Pep Boys 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

(ITEM 4) APPROVAL OF THE AMENDMENT AND RESTATEMENT OF OUR

ANNUAL INCENTIVE BONUS PLAN

TO ALLOW CERTAIN AMOUNTS PAID UNDER THE PLAN TO BE DEDUCTIBLE

UNDER SECTION 162(m) OF THE INTERNAL REVENUE CODE

On February 26, 2009, the Board of Directors approved an amendment and restatement of The Pep Boys –

Manny, Moe & Jack Annual Incentive Bonus Plan (the “Bonus Plan”), to make certain clarifying changes to the

Bonus Plan, and is submitting the Bonus Plan, as amended and restated, for stockholder approval so that the

Committee may continue to award bonuses under the Bonus Plan that qualify for the performance-based

compensation exemption under Section 162(m) of the Code.

The Bonus Plan provides for the award of cash bonuses to eligible employees based on their achievement of

certain preset performance objectives, be it company-wide, departmental or, where appropriate, individual

performance, over our fiscal year. The Board of Directors believes that the Bonus Plan furthers our compensation

structure and strategy and encourages results-oriented actions on the part of our eligible employees. The Board of

Directors believes that our interests, as well as the interests of our stockholders, will be advanced if we continue to

have the ability to structure incentive awards under the Bonus Plan that qualify for the exemption from the

$1,000,000 deduction limitation under Section 162(m) of the Code. Employees holding officer-level positions are

eligible to participate in the Bonus Plan. If our stockholders approve this proposal, we will continue to have the

ability to provide performance-based bonuses to our officers under the Bonus Plan that will meet the requirements

of Section 162(m) of the Code. Section 162(m) permits us to deduct “qualified performance-based compensation”

in excess of $1,000,000 in any taxable year to our Chief Executive Officer and certain of our other executive

officers, if, among other things, the material terms of the performance-based compensation have been approved by

our stockholders. If stockholders do not approve this proposal, no bonuses under the Bonus Plan that were

conditioned on the stockholder approval of the Bonus Plan will be paid, regardless of whether the bonuses would

otherwise be earned.

The material terms of the Bonus Plan are summarized below. A copy of the Bonus Plan is attached to this Proxy

Statement as Exhibit B. This summary of the Bonus Plan is not intended to be a complete description of the Bonus

Plan and is qualified in its entirety by the text of the Bonus Plan, to which reference is made.

Material Features of the Bonus Plan

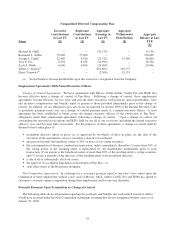

Types of Awards. The Bonus Plan provides that incentive awards may be granted that qualify as qualified

performance-based compensation under Section 162(m) of the Code. In addition to such awards, awards may be

granted under the Bonus Plan that do not qualify as such; provided, however, that in no event may any award be

granted under the Bonus Plan in substitution or replacement of an award intended to qualify as qualified

performance-based compensation under Section 162(m) of the Code. If the stockholders do not approve the Bonus

Plan, no incentive awards may be issued under the Bonus Plan that would be exempt from the $1,000,000 deduction

limitation under Section 162(m) of the Code. All incentive awards payable under the Bonus Plan are paid in cash.

Administration. The Bonus Plan is administered by the Human Resources Committee (the “Committee”). As

such, the Committee has the power and authority to take all actions and make all determinations which it deems

necessary to effectuate, administer and interpret the Bonus Plan. The Committee has the power and authority to

extend, amend, modify and terminate the Bonus Plan at any time; however, the Committee does not have the power

to amend or modify any provision of the Bonus Plan without stockholder approval in a manner that would affect the

terms of the Bonus Plan applicable to any bonus intended to constitute qualified performance-based compensation

under Section 162(m) of the Code, if stockholder approval is required under Section 162(m) of the Code. As

administrator of the Bonus Plan, the Committee’s authority includes, without limitation, the right to select

participants, to determine each participant’s minimum, maximum and target bonus amounts (each expressed as a

percentage of the participant’s base salary), to determine the time or times of paying bonuses, to establish and

approve corporate and individual performance goals and the relative weightings of the goals, to approve bonuses

under the Bonus Plan, to decide the facts in any case arising under the Bonus Plan and to make all other