Pep Boys 2008 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

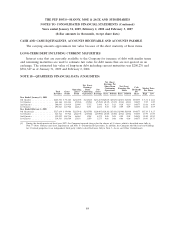

CASH AND CASH EQUIVALENTS, ACCOUNTS RECEIVABLE AND ACCOUNTS PAYABLE

The carrying amounts approximate fair value because of the short maturity of these items.

LONG-TERM DEBT INCLUDING CURRENT MATURITIES

Interest rates that are currently available to the Company for issuance of debt with similar terms

and remaining maturities are used to estimate fair value for debt issues that are not quoted on an

exchange. The estimated fair value of long-term debt including current maturities was $200,276 and

$381,347 as of January 31, 2009 and February 2, 2008.

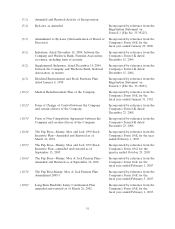

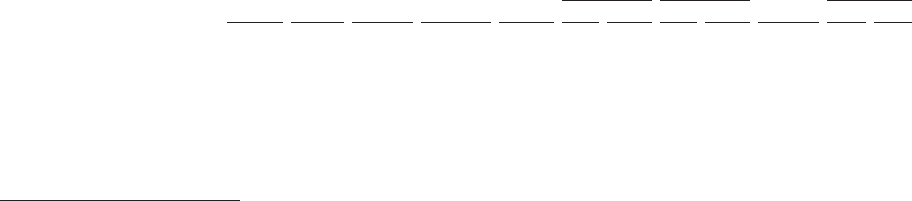

NOTE 18—QUARTERLY FINANCIAL DATA (UNAUDITED)

Net (Loss)

Earnings Per

Net (Loss) Share From Net (Loss)

Earnings Cash

Continuing Earnings Per Market Price

Operating From Net Dividends

Operations Share Per Share

Total Gross (Loss) Continuing (Loss) Per

Revenues Profit Profit Operations Earnings Basic Diluted Basic Diluted Share High Low

Year Ended January 31, 2009

4th Quarter .............. $465,536 $ 92,188 $(31,250) $(32,827) $(33,267) $(0.63) $(0.63) $(0.63) $(0.63) $0.0675 $ 5.31 $ 2.62

3rd Quarter .............. 464,166 114,844 (5,036) (7,054) (7,282) (0.13) (0.13) (0.14) (0.14) 0.0675 9.49 3.00

2nd Quarter ............. 500,043 130,434 11,908 5,752 5,448 0.11 0.11 0.10 0.10 0.0675 10.36 6.40

1st Quarter .............. 498,043 127,966 14,482 5,291 4,672 0.10 0.10 0.09 0.09 0.0675 12.56 8.59

Year Ended February 2, 2008

4th Quarter(1) ............ $517,639 $ 99,006 $(13,544) $(18,505) $(20,403) $(0.36) $(0.36) $(0.40) $(0.40) $0.0675 $15.14 $ 8.25

3rd Quarter .............. 528,761 97,926 (36,139) (25,926) (27,990) (0.50) (0.50) (0.54) (0.54) 0.0675 17.97 13.50

2nd Quarter ............. 552,092 148,716 16,860 3,948 4,179 0.08 0.08 0.08 0.08 0.0675 22.49 15.90

1st Quarter .............. 539,583 140,589 15,838 3,050 3,175 0.06 0.06 0.06 0.06 0.0675 19.93 14.73

(1) During the fourth quarter of fiscal year 2007, the Company incurred charges for the closure of 31 stores, which is described more fully in

Note 7—Store Closures and Asset Impairments and Note 8—Discontinued Operations. In addition, the Company sold the land and buildings

for 34 owned properties to an independent third party, which is described more fully in Note 5—Lease and Other Commitments.

84