Pep Boys 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

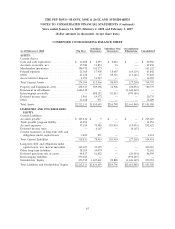

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

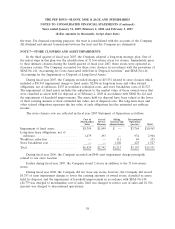

the Company believes that its remaining stores will retain the cash flows lost from the 20 closed

locations. Below is a summary of the results of discontinued operations:

January 31, February 2, February 3,

Year ended 2009 2008 2007

Merchandise Sales ....................... $ — $21,422 $23,213

Service Revenue ........................ — 3,988 5,093

Total Revenues ......................... — 25,410 28,306

(Loss) Earnings from Discontinued Operations

Before Income Taxes ................... $(2,448) $ (6,064) $ 6,129

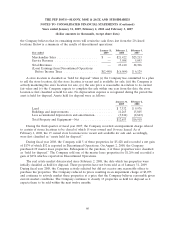

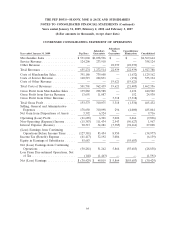

A store location is classified as ‘‘held for disposal’’ when (i) the Company has committed to a plan

to sell the store location, (ii) the store location is vacant and is available for sale, (iii) the Company is

actively marketing the store location for sale, (iv) the sale price is reasonable in relation to its current

fair value and (v) the Company expects to complete the sale within one year from the date the store

location is first classified as held for sale. No depreciation expense is recognized during the period the

asset is held for disposal. Assets held for disposal were as follows:

January 31, February 2,

2009 2008

Land ......................................... $ 7,332 $ 9,976

Buildings and improvements ........................ 11,265 15,805

Less accumulated depreciation and amortization .......... (5,944) (8,863)

Total Property and Equipment—Net .................. $12,653 $16,918

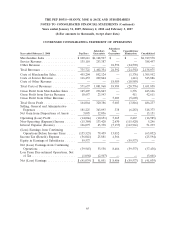

During the third quarter of fiscal year 2007, the Company recorded an impairment charge related

to certain of stores locations to be closed of which 15 were owned and 16 were leased. As of

February 2, 2008, the 15 owned store locations were vacant and available for sale and, accordingly,

were first classified as ‘‘assets held for disposal.’’

During fiscal year 2008, the Company sold 5 of these properties for $5,428 and recorded a net gain

of $174 of which $52 is reported in Discontinued Operations. On August 2, 2008, the Company

purchased 29 master lease properties. Subsequent to the purchase, 4 of these properties were classified

as ‘‘held for disposal.’’ The Company sold one of the master lease properties for $1,266 and recorded a

gain of $254 which is reported in Discontinued Operations.

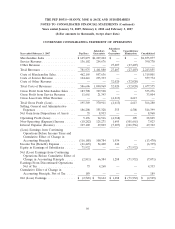

The real estate market deteriorated since February 2, 2008, the date which ten properties were

initially classified as held for disposal. These properties have not been sold as of January 31, 2009.

During fiscal year 2008, the Company actively solicited but did not receive any reasonable offers to

purchase the properties. The Company reduced its prices resulting in an impairment charge of $3,075

and continues to actively market these properties at a price that the Company believes reasonable given

current market conditions. The Company continues to classify 13 properties as held for disposal as it

expects them to be sold within the next twelve months.

60