Pep Boys 2008 Annual Report Download - page 89

Download and view the complete annual report

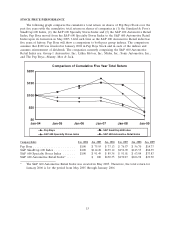

Please find page 89 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal Year 2008 vs. Fiscal Year 2007

Total revenues for fiscal year 2008 decreased 9.8% to $1,927,788,000 compared to $2,138,075,000

for fiscal year 2007. This decrease was primarily due to weaker sales in our retail business stemming

from lower customer counts and the de-emphasis of non-core automotive merchandise. Comparable

revenues decreased by 8.0%, consisting of an 8.4% decrease in comparable merchandise sales and a

6.2% decrease in comparable service revenue. Upon reaching its 13th month of operation, a store is

added to our comparable sales store base. Stores are removed from the comparable sales store base

upon their relocation or closure. Once a relocated store reaches its 13th month of operation at its new

location, it is added back into our comparable sales store base. Square footage increases are infrequent

and immaterial and, accordingly are not considered in our calculations of comparable sales data.

In late fiscal year 2007 and the first half of fiscal year 2008, as part of our long-term strategic plan,

we rebalanced our inventory through an aggressive mark-down and sell through program of non-core

and unproductive merchandise in order to allow us to allocate a larger portion of our inventory

investment to core automotive merchandise. This action was taken because our core automotive

merchandise, which is utilized in each of our lines of business (DIY and DIFM) carries a higher gross

product margin, requires less promotional activity and communicates to our customers our commitment

to fulfilling all of their automotive aftermarket needs. Merchandise sales declined in fiscal year 2008 as

compared to fiscal year 2007 as a result of our decision to exit non-core and unproductive products and

lower customer counts.

Customer counts continued to decline in fiscal year 2008 due to increased competition as our

competitors continued to open more stores, the overall industry decline in the DIY business and as the

result of challenging macroeconomic factors. Higher interest rates, energy costs and gas prices resulted

in less discretionary income and resulted in a reduction in miles driven in the USA as compared to the

prior year. We believe that less discretionary income coupled with fewer miles driven resulted in fewer

purchases of automotive accessories and the deferral of automotive maintenance. Fewer miles driven

results in less wear and tear on vehicles, which in turn results in fewer sales of automotive parts and

automotive maintenance and repair services. Due to the changing macroeconomic conditions, future

trends in consumer confidence, disposable income and miles driven are uncertainties that could impact

future results.

To address these sales and customer count declines, we are (i) improving store execution by

providing additional associate sales and technical training, (ii) increasing service center productivity by

transitioning to performance-based pay compensation programs, (iii) utilizing more impactful targeted

marketing through a variety of media platforms, (iv) offering our customers a broader selection of tires

and hard parts and (v) focusing on providing fast, expert customer service. We believe that providing a

better customer experience, value proposition and marketing will stem the decline in customer counts

and sales over the long term.

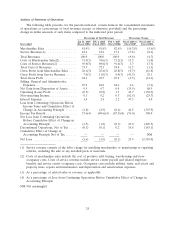

Gross profit from merchandise sales increased, as a percentage of merchandise sales, to 28.1% in

fiscal year 2008 from 25.4% in fiscal year 2007. The decrease in dollars was $3,124,000 or a 0.7%

decrease from the prior year. The prior year included an inventory impairment charge of $32,803,000

and a $5,350,000 asset impairment charge resulting from the closure of 20 stores. Included in the

current year is an asset and inventory impairment charge of $5,779,000. The asset impairment charge

was primarily for certain closed locations as a result of the decline in real estate values and the

inventory impairment charge was due to our temporarily restricting certain small engine merchandise

for sale that is the subject of an ongoing EPA inquiry. Excluding these adjustments from both years,

gross profit as a percent of merchandise sales increased from 27.5% in fiscal year 2007 to 28.4 in the

current year. In dollars, merchandise gross profit decreased $35,498,000 or 7.4% primarily due to

reduced merchandise sales. A further breakdown of our gross profit from merchandise sales excluding

the items mentioned above is as follows: Our product gross margins improved by 170 basis points to

25