Pep Boys 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

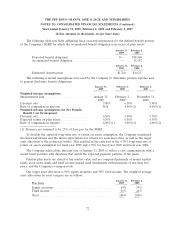

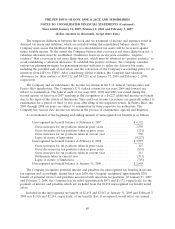

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

options and exercisable options is 4 years and 2.7 years, respectively. At January 31, 2009, the weighted

average remaining contractual term and aggregate intrinsic value of outstanding and expected to vest

options is 5.9 years and $0. The cash received and related tax benefit realized from options exercised

during fiscal 2008 was $23 and $9, respectively. At January 31, 2009, there was approximately $647 of

total unrecognized pre-tax compensation cost related to non-vested stock options which is expected to

be recognized over a weighted-average period of 1.5 years.

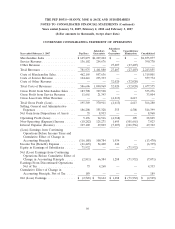

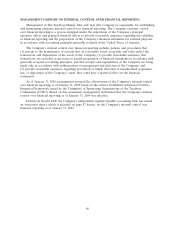

The following table summarizes information about non-vested stock awards (RSUs) since

February 2, 2008:

Weighted

Number of Average

RSUs Fair Value

Nonvested at February 2, 2008 ............................... 710,945 $15.58

Granted ............................................. 254,165 11.25

Forfeited ............................................. (402,201) 14.21

Vested .............................................. (243,900) 15.60

Nonvested at January 31, 2009 ............................. 319,009 $13.66

The following table summarizes information about RSUs during the last three fiscal years (dollars

in thousands except per unit amount):

Fiscal 2008 Fiscal 2007 Fiscal 2006

Weighted average fair value at grant date per unit ....... $11.25 $15.56 $13.58

Fair value at vesting date ......................... 5,441 3,341 1,660

Intrinsic value at conversion date ................... 1,586 3,773 1,075

Tax benefits realized from conversions ................ 589 1,402 734

At January 31, 2009, there was approximately $3,003 of total unrecognized pre-tax compensation

cost related to non-vested RSUs, which is expected to be recognized over a weighted-average period of

1.6 years.

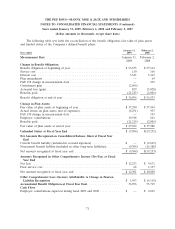

NOTE 13—ASSET RETIREMENT OBLIGATIONS

The Company records asset retirement obligations as incurred and reasonably estimable, including

obligations for which the timing and/or method of settlement are conditional on a future event that

may or may not be within the control of the Company. The fair values of obligations are recorded as

liabilities on a discounted basis and are accreted over time for the change in present value. Costs

associated with the liabilities are capitalized and amortized over the estimated remaining useful life of

the asset, generally for periods of 15 years.

At January 31, 2009, the Company has a liability pertaining to the asset retirement obligation in

accrued expenses and other long-term liabilities on its consolidated balance sheet. The following is a

76