby letters of credit ................ 86,502 46,502 40,000 — —

Surety bonds ........................ 9,235 9,195 40 — —

Purchase obligations(1)(2) .............. 14,633 13,920 594 119 —

Total commercial commitments .......... $110,724 $69,971 $40,634 $119 $—

(1) Our open purchase orders are based on current inventory or operational needs and are fulfilled by

our vendors within short periods of time. We currently do not have minimum purchase

commitments under our vendor supply agreements and generally our open purchase orders (orders

that have not been shipped) are not binding agreements. Those purchase obligations that are in

transit from our vendors at January 31, 2009 are considered to be a commercial commitment.

(2) In the first quarter of fiscal 2005, we entered into a commercial commitment to purchase

approximately $4,800 of products over a six-year period. The commitment for years two through

five is approximately $950 per year, while the final year’s commitment is approximately half that

amount. Following year two, we are obligated to pay the vendor a per unit fee if there is a

shortfall between our cumulative purchases during the two year period and the minimum purchase

requirement. For years three through six, we are obligated to pay the vendor a per unit fee for any

19