Pep Boys 2008 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

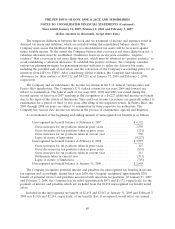

effective tax rate. The Company is undergoing examinations of its tax returns in certain jurisdictions.

The Company has unrecognized tax benefits of approximately $1,011 for which it is reasonably possible

that the amount will increase or decrease within the next twelve months. However, based on the

uncertainties associated with litigation and the status of examination, it is not possible to estimate the

impact of the change.

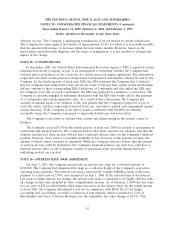

NOTE 15—CONTINGENCIES

In September 2006, the United States Environmental Protection Agency (‘‘EPA’’) requested certain

information from the Company as part of an investigation to determine whether the Company had

violated, and is in violation of, the Clean Air Act and its non-road engine regulations. The information

requested concerned certain generator and personal transportation merchandise offered for sale by the

Company. In the fourth quarter of fiscal year 2008, the EPA informed the Company that it believed

that the Company had violated the Clean Air Act by virtue of the fact that certain of this merchandise

did not conform to their corresponding EPA Certificates of Conformity and that unless the EPA and

the Company were able to reach a settlement, the EPA was prepared to commence a civil action. The

Company is currently engaged in settlement discussions with the EPA that would call for the payment

of a civil penalty and certain injunctive relief. As a result of these discussions, the Company has

accrued an amount equal to its estimate of the civil penalty that the Company is prepared to pay to

settle the matter and has temporarily restricted from sale, and taken a partial asset impairment against

certain inventory. If the Company is not able to reach a settlement with the EPA on mutually

acceptable terms, the Company is prepared to vigorously defend any civil action filed.

The Company is also party to various other actions and claims arising in the normal course of

business.

The Company accrued $5,700 in the fourth quarter of fiscal year 2008 for awards or assessments in

connection with all such matters. The Company believes that these amounts are adequate and that the

ultimate resolution of these matters will not have a material adverse effect on the Company’s financial

position. However, there exists a reasonable possibility of loss in excess of the amounts accrued, the

amount of which cannot currently be estimated. While the Company does not believe that the amount

of such excess loss could be material to the Company’s financial position, any such loss could have a

material adverse effect on the Company’s results of operations in the period(s) during which the

underlying matters are resolved.

NOTE 16—INTEREST RATE SWAP AGREEMENT

On June 3, 2003, the Company entered into an interest rate swap for a notional amount of

$130,000. The Company had designated the swap as a cash flow hedge of the Company’s real estate

operating lease payments. The interest rate swap converted the variable LIBOR portion of the lease

payment to a fixed rate of 2.90% and terminated on July 1, 2008. If the critical terms of the interest

rate swap or hedge item do not change, the interest rate swap is considered to be highly effective with

all changes in fair value included in other comprehensive income. As of February 2, 2008 the fair value

was an asset of $22 recorded within other long-term assets on the balance sheet. In the fourth quarter

of fiscal 2006, the Company determined it was not in compliance with SFAS No.133 for hedge

accounting and, accordingly, recorded a reduction of rent expense, which is included in Costs of

Merchandise and Costs of Service Revenues, for the cumulative fair value change of $4,150. This

81