Pep Boys 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

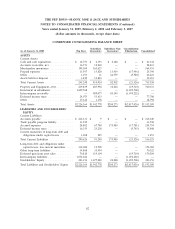

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2009, February 2, 2008 and February 3, 2007

(dollar amounts in thousands, except share data)

payments and an additional payment to release a store from the collateral pool to allow it to be sold to

an unrelated third party.

Senior Subordinated Notes due December, 2014

On December 14, 2004, the Company issued $200,000 aggregate principal amount of 7.5% Senior

Subordinated Notes due December 15, 2014. During fiscal year 2008 the Company repurchased notes

in the principal amount of $25,465 with a portion of the net proceeds generated from the sale

leaseback transactions on 63 stores during fiscal year 2008. On January 31, 2009 the outstanding

balance of these notes was $174,535.

Revolving Credit Agreement due December, 2009

On December 2, 2004, the Company further amended its amended and restated line of credit

agreement. The amendment increased the amount available for borrowings to $357,500 with an ability,

upon satisfaction of certain conditions, to increase such amount to $400,000. The amendment also

reduced the interest rate under the agreement to LIBOR plus 1.75% (after June 1, 2005, the rate

decreased to LIBOR plus 1.50%, subject to 0.25% incremental increases as excess availability falls

below $50,000). The amendment also provided the flexibility, upon satisfaction of certain conditions, to

release up to $99,000 of reserves required as of December 2, 2004 under the line of credit agreement

to support certain operating leases. Finally, the amendment extended the term of the agreement

through December 2009. The weighted average interest rate on borrowings under the line of credit

agreement was 7.51% at February 2, 2008. On January 16, 2009, the Company terminated this revolving

credit agreement and recognized in interest expense $1,172 of deferred financing costs.

Revolving Credit Agreement due December, 2014

On January 16, 2009, the Company entered into a new revolving credit agreement with available

borrowings up to $300,000. Our ability to borrow under the revolving credit agreement is based on a

specific borrowing base consisting of inventory and accounts receivable. Total incurred fees of $6,754

were capitalized and will be amortized over the 5 year life of the facility. The interest rate on this

credit line is LIBOR or Prime plus 2.75% to 3.25% based upon the then current availability under the

facility. The weighted average interest rate on borrowing under the facility was 6.25% at January 31,

2009. Fees based on the unused portion of the facility range from 37.5 to 75.0 basis points. As of

January 31, 2009, the availability under the facility was $182,115.

The weighted average interest rate on borrowings during fiscal years 2008 and 2007 was 5.8% and

7.51%, respectively.

Other Notes

During fiscal year 2008, notes payable with aggregate principal balances of $248 and a weighted

average interest rates of 8.0% at February 2, 2008 was paid in full.

Other Matters

Several of the Company’s debt agreements require compliance with covenants. The most restrictive

of these requirements is contained in the Company’s revolving credit agreement. During any period

52