Pep Boys 2008 Annual Report Download - page 119

Download and view the complete annual report

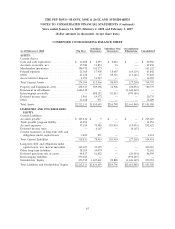

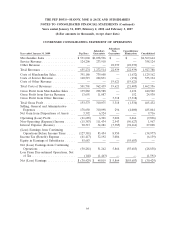

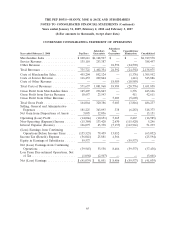

Please find page 119 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

Flows. Accordingly, the Company continues to reflect the property on its balance sheet in accordance

with SFAS No.13.

On March 25, 2008, the Company sold 18 owned properties to an independent third party. Net

proceeds from this sale were $62,542. Concurrent with the sale, the Company entered into agreements

to lease the properties back from the purchaser over a minimum lease term of 15 years. Each property

was separately evaluated under SFAS No.13. The two master leases have an initial term of 15 years

with four five-year renewal options of which none were considered bargain renewal options. The second

through the fourth renewal options are at fair market rents. The leases have yearly incremental rental

increases that are 1.5% of the prior year’s rentals. The Company discounted the minimum lease

payments, reflecting escalation amounts, during the initial term of 15 years using its then incremental

borrowing rate. For properties where the value of the land was greater than 25% of the property value,

the building component was evaluated separately. The Company classified these 18 leases as operating

leases in accordance with SFAS No.13. The Company actively uses these properties and considers the

leases as normal leasebacks. In accordance with SFAS No.98, a $9 gain on the sale of these properties

was recognized immediately upon execution of the sale and a $26,809 gain was deferred. The

immediate gain represents those properties sold where the realized gain exceeds the present value of

the minimum lease payments. The deferred gain is being recognized over the minimum term of these

leases.

On April 10, 2008, the Company sold 23 owned properties to an independent third party. Net

proceeds from this sale were $72,977. Concurrent with the sale, the Company entered into agreements

to lease the properties back from the purchaser over a minimum lease term of 15 years. Each property

has a separate lease and was separately evaluated under SFAS No.13. The leases have an initial term of

15 years with four five-year renewal options of which none were considered bargain renewal options.

The leases have yearly incremental rental increases that are 1.5% of the prior year’s rentals. The

second through the fourth renewal options are at fair market rents. The Company discounted the

minimum lease payments, reflecting escalation amounts, during the initial term of 15 years using its

then incremental borrowing rate. For properties where the value of the land was greater than 25% of

the property value, the building component was evaluated separately. The Company classified 22 of

these leases as operating leases in accordance with SFAS No.13. The Company actively uses these

properties and considers the leases as normal leasebacks. In accordance with SFAS No.98, a $5,522 gain

on the sale of these properties was recognized immediately upon execution of the sale and a $34,483

gain was deferred. The immediate gain represents those properties sold where the realized gain exceeds

the present value of the minimum lease payments. The deferred gain is being recognized over the

minimum term of these leases. The Company initially had continuing involvement in one property

relating to an environmental indemnity and, accordingly, recorded $4,583 of the transaction’s total net

proceeds as a borrowing and as a financing activity in the Statement of Cash Flows. During the second

quarter of fiscal year 2008, the Company provided the necessary documentation to satisfy its indemnity

and remove its continuing involvement with this property. The Company then recorded the sale of this

property as a sale-leaseback transaction, removing the asset and related lease financing and recorded a

$1,515 deferred gain which is being recognized over the remaining minimum term of this lease.

On July 30, 2008, the Company sold 22 properties to an independent third party. Net proceeds

from this sale were $75,951. Concurrent with the sale, the Company entered into agreements to lease

the properties back from the purchaser over a minimum lease term of 15 years. Each property has a

55