Pep Boys 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

that the Company’s availability under its revolving credit agreement drops below $52,500 the Company

is required to maintain a consolidated fixed charge coverage ratio, of at least 1.1:1.0, calculated as the

ratio of (a) EBITDA (net income plus interest charges, provision for taxes, depreciation and

amortization expense, non-cash stock compensation expenses and other non-recurring, non-cash items)

minus capital expenditures and income taxes paid to (b) the sum of debt service charges and restricted

payments made. The failure to satisfy this covenant would constitute an event of default under the

Company’s revolving credit agreement, which would result in a cross-default under the Company’s 7.5%

Senior Subordinated Notes and Senior Secured Term Loan.

As of January 31, 2009, the Company had additional availability under the revolving credit

agreement of approximately $182,115 and was in compliance with its financial covenants.

Other Contractual Obligations

In the third quarter of fiscal 2004, the Company entered into a vendor financing program with an

availability of $20,000. Under this program, the Company’s factor made accelerated and discounted

payments to its vendors and the Company, in turn, made regularly-scheduled full vendor payments to

the factor. This program was terminated effective December, 2007.

On June 29, 2007, we entered into a new vendor financing program with availability up to $65,000.

The availability was subsequently reduced and as of January 31, 2009 the availability was $40,000.

There was an outstanding balance of $31,930 and $14,254 under this program as of January 31, 2009

and February 2, 2008, respectively.

The Company has letter of credit arrangements in connection with its risk management, import

merchandising and vendor financing programs. The Company was contingently liable for $354 and $691

in outstanding import letters of credit and $86,502 and $63,477 in outstanding standby letters of credit

as of January 31, 2009 and February 2, 2008, respectively.

The Company is also contingently liable for surety bonds in the amount of $9,235 and $6,598 as of

January 31, 2009 and February 2, 2008, respectively. The surety bonds guarantee certain of our

payments (for example utilities, easement repairs, licensing requirements and customs fees).

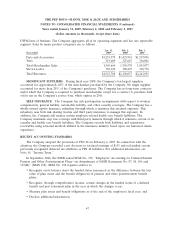

The annual maturities of all long-term debt and capital lease commitments for the next five fiscal

years are:

Long-Term Capital Lease Financing

Year Debt Leases Obligation Total

2009 ............................... $ 1,078 $129 $ 247 $ 1,454

2010 ............................... 1,078 — 258 1,336

2011 ............................... 1,078 — 269 1,347

2012 ............................... 1,078 — 281 1,359

2013 ............................... 146,482 — 294 146,776

Thereafter ........................... 198,397 — 3,166 201,563

Total ............................... $349,191 $129 $4,515 $353,835

53