Pep Boys 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

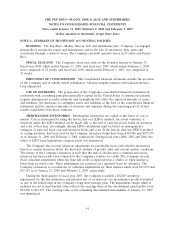

Expected volatility is based on historical volatilities for a time period similar to that of the

expected term. In estimating the expected term of the options, the Company has utilized the

‘‘simplified method’’ allowable under the Securities and Exchange Commission, or SEC, Staff

Accounting Bulletin No. 107, ‘‘Share-Based Payment’’ through December 31, 2007 and changed to an

actual experience method during fiscal year 2008. The risk-free rate is based on the U.S. treasury yield

curve for issues with a remaining term equal to the expected term. The fair value of each option

granted during fiscal years 2008, 2007 and 2006 is estimated on the date of grant using the Black-

Scholes option-pricing model with the following weighted-average assumptions:

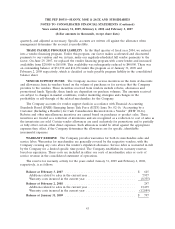

Year ended

January 31, February 2, February 3,

2009 2008 2007

Dividend yield ................................ 2.93% 1.79% 2.02%

Expected volatility .............................. 45% 39% 53%

Risk-free interest rate range:

High ....................................... 3.2% 5.0% 4.8%

Low........................................ 2.7% 3.5% 4.6%

Ranges of expected lives in years ................... 3-4 4-5 5-7

SFAS No. 123R also requires the Company to reflect in its consolidated statement of cash flows,

any excess tax benefits realized upon the exercise of stock options or issuance of RSUs, in excess of

that which is associated with the expense recognized for financial reporting purposes. Approximately

$3; $1,104 and $95 are reflected as a financing cash inflows in the consolidated statement of cash flows

for fiscal years 2008, 2007 and 2006, respectively.

COMPREHENSIVE LOSS Comprehensive loss is reported in accordance with SFAS No. 130,

‘‘Reporting Comprehensive Income.’’ Other comprehensive loss includes minimum pension liability and

fair market value of cash flow hedges.

DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES The Company may enter into

interest rate swap agreements to hedge the exposure to increasing rates with respect to its variable rate

lease and debt agreements, when the Company deems it prudent to do so. The Company reports

derivatives and hedging activities in accordance with SFAS No. 133, ‘‘Accounting for Derivative

Instruments and Hedging Activities,’’ as amended by SFAS No. 137, SFAS No. 138 and SFAS No. 149.

This statement establishes accounting and reporting standards for derivative instruments, including

certain derivative instruments embedded in other contracts (collectively referred to as derivatives), and

for hedging activities. It requires that an entity recognize all derivatives as either assets or liabilities in

the statement of financial position and measure those instruments at fair value.

SEGMENT INFORMATION The Company reports segment information in accordance with

SFAS No. 131, ‘‘Disclosure about Segments of an Enterprise and Related Information’’ (SFAS

No. 131). The Company operates in one industry, the automotive aftermarket using a SUPERCENTER

layout, which houses both retail and service centers in one building. In accordance with SFAS No. 131,

the Company has 6 operating segments defined by geographic regions which are Northeast,

Mid-Atlantic, Southeast, Central, West and Southern CA. Each segment serves both our DIY and our

46