Pep Boys 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

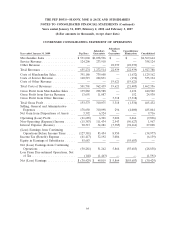

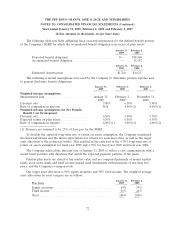

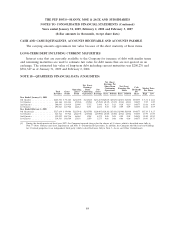

NOTE 11—EARNINGS PER SHARE

Basic earnings per share is based on net earnings divided by the weighted average number of

shares outstanding during the period. Adjustments for the stock options were anti-dilutive in fiscal

years 2008, 2007 and 2006 and therefore excluded from the calculation due to the Company’s net loss

for the year. Additionally, adjustments for the convertible senior notes and purchase rights were

anti-dilutive in all periods presented. During fiscal year 2008, no convertible notes were outstanding.

The following schedule presents the calculation of basic and diluted earnings per share for net loss

from continuing operations:

January 31, February 2, February 3,

Year ended 2009 2008 2007

Net loss from continuing operations ................... $ (28,838) $ (37,438) $ (7,071)

Average number of common shares outstanding during

period ...................................... 52,136,000 52,130,000 54,318,000

Basic and Diluted Loss Per Share:

Net loss From Continuing Operations ................ $ (0.55) $ (0.72) $ (0.13)

(Loss) Earnings from Discontinued Operations, Net of Tax . (0.03) (0.07) 0.08

Basic and Diluted Loss Per Share ................... $ (0.58) $ (0.79) $ (0.05)

All outstanding options and non vested restricted stock units were excluded from the computation

of diluted EPS because they were anti-dilutive for the fiscal years ended January 31, 2009; February 2,

2008 and February 3, 2007.

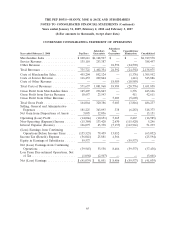

NOTE 12—EQUITY COMPENSATION PLANS

The Company has a stock-based compensation plan originally approved by the stockholders on

May 21, 1990 under which it has previously granted non-qualified stock options and incentive stock

options to key employees and members of its Board of Directors. As of February 2, 2007, there were

no awards remaining available for grant under the 1990 Plan. The Company has a stock-based

compensation plan originally approved by the stockholders on June 2, 1999 under which it has

previously granted and may continue to grant non-qualified stock options, incentive stock options and

restricted stock units (RSUs) to key employees and members of its Board of Directors. As of

January 31, 2009, there were 1,638,118 awards remaining available for grant under the 1999 Plan. The

Company adopted two standalone inducement plans under which it can grant non-qualified stock

options and RSUs. As of January 31, 2009, there were no awards outstanding and 500,000 awards

available for grant under these plans.

Incentive stock options and non-qualified stock options previously granted under the 1990 and

1999 plans (i) to non-officers, vest fully on the third anniversary of their grant date and (ii) to officers

(other than the current President & Chief Executive Officer), vest over a four-year period, with

one-fifth vesting on each of the grant date and the next four anniversaries thereof.

Non-qualified stock options and RSUs granted to the current President & Chief Executive Officer

vest over a three-year period, with one-quarter vesting on each of the grant date and the next three

anniversaries thereof.

74