Pep Boys 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

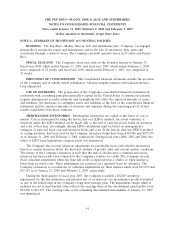

The Company adopted the requirement to recognize the funded status of a benefit plan and the

additional disclosure requirements at February 3, 2007. At February 2, 2008, the Company adopted the

SFAS No. 158 requirement to measure plan assets and benefit obligations as of the date of the

Company’s fiscal year end. In accordance with SFAS 158, the change of measurement date from a

calendar year to the Company’s fiscal year resulted in a net charge to Retained Earnings of $189 and a

credit to Accumulated Other Comprehensive Loss of $123. This net charge to Retained Earnings

represents the after-tax pension expense for the period from January 1, 2008 to February 2, 2008.

In September 2006, the Financial Accounting Standards Board (FASB) issued Statement of

Financial Accounting Standards (SFAS) No.157, ‘‘Fair Value Measurements’’ (SFAS No. 157). SFAS

No. 157 defines the term fair value, establishes a framework for measuring it within generally accepted

accounting principles and expands disclosures about its measurements. The Company adopted

SFAS 157 on February 3, 2008. This adoption did not have a material effect on the Company’s financial

statements. Fair value disclosures are provided in Note 16.

In March 2007, the EITF reached a consensus on Issue Number 06-10, ‘‘Accounting for Deferred

Compensation and Postretirement Benefit Aspects of Collateral Assignment Split-Dollar Life Insurance

Arrangements’’ (EITF 06-10). EITF 06-10 provides guidance to help companies determine whether a

liability for the postretirement benefit associated with a collateral assignment split-dollar life insurance

arrangement should be recorded in accordance with either SFAS No.106, ‘‘Employers’ Accounting for

Postretirement Benefits Other Than Pensions’’ (if, in substance, a postretirement benefit plan exists), or

Accounting Principles Board Opinion No. 12 (if the arrangement is, in substance, an individual

deferred compensation contract). EITF 06-10 also provides guidance on how a company should

recognize and measure the asset in a collateral assignment split-dollar life insurance contract.

EITF 06-10 is effective for fiscal years beginning after December 15, 2007, although early adoption is

permitted. The adoption of EITF 06-10 resulted in a $1,165 net of tax charge to retained earnings on

February 3, 2008.

In June 2007, the FASB ratified EITF Issue Number 06-11, ‘‘Accounting for Income Tax Benefits

of Dividends on Share-Based Payment Awards’’ (EITF 06-11). EITF 06-11 applies to share-based

payment arrangements with dividend protection features that entitle employees to receive (a) dividends

on equity-classified non-vested shares, (b) dividend equivalents on equity-classified non-vested share

units, or (c) payments equal to the dividends paid on the underlying shares while an equity-classified

share option is outstanding, when those dividends or dividend equivalents are charged to retained

earnings under SFAS No. 123(R), ‘‘Share-Based Payment,’’ and result in an income tax deduction for

the employer. A consensus was reached that a realized income tax benefit from dividends or dividend

equivalents that are charged to retained earnings and are paid to employees for equity-classified

non-vested equity shares, non-vested equity share units, and outstanding equity share options should be

recognized as an increase in additional paid-in capital. EITF 06-11 is effective prospectively for the

income tax benefits that result from dividends on equity-classified employee share-based payment

awards that are declared in fiscal years beginning after December 15, 2007, and interim periods within

those fiscal years. On February 3, 2008, the Company adopted EITF 06-11, which did not have a

material impact on its consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141R, ‘‘Business Combinations’’ (SFAS No. 141R),

which replaces SFAS No. 141, ‘‘Business Combinations.’’ SFAS No. 141R, among other things,

establishes principles and requirements for how an acquirer entity recognizes and measures in its

48