Pep Boys 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report

Notice of Annual Meeting & Proxy Statement

Table of contents

-

Page 1

2008 Annual Report Notice of Annual Meeting & Proxy Statement -

Page 2

-

Page 3

...- service, retail and commercial - work together for the benefit of our customers. We feel good about the level of pride we see returning to our stores and, more importantly, our associates feel that we are making the right moves to restore the Pep Boys brand. Our company-wide commitment for 2009 is... -

Page 4

..., that will include on-line service scheduling and many more customer benefits. SERVICE SPOKES When we announced our strategic plan in the fall of 2007, we identified two meaningful legacy issues - store size and market density. We are addressing our larger than necessary stores with our Automotive... -

Page 5

... Board of Directors for a one-year term. The ratification of the appointment of our independent registered public accounting firm. The amendment and restatement of our Stock Incentive Plan to extend its term through December 31, 2014 and to provide an additional 1,500,000 shares available for award... -

Page 6

... of the Board of Directors ...12 Independent Registered Public Accounting Firm's Fees ...13 EXECUTIVE COMPENSATION ...14 Compensation Discussion and Analysis ...14 Human Resources Committee Report ...18 Summary Compensation Table ...19 Grants of Plan Based Awards ...21 Outstanding Equity Awards at... -

Page 7

... Statement, form of proxy card, and our 2008 Annual Report on or about May 13, 2009. What is the purpose of the meeting? At the meeting, shareholders will vote on: • The election of directors. • The ratification of the appointment of our independent registered public accounting firm. • The... -

Page 8

... proxy using one of the foregoing methods. Your shares will be voted as you direct. If you sign and return a proxy card prior to the meeting that does not contain instructions, your shares will be voted as recommended by the Board of Directors. Can I change my vote after I return my proxy card? Yes... -

Page 9

... of directors. • FOR the ratification of the appointment of our independent registered public accounting firm. • FOR the amendment and restatement of our Stock Incentive Plan to extend its term through December 31, 2014 and to provide an additional 1,500,000 shares available for award issuances... -

Page 10

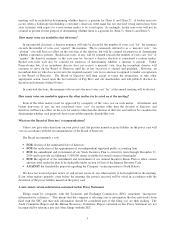

... table provides information about those shareholders that beneficially own more than 5% of the outstanding shares of Pep Boys Stock. Name Glenhill Advisors LLC and affiliates 598 Madison Avenue, 12th Floor New York, NY 100221 Dimensional Fund Advisors LP Palisades West, Building One 6300 Bee Cave... -

Page 11

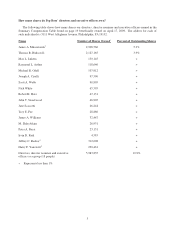

...table shows how many shares our directors, director nominee and executive officers named in the Summary Compensation Table found on page 19 beneficially owned on April 17, 2009. The address for each of such individuals is 3111 West Allegheny Avenue, Philadelphia, PA 19132. Name James A. Mitarotonda2... -

Page 12

... investment power and non-voting interests including restricted stock units and deferred compensation accounted for as Pep Boys Stock. Also includes shares that can be acquired through stock option exercises through June 16, 2009: Mitarotonda - 3,654; Hudson - 3,544; Arthur - 33,334; Odell - 5,734... -

Page 13

..., 55, a CPA, is the Chief Executive Officer of Drucker & Scaccetti PC, a public accounting and business advisory firm, of which she has a been a principal since 1990. Ms. Scaccetti serves as a director of Nutrition Management Services Company. John T. Sweetwood Director since 2002 Mr. Sweetwood, 61... -

Page 14

...since September 22, 2008. He joined Pep Boys in September 2007 as Executive Vice President-Chief Operating Officer, after having most recently served as the Executive Vice President and General Manager of Sears Retail & Specialty Stores. Mr. Odell joined Sears in its finance department in 1994 where... -

Page 15

... by the New York Stock Exchange (NYSE), promptly following our 2008 Annual Meeting, our Interim CEO certified to the NYSE that he was not aware of any violation by Pep Boys of NYSE corporate governance listing standards. Independence. An independent director is independent from management and free... -

Page 16

... serve on the Board and serves as the Board's representative on all corporate governance matters. The Nominating and Governance Committee met four times during fiscal 2008. Operating Efficiency Committee. The Board has appointed a special committee that meets from time-to-time, to assist management... -

Page 17

...are paid at a later date chosen by the director at the time of deferral. A director who is also an employee of Pep Boys receives no additional compensation for service as a director. Equity Grants. The Pep Boys Stock Incentive Plan provides for an annual equity grant having an aggregate value of $45... -

Page 18

...point for communication among the Board of Directors, the independent registered public accounting firm, management and Pep Boys' internal audit function, as the respective duties of such groups, or their constituent members, relate to Pep Boys' financial accounting and reporting and to its internal... -

Page 19

... access to work papers. Audit-related fees billed in fiscal 2007 consisted of employee benefit plan audits. Tax Fees. Tax Fees billed in fiscal 2008 and 2007 consisted of tax compliance services in connection with tax audits and appeals. The Audit Committee annually engages Pep Boys' independent... -

Page 20

...reflect market competitiveness and job level responsibility. The Human Resources Committee recommends to the full Board of Directors the annual total compensation levels for all of the named executive officers (other than the CEO), based on recommendations made by the CEO and the SVP-Human Resources... -

Page 21

...'s current salary within the market range for his position and the budgeted percentage increase for all officers as a group. This budgeted percentage increase was 2.0% for fiscal 2008. However, consistent with our plan to return Pep Boys to profitability, no named executive officer was awarded... -

Page 22

... five years of employment with Pep Boys, and then hold, at least two times their annual salary in Pep Boys stock. An officer may satisfy the stock ownership guidelines through direct share ownership and/or by holding RSUs. Retirement Plans. We maintain The Pep Boys Savings Plan, which is a broad... -

Page 23

...interests of the company without regard to any possible change of control. New Executive Officer. Mr. Arthur joined the Company on May 1, 2008. In order to induce Mr. Arthur to join the Company, the Human Resource Committee recommended, and the full Board, approved (i) a base salary of $500,000, (ii... -

Page 24

... payments are in the best interests of Pep Boys and our shareholders. All compensation paid to the named executive officers in fiscal 2008, except for a portion paid to Mr. Cirelli (due to the payout of his vested benefit under the Legacy Plan) was fully deductible. Human Resources Committee Report... -

Page 25

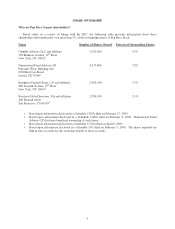

... plan compensation. Name and Fiscal Principal Position Year Michael R. Odell CEO(f) Raymond L. Arthur EVP - CFO(g) Joseph A. Cirelli SVP - Corp.Dev. 2008 2007 2008 Salary ($) Bonus ($) Stock Awards ($) (a) 185,471 72,142 52,421 Option Awards ($) (b) 17,002 8,460 66,783 Change in Pension... -

Page 26

... Account Plan balance. Mr. Odell joined Pep Boys on September 17, 2007 as EVP - COO. Mr. Odell was appointed interim CEO on May 24, 2008 and permanent CEO on September 22, 2008. (g) Mr. Arthur joined Pep Boys on May 1, 2008. (h) Mr. Fee joined Pep Boys on July 16, 2007. (i) Mr. Webb joined Pep Boys... -

Page 27

.... Odell, Cirelli, Fee and Webb on account of their fiscal 2008 service and grants made to Mr. Arthur to induce him to join the Company. Estimated Potential Payouts Under Non-Equity Incentive Plan Awards(a) All Other Option Awards: Number of Securities Underlying Options (#) Name Michael R. Odell... -

Page 28

... stock options and unvested RSUs held by the named executive officers as of January 31, 2009. Option Awards Stock Awards Market Value of Shares or Units of Stock Number of That Shares or Have Not Units of Yet Stock That Vested Have Not ($) Vested (#) (a) Name Michael R. Odell Number of Securities... -

Page 29

...information regarding stock options exercised by the named executive officers and RSUs held by the named executive officers that vested, during fiscal 2008. Name Michael R. Odell Joseph A. Cirelli Troy E. Fee Scott A. Webb Jeffrey C. Rachor Harry F. Yanowitz Option Awards Number of Shares Acquired... -

Page 30

... Compensation Plan for our named executive officers. The Account Plan is a retirement plan pursuant to which we make annual contributions based upon a named executive officer's age and then current compensation. In order to further assist our named executive officers with their retirement savings... -

Page 31

... the Internal Revenue Code (a parachute payment excise tax) on a change of control payment made to a named executive officer. A trust agreement has been established to better assure the named executive officers of the satisfaction of Pep Boys' obligations under their employment agreements following... -

Page 32

... and benefits that each named executive officer would have received under his Change of Control Agreement assuming that he was terminated immediately upon a change of control as of January 31, 2009. 2X Account Plan Contributions ($) (a) 320,000 280,000 139,209 72,500 116,000 Name Michael R. Odell... -

Page 33

... AND TO PROVIDE AN ADDITIONAL 1,500,000 SHARES AVAILABLE FOR AWARD ISSUANCES THEREUNDER On February 26, 2009, the Board of Directors, subject to stockholder approval at the 2009 Annual Meeting, approved The Pep Boys - Manny, Moe & Jack 2009 Stock Incentive Plan, which is an amendment and restatement... -

Page 34

... determine the key employees and members of the Board of Directors (including directors who are not employees) to whom and the times and the prices at which awards will be granted, (ii) determine the type of award to be granted and the number of shares of Pep Boys Stock subject to such awards, (iii... -

Page 35

... has the discretion to make additional awards under the 2009 Plan to non-employee directors. "RSU Annualized Value" means, as of the date an award is granted, the average fair market value of a share of Pep Boys Stock during the immediately preceding year. "Option Annualized Value" means, as of... -

Page 36

... Stock as to which awards may be granted under the 2009 Plan, the number of shares of Pep Boys Stock for which awards may be granted to any individual during any calendar year, the kind and number of shares of Pep Boys Stock covered by each outstanding award and the exercise price for a stock option... -

Page 37

...be granted to key employees or who will receive any grants under the 2009 Plan after the 2009 Annual Meeting, except for the automatic grants to non-employee directors described above. On April 17, 2009, the closing price of a share of Pep Boys Stock on the New York Stock Exchange was $7.62. Federal... -

Page 38

... UNDER SECTION 162(m) OF THE INTERNAL REVENUE CODE On February 26, 2009, the Board of Directors approved an amendment and restatement of The Pep Boys - Manny, Moe & Jack Annual Incentive Bonus Plan (the "Bonus Plan"), to make certain clarifying changes to the Bonus Plan, and is submitting the Bonus... -

Page 39

... equity; (2) earnings per share of Pep Boys Stock; (3) net income (before or after taxes); (4) earnings before interest, taxes, depreciation and amortization; (5) sales or revenue targets; (6) return on assets, capital or investment; (7) cash flow; (8) market share; (9) cost reduction goals; (10... -

Page 40

.... However, the following table sets forth the threshold, target, MAX and CAP amounts that are potentially payable under our Annual Incentive Bonus Plan to our named executive officers if certain corporate targets pre-established by our Human Resources Committee were achieved in fiscal 2009. 34 -

Page 41

... at the time of payment of cash or delivery of actual shares of Pep Boys Stock. Future appreciation on shares of Pep Boys Stock held beyond the ordinary income recognition event will be taxable at capital gains rates when the shares of Pep Boys Stock are sold. We, as a general rule, will be... -

Page 42

...retain from shares of Pep Boys Stock that would otherwise be deliverable in connection with an award, a number of shares of Pep Boys Stock equal to such tax liability. THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE AMENDMENT AND RESTATEMENT OF OUR ANNUAL INCENTIVE BONUS PLAN 36 -

Page 43

.... "High Governance Risk Assessment." "Very High Concern" in Executive Pay with $10 million for Jeffrey Rachor. "Very High Concern" in accounting with a SOX 404 violation. • In addition to our D-rated board our directors also served on other boards rated D or F by the Corporate Library: James... -

Page 44

... current CEO has a much more modest compensation package. Our Accounting rating was based upon our previously disclosed material weakness in internal controls over financial reporting, which was remediated as of January 31, 2009. Pep Boys scored a "low concern" rating in their other two areas, Board... -

Page 45

... Securities Exchange Act of 1934 requires our directors, executive officers and 10% Holders to file initial reports of ownership and reports of changes in ownership of Pep Boys Stock. Based solely upon a review of copies of such reports, we believe that during fiscal 2008, our directors, executive... -

Page 46

... the 2010 Annual Meeting and to have included in the Board of Directors' proxy materials relating to that meeting must be received no later than January 8, 2010. Such proposals should be sent to: Pep Boys 3111 West Allegheny Avenue Philadelphia, PA 19132 Attention: Secretary Any shareholder proposal... -

Page 47

... 1999 Stock Incentive Plan, and renames it as The Pep Boys - Manny, Moe & Jack 2009 Stock Incentive Plan, effective as of June 24, 2009, (the "Plan"). The Plan is intended to recognize the contributions made to the Company by key employees, and members of the Board of Directors, of the Company or... -

Page 48

... discretion to (A) determine the key employees and members of the Board of Directors (including Non-management Directors) to whom and the times and the prices at which Awards shall be granted, (B) determine the type of Award to be granted and the number of Shares subject thereto, (C) determine the... -

Page 49

... their initial election to the Board of Directors, each Non-management Director shall receive a pro-rata portion of an Annual Non-management Director Award based on a fraction, the numerator of which is the number of days remaining until the next scheduled Annual Meeting Date and the denominator of... -

Page 50

...All key employees and members of the Board of Directors of the Company or its Affiliates shall be eligible to receive Awards hereunder. The Committee, in its sole discretion, shall determine whether an individual qualifies as a key employee. 6. Shares Subject to Plan. The aggregate maximum number of... -

Page 51

...of the Federal Reserve Board. Furthermore, the Committee may provide in an Option Document issued to an employee (and shall provide in the case of Option Documents issued to Non-management Directors) that payment may be made all or in part in shares of the Company's Common Stock held by the Optionee... -

Page 52

... upon official notice of issuance) upon each stock exchange upon which outstanding Shares of such class at the time of the Award are listed nor until there has been compliance with such laws or regulations as the Company may deem applicable, including without limitation registration or qualification... -

Page 53

...permit or require a Participant to defer receipt of the payment of cash or the delivery of Shares that would otherwise be due to the Participant in connection with any Restricted Stock grant as phantom units . The Committee shall establish rules and procedures for any such deferrals, consistent with... -

Page 54

... to elect directors of the Surviving Corporation (the "Parent Corporation"), is represented by the Company's Voting Securities that were outstanding immediately prior to such Business Combination (or, if applicable, is represented by shares into which the Company's Voting Securities were converted... -

Page 55

... actions with respect to any or all outstanding Awards, without the consent of any Optionee or Participant: (i) the Committee may require that Optionees surrender their outstanding Options in exchange for one or more payments by the Company, in cash or Shares as determined by the Committee, in an... -

Page 56

... to the Plan shall not be construed to imply or to constitute evidence of any agreement, express or implied, on the part of the Company or any Affiliate to retain the Optionee or Participant in the employ of the Company or an Affiliate and/or as a member of the Company's Board of Directors or in... -

Page 57

... and restated as of June 24, 2009) The Pep Boys - Manny, Moe & Jack, a Pennsylvania corporation (the "Company"), previously established, effective January 29, 1989, an Annual Incentive Bonus Plan (the "Plan") for the benefit of officers of the Company who were eligible to participate as provided... -

Page 58

... the right to change Award Periods, to determine the time or times of paying Bonuses, to establish and approve Company and individual performance goals and the relative weightings of the goals, and to establish such other measures as may be necessary to meet the objectives of the Plan. In particular... -

Page 59

...each Award Period the Compensation Committee will establish minimum, target and maximum performance goals for the Company using one or more of the following business criteria (the "Company Performance Measures"): (1) return on total stockholder equity; (2) earnings per share of Common Stock; (3) net... -

Page 60

... has the authority to recommend to the Board of Directors payments to any of the Eligible Employees, in cash or otherwise, based on performance measures or otherwise, other than Bonuses under this Plan to Participants. 8. Special Rules for Qualified Performance -Based Compensation (a) The maximum... -

Page 61

... discharge a Participant from employment at any time for any reason whatsoever, with or without cause. (b) The Company may withhold from any amounts payable under the Plan such Federal, state or local taxes as may be required to be withheld pursuant to any applicable law or regulation. (c) It is the... -

Page 62

-

Page 63

... proxy statement, which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the Company's fiscal year, for the Company's Annual Meeting of Shareholders 2009 are incorporated by reference into Part III of this Form 10-K. -

Page 64

...Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions and Director Independence ...Principal Accounting Fees and Services ...89 89 89 89 89 Market... -

Page 65

... the PEP BOYS EXPRESS stores average approximately 9,500 square feet. The Company believes that its unique SUPERCENTER format offers the broadest capabilities in the industry and positions the Company to gain market share and increase its profitability by serving ''do-it-for-me'' DIFM (service labor... -

Page 66

As of January 31, 2009 the Company operated its stores in 35 states and Puerto Rico. The following table indicates, by state, the number of stores the Company had in operation at the end of each of the last five fiscal years, and the number of stores opened and closed by the Company during each of ... -

Page 67

... automotive repair and maintenance service (except body work) and installs tires, hard parts and accessories. Each Pep Boys SUPERCENTER and PEP BOYS EXPRESS store carries a similar product line, with variations based on the number and type of cars in the markets where the store is located. A full 3 -

Page 68

...inventory at a typical SUPERCENTER includes an average of approximately 23,000 items (approximately 21,000 items at a PEP BOYS EXPRESS store). The Company's product lines include: tires (not stocked at PEP BOYS EXPRESS stores); batteries; new and remanufactured parts for domestic and import vehicles... -

Page 69

... and commercial credit accounts. The Company does not experience significant seasonal fluctuation in the generation of its revenues. STORE OPERATIONS AND MANAGEMENT All Pep Boys stores are open seven days a week. Each SUPERCENTER has a Retail Manager and Service Manager (PEP BOYS EXPRESS STORES only... -

Page 70

... of batteries, tires and used lubricants, and the ownership and operation of real property. EMPLOYEES At January 31, 2009, the Company employed 18,458 persons as follows: Description Full-time % Part-time % Total % Retail ...Service Center ...STORE TOTAL ...Warehouses ...Offices ...TOTAL EMPLOYEES... -

Page 71

...references only. Copies of our SEC reports are also available free of charge from our investor relations department. Please call 215-430-9720 or write Pep Boys, Investor Relations, 3111 West Allegheny Avenue, Philadelphia, PA 19132. EXECUTIVE OFFICERS OF THE COMPANY The following table indicates the... -

Page 72

...parent company of Big O Tires, Tire Kingdom and National Tire & Battery. Mr. Fee has over 20 years experience in operations and human resources in the tire and automotive service and repair business. Scott A. Webb, Senior Vice President-Merchandising & Marketing, joined the Company in September 2007... -

Page 73

... our financial statements. Risks Related to Pep Boys We may not be able to successfully implement our business strategy, which could adversely affect our business, financial condition, results of operations and cash flows. In fiscal year 2007, we adopted our long-term strategic plan, which includes... -

Page 74

...Do-It-Yourself'' customers, such as generators, power tools and canopies. Do-It-For-Me Service Labor • regional and local full service automotive repair shops; • automobile dealers that provide repair and maintenance services; • national and regional (including franchised) tire retailers that... -

Page 75

... conditions, consumers may opt to purchase new vehicles rather than service the vehicles they currently own and replace worn or damaged parts; • gas prices-as increases in gas prices may deter consumers from using their vehicles; and • travel patterns-as changes in travel patterns may cause... -

Page 76

..., approximately 300,000 square foot corporate headquarters in Philadelphia, Pennsylvania. The Company also owns the following administrative regional offices- approximately 4,000 square feet of space in each of Melrose Park, Illinois and Bayamon, Puerto Rico as well as a 1,700 square foot space in... -

Page 77

...from the Company as part of an investigation to determine whether the Company had violated, and is in violation of, the Clean Air Act and its non-road engine regulations. The information requested concerned certain generator and personal transportation merchandise offered for sale by the Company. In... -

Page 78

...New York Stock Exchange under the symbol ''PBY''. There were 5,261 registered shareholders as of April 3, 2009. The following table sets forth for the periods listed, the high and low sale prices and the cash dividends paid on the Company's common stock. MARKET PRICE PER SHARE Market Price Per Share... -

Page 79

STOCK PRICE PERFORMANCE The following graph compares the cumulative total return on shares of Pep Boys Stock over the past five years with the cumulative total return on shares of companies in (1) the Standard & Poor's SmallCap 600 Index, (2) the S&P 600 Specialty Stores Index and (3) the S&P 600 ... -

Page 80

... from Merchandise Sales includes the cost of products sold, buying, warehousing and store occupancy costs. Gross Profit from Service Revenue includes the cost of installed products sold, buying, warehousing, service payroll and related employee benefits and occupancy costs. Occupancy costs include... -

Page 81

... aftermarket, with 562 locations, housing 5,845 service bays, located throughout 35 states and Puerto Rico. All of our stores feature the nationally recognized Pep Boys brand name, established through more than 85 years of providing high-quality automotive merchandise and services, and are company... -

Page 82

... Company's defined benefit executive supplemental retirement plan in the current year and to repay borrowings under our revolving credit facility and for general corporate purposes in the prior year. Our primary capital requirements are for new stores and for maintenance capital expenditures related... -

Page 83

...$9,304, FIN 48 liabilities and asset retirement obligations. We made voluntary contributions of $19,918; $440 and $504, to our pension plans in fiscal 2008, 2007 and 2006, respectively. Future plan contributions are dependent upon actual plan asset returns and interest rates. See Note 10 of Notes to... -

Page 84

... the portion of the related interest rate swap that is no longer designated as a hedge. As of January 31, 2009, the number of stores which collateralize the Senior Secured Term Loan was reduced to 101 properties. The outstanding balance under the Term loan at the end of fiscal year 2008 was $150,794... -

Page 85

... 6.25% at January 31, 2009. Fees based on the unused portion of the facility range from 37.5 to 75.0 basis points. As of January 31, 2009, current borrowings under the facility were $23,862,000. The weighted average interest rate on borrowings during the fiscal years 2008 and 2007 were 5.8% and 7.51... -

Page 86

...index or rate are included in our minimum lease payment calculations. Total operating lease commitments as of January 31, 2009 were $777,957,000. Pension and Retirement Plans We have a defined benefit pension plan covering our full-time employees hired on or before February 1, 1992. The Company also... -

Page 87

... $19,918,000 to our pension plans to fund the retirement obligations and for the termination of the defined benefit portion of the SERP. Based upon the current funded status of the defined benefit pension plan, we do not expect to make any cash contributions in fiscal year 2009. See Note 10 of Notes... -

Page 88

.... (2) Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits and service center occupancy costs. Occupancy costs include utilities, rents, real estate and... -

Page 89

... at its new location, it is added back into our comparable sales store base. Square footage increases are infrequent and immaterial and, accordingly are not considered in our calculations of comparable sales data. In late fiscal year 2007 and the first half of fiscal year 2008, as part of our... -

Page 90

...11.0% in fiscal year 2007. Gross profit dollars from service revenue declined by 41.5% in fiscal year 2008 or $17,681,000 from fiscal year 2007. The prior year included a $1,849,000 asset impairment charge related to the closure of 20 closed stores while the current year included an additional asset... -

Page 91

...at its new location, it is added back into our comparable sales store base. Square footage increases are infrequent and immaterial and, accordingly are not considered in our calculations of comparable sales data. Gross profit from merchandise sales decreased, as a percentage of merchandise sales, to... -

Page 92

...from Retail Sales includes the cost of products sold, buying, warehousing and store occupancy costs. (4) Gross Profit from Service Center Revenue includes the cost of installed products sold, buying, warehousing, service center payroll and related employee benefits and service center occupancy costs... -

Page 93

...-going basis, management evaluates its estimates and judgments, including those related to customer incentives, product returns and warranty obligations, bad debts, inventories, income taxes, financing operations, restructuring costs, retirement benefits, share-based compensation, risk participation... -

Page 94

... are key assumptions including discount rates, expected return on plan assets, mortality rates and merit and promotion increases. We are required to consider current market conditions, including changes in interest rates, in selecting these assumptions. Changes in the related pension costs or... -

Page 95

...) of pension and other postretirement benefit plans; • Recognize, through comprehensive income, certain changes in the funded status of a defined benefit and post retirement plan in the year in which the changes occur; • Measure plan assets and benefit obligations as of the end of the employer... -

Page 96

... 3, 2008. In June 2007, the FASB ratified EITF Issue Number 06-11, ''Accounting for Income Tax Benefits of Dividends on Share-Based Payment Awards'' (EITF 06-11). EITF 06-11 applies to share-based payment arrangements with dividend protection features that entitle employees to receive (a) dividends... -

Page 97

In December 2007, the FASB issued SFAS No. 160, ''Noncontrolling Interests in Consolidated Financial Statements-an amendment of ARB No. 51'' (SFAS No. 160). SFAS No. 160, among other things, provides guidance and establishes amended accounting and reporting standards for a parent company's ... -

Page 98

... Company has a Senior Secured Term Loan facility with a balance of $150,794,000 at January 31, 2009, that bears interest at three month LIBOR plus 2.00%, and $1,809,000 of equipment operating leases which have lease payments that vary based on changes in LIBOR. A one percent change in the LIBOR rate... -

Page 99

... fixed rate debt by using quoted market prices and current interest rates. Interest Rate Swaps On June 3, 2003, the Company entered into an interest rate swap for a notional amount of $130,000,000. The Company had designated the swap as a cash flow hedge of the Company's real estate master operating... -

Page 100

... for Defined Benefit Pension and Other Postretirement Plans, as of February 4, 2007 and February 3, 2007, respectively. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as... -

Page 101

... BALANCE SHEETS The Pep Boys-Manny, Moe & Jack and Subsidiaries (dollar amounts in thousands, except share data) January 31, 2009 February 2, 2008 ASSETS Current Assets: Cash and cash equivalents ...Accounts receivable, less allowance for $1,937 ...Merchandise inventories ...Prepaid expenses... -

Page 102

... The Pep Boys-Manny, Moe & Jack and Subsidiaries (dollar amounts in thousands, except share data) January 31, 2009 February 2, 2008 February 3, 2007 Year ended Merchandise Sales ...Service Revenue ...Total Revenues ...Costs of Merchandise Sales ...Costs of Service Revenue ...Total Costs of... -

Page 103

... Loss: Net loss ...Changes in net unrecognized other postretirement benefit costs, net of tax ...Fair market value adjustment on derivatives, net of tax . . Total Comprehensive Loss ...Cash dividends ($.27 per share) ...Effect of stock options and related tax benefits Effect of restricted... -

Page 104

... ...Excess tax benefits from stock based awards ...Increase in cash surrender value of life insurance policies ...Changes in operating assets and liabilities: Decrease (increase) in accounts receivable, prepaid expenses and other ...(Increase) decrease in merchandise inventories ...(Decrease... -

Page 105

... POLICIES BUSINESS The Pep Boys-Manny, Moe & Jack and subsidiaries (the ''Company'') is engaged principally in automotive repair and maintenance and in the sale of automotive tires, parts and accessories through a chain of stores. The Company currently operates stores in 35 states and Puerto Rico... -

Page 106

... the time the merchandise is sold. Service revenues are recognized upon completion of the service. The Company records revenue net of an allowance for estimated future returns. The Company establishes reserves for sales returns and allowances based on current sales levels and historical return rates... -

Page 107

... funds. Typically, these funds are dependent on purchase volumes. The amounts received are subject to changes in market conditions, vendor marketing strategies and changes in the profitability or sell-through of the related merchandise for the Company. The Company accounts for vendor support funds... -

Page 108

...Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits, service center occupancy costs and cost of providing free or discounted towing services to our customers... -

Page 109

...and incremental shares that would have been outstanding upon the assumed exercise of dilutive stock options. During fiscal year 2008, no convertible notes were outstanding. ACCOUNTING FOR STOCK-BASED COMPENSATION At January 31, 2009, the Company has two stock-based employee compensation plans, which... -

Page 110

... the options, the Company has utilized the ''simplified method'' allowable under the Securities and Exchange Commission, or SEC, Staff Accounting Bulletin No. 107, ''Share-Based Payment'' through December 31, 2007 and changed to an actual experience method during fiscal year 2008. The risk-free rate... -

Page 111

...data) DIFM lines of business. The Company aggregates all of its operating segments and has one reportable segment. Sales by major product categories are as follows: Year ended Jan. 31, 2009 Feb. 2, 2008 Feb. 3, 2007 Parts and Accessories ...Tires ...Total Merchandise Sales ...Service Labor ...Total... -

Page 112

... 3, 2008. In June 2007, the FASB ratified EITF Issue Number 06-11, ''Accounting for Income Tax Benefits of Dividends on Share-Based Payment Awards'' (EITF 06-11). EITF 06-11 applies to share-based payment arrangements with dividend protection features that entitle employees to receive (a) dividends... -

Page 113

... Company. In December 2007, the FASB issued SFAS No. 160, ''Noncontrolling Interests in Consolidated Financial Statements-an amendment of ARB No. 51'' (SFAS No. 160). SFAS No. 160, among other things, provides guidance and establishes amended accounting and reporting standards for a parent company... -

Page 114

...''. The FASB concluded that all outstanding unvested share-based payment awards that contain rights to non-forfeitable dividends participate in undistributed earnings with common shareholders. Under SFAS No. 128, restricted shares are better termed non-vested and are accounted for under SFAS No. 123... -

Page 115

... the portion of the related interest rate swap that is no longer designated as a hedge. As of January 31, 2009, the number of stores which collateralize the Senior Secured Term Loan was reduced to 101 properties. The outstanding balance under the Term loan at the end of fiscal year 2008 was $150,794... -

Page 116

...) Years ended January 31, 2009, February 2, 2008 and February 3, 2007 (dollar amounts in thousands, except share data) payments and an additional payment to release a store from the collateral pool to allow it to be sold to an unrelated third party. Senior Subordinated Notes due December, 2014... -

Page 117

... sum of debt service charges and restricted payments made. The failure to satisfy this covenant would constitute an event of default under the Company's revolving credit agreement, which would result in a cross-default under the Company's 7.5% Senior Subordinated Notes and Senior Secured Term Loan... -

Page 118

... On November 27, 2007, the Company sold the land and buildings for 34 owned properties to an independent third party. Net proceeds from this sale were $162,918. Concurrent with the sale, the Company entered into agreements to lease the stores back from the purchaser over minimum lease terms... -

Page 119

... year's rentals. The second through the fourth renewal options are at fair market rents. The Company discounted the minimum lease payments, reflecting escalation amounts, during the initial term of 15 years using its then incremental borrowing rate. For properties where the value of the land was... -

Page 120

... year's rentals. The second through the fourth renewal options are at fair market rents. The Company discounted the minimum lease payments, reflecting escalation amounts, during the initial term of 15 years using its then incremental borrowing rate. For properties where the value of the land was... -

Page 121

... flexible employee benefits trust with the intention of purchasing up to $75,000 worth of the Company's common shares. The repurchased shares will be held in the trust and will be used to fund the Company's existing benefit plan obligations including healthcare programs, savings and retirement plans... -

Page 122

... an $840 asset impairment charge principally related to one store location. Earlier during fiscal year 2007, the Company closed 2 stores in addition to the 31 low-return stores. During fiscal year 2008, the Company did not close any stores, however, the Company did record $5,353 of asset impairment... -

Page 123

... In accordance with SFAS No.144, the Company's discontinued operations reflect the operating results for 11 of the 31 low-return stores closed as part of the Company's long term strategic plan adopted in 2007. The remaining 20 stores' operating results are reflected in continuing operations... -

Page 124

... disposal'' when (i) the Company has committed to a plan to sell the store location, (ii) the store location is vacant and is available for sale, (iii) the Company is actively marketing the store location for sale, (iv) the sale price is reasonable in relation to its current fair value and (v) the... -

Page 125

... by certain of the Company's direct and indirectly wholly-owned subsidiaries-namely, The Pep Boys Manny Moe & Jack of California, The Pep Boys-Manny Moe & Jack of Delaware, Inc., The Pep Boys-Manny Moe & Jack of Puerto Rico, Inc. and PBY Corporation, (collectively, the ''Subsidiary Guarantors... -

Page 126

..., except share data) CONDENSED CONSOLIDATING BALANCE SHEET As of January 31, 2009 Pep Boys Subsidiary Guarantors Subsidiary NonGuarantors Consolidation/ Elimination Consolidated ASSETS Current Assets: Cash and cash equivalents . Accounts receivable, net . . Merchandise inventories . . Prepaid... -

Page 127

... February 3, 2007 (dollar amounts in thousands, except share data) CONDENSED CONSOLIDATING BALANCE SHEET As of February 2, 2008 Pep Boys Subsidiary Guarantors Subsidiary NonGuarantors Consolidation/ Elimination Consolidated ASSETS Current Assets: Cash and cash equivalents . Accounts receivable, net... -

Page 128

...2008 and February 3, 2007 (dollar amounts in thousands, except share data) CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS Subsidiary Guarantors Subsidiary NonGuarantors Consolidation/ Elimination Year ended January 31, 2009 Pep Boys Consolidated Merchandise Sales ...$ 531,068 $1,038,596 Service... -

Page 129

...2008 and February 3, 2007 (dollar amounts in thousands, except share data) CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS Subsidiary Guarantors Subsidiary NonGuarantors Consolidation/ Elimination Year ended February 2, 2008 Pep Boys Consolidated Merchandise Sales ...$ 600,611 $1,148,967 Service... -

Page 130

...2008 and February 3, 2007 (dollar amounts in thousands, except share data) CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS Subsidiary Guarantors Subsidiary NonGuarantors Consolidation/ Elimination Year ended February 3, 2007 Pep Boys Consolidated Merchandise Sales ...$ 645,873 $1,207,204 Service... -

Page 131

...464 - Excess tax benefits from stock based awards ...(3) - Increase in cash surrender value of life insurance policies ...100 - Changes in operating assets and liabilities: Decrease in accounts receivable, prepaid expenses and other ...17,926 2,211 Increase in merchandise inventories ...(328) (3,451... -

Page 132

... from subsidiary ...Excess tax benefits from stock based awards ...Increase in cash surrender value of life insurance policies . . Changes in operating assets and liabilities: (Increase) decrease in accounts receivable, prepaid expenses and other ...Increase in merchandise inventories ...Decrease in... -

Page 133

...tax benefits from stock based awards ...Increase in cash surrender value of life insurance policies ...Changes in operating assets and liabilities: Decrease (increase) in accounts receivable, prepaid expenses and other ...Increase (decrease) in merchandise inventories ...Increase in accounts payable... -

Page 134

...full-time employees hired on or before February 1, 1992. Normal retirement age is 65. Pension benefits are based on salary and years of service. The Company's policy is to fund amounts as are necessary on an actuarial basis to provide assets sufficient to meet the benefits to be paid to plan members... -

Page 135

...fair value of plan assets and funded status of the Company's defined benefit plans: Year ended January 31, 2009 February 2, 2008 Measurement Date ...Change in Benefit Obligation: Benefit obligation at beginning of year Service cost ...Interest cost ...Plan amendment ...FAS 158 change in measurement... -

Page 136

... were used by the Company to determine pension expense and to present disclosure benefit obligations: January 31, 2009 February 2, 2008 February 3, 2007 Weighted-Average Assumptions: Measurement date ...Discount rate ...Rate of compensation increase ...Weighted-Average Assumptions for Benefit Cost... -

Page 137

... and February 3, 2007 (dollar amounts in thousands, except share data) Equity securities include Pep Boys common stock in the amounts of $200 (0.6% of total plan assets) and $640 (1.7% of total plan assets) at January 31, 2009 and February 2, 2008, respectively. Benefit payments, including amounts... -

Page 138

...weighted average number of shares outstanding during the period. Adjustments for the stock options were anti-dilutive in fiscal years 2008, 2007 and 2006 and therefore excluded from the calculation due to the Company's net loss for the year. Additionally, adjustments for the convertible senior notes... -

Page 139

...applicable to future stock option and RSU grants under the 1999 plan are generally determined by the Board of Directors; provided that the exercise price of stock options must be at least 100% of the quoted market price of the common stock on the grant date. The Company currently satisfies all share... -

Page 140

... respectively. At January 31, 2009, the weighted average remaining contractual term and aggregate intrinsic value of outstanding and expected to vest options is 5.9 years and $0. The cash received and related tax benefit realized from options exercised during fiscal 2008 was $23 and $9, respectively... -

Page 141

... $7,346 (380) (99) 263 $7,130 Asset retirement obligation, January 31, 2009 ...NOTE 14-INCOME TAXES The (benefit) provision for income taxes includes the following: January 31, 2009 Year ended February 2, 2008 February 3, 2007 Current: Federal ...State ...Foreign ...Deferred: Federal(a) . State... -

Page 142

..., except share data) A reconciliation of the statutory federal income tax rate to the effective rate of the benefit for income taxes follows: January 31, 2009 Year ended February 2, 2008 February 3, 2007 Statutory tax rate ...State income taxes, net of federal tax Job credits ...Changes in state... -

Page 143

...2, 2008 Deferred tax assets: Employee compensation ...Store closing reserves ...Legal ...Benefit accruals ...Net operating loss carryforwards-Federal Net operating loss carryforwards-State . . Tax credit carryforwards ...Accrued leases ...Interest rate derivatives ...Deferred gain on sale leaseback... -

Page 144

... Puerto Rico jurisdictions. The Company's U.S. federal returns for tax years 2004 and forward are subject to examination. The federal audit of tax years 2001, 2002 and 2003 was closed during the second quarter of fiscal year 2007 resulting in the recognition of a $4,227 additional income tax benefit... -

Page 145

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 31, 2009, February 2, 2008 and February 3, 2007 (dollar amounts in thousands, except share data) effective tax rate. The Company is undergoing examinations of its tax returns in... -

Page 146

...$320,000 senior secured notes. The interest rate swap converts the variable LIBOR portion of the interest payments to a fixed rate of 5.036% and terminates in October 2013. The Company did not meet the documentation requirements of SFAS No.133, at inception or as of February 3, 2007 and, accordingly... -

Page 147

....'' The Company values this swap using observable market data to discount projected cash flows and for credit risk adjustments. The inputs used to value our derivative fall within Level 2 of the fair value hierarchy. Cash Equivalents: Cash equivalents, other than credit card receivables, include... -

Page 148

... items. LONG-TERM DEBT INCLUDING CURRENT MATURITIES Interest rates that are currently available to the Company for issuance of debt with similar terms and remaining maturities are used to estimate fair value for debt issues that are not quoted on an exchange. The estimated fair value of long-term... -

Page 149

... changes: (i) hiring staff and providing additional accounting research resources, (ii) improving process documentation and (iii) improving the review process by more senior accounting personnel. As of January 31, 2009, the Company believes that its ongoing efforts to hire and train additional... -

Page 150

... of The Pep Boys-Manny, Moe and Jack (the Company) is responsible for establishing and maintaining adequate internal control over financial reporting. The Company's internal control over financial reporting is a process designed under the supervision of the Company's principal executive officer and... -

Page 151

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of The Pep Boys-Manny, Moe & Jack Philadelphia, Pennsylvania We have audited the internal control over financial reporting of The Pep Boys-Manny, Moe & Jack and subsidiaries (the ''Company'') as of January 31, 2009, based... -

Page 152

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the year ended January 31, 2009 of the Company and our report dated April 14, 2009 expressed an unqualified opinion on those... -

Page 153

... ''Investor Relations-Corporate Governance'' section of our website. As required by the New York Stock Exchange (NYSE), promptly following our 2008 Annual Meeting, our Interim CEO certified to the NYSE that he was not aware of any violation by Pep Boys of NYSE corporate governance listing standards... -

Page 154

... SCHEDULES (a) The following documents are filed as part of this report: Page 1. The following consolidated financial statements of The Pep Boys-Manny, Moe & Jack are included in Item 8 Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets-January 31, 2009... -

Page 155

... Purchase Plan dated January 4, 1990 Medical Reimbursement Plan of the Company (4.1) (4.2) (4.3) (10.1)* (10.2)* Form of Change of Control between the Company and certain officers of the Company. Form of Non-Competition Agreement between the Company and certain officers of the Company. The Pep... -

Page 156

...restatement as of September 3, 2002 of The Pep Boys Savings Plan-Puerto Rico. The Pep Boys Deferred Compensation Plan, as amended and restated The Pep Boys Annual Incentive Bonus Plan (amended and restated as of December 9, 2003) Account Plan Flexible Employee Benefits Trust (10.14)* (10.15)* (10... -

Page 157

(23) (31.1) (31.2) (32.1) Consent of Independent Registered Public Accounting Firm Certification of Principal Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 Certification of Principal Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 Principal ... -

Page 158

... DATED: APRIL 15, 2009 /s/ RAYMOND L. ARTHUR Raymond L. Arthur Executive Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 159

SIGNATURE CAPACITY DATE /s/ JOHN T. SWEETWOOD John T. Sweetwood /s/ NICK WHITE Nick White /s/ JAMES A. WILLIAMS James A. Williams Director April 15, 2009 Director April 15, 2009 Director April 15, 2009 95 -

Page 160

... to Costs and Other Expenses Accounts(2) Deductions(3) (in thousands) Column E Balance at End of Period SALES RETURNS AND ALLOWANCES: Year Ended January 31, 2009 ...Year Ended February 2, 2008 ...Year Ended February 3, 2007 ...(2) Additions charged to merchandise sales. (3) Actual returns and... -

Page 161

...2008 2007 2006 (in thousands, except ratios) January 29, 2005 Interest ...Interest factor in rental expense ...Capitalized interest ...(a) Fixed charges, as defined ...(Loss) Earnings from continuing operations before income taxes and cumulative effect of change in accounting... interest costs) plus... -

Page 162

...SFAS'') No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, as of February 4, 2007 and February 3, 2007, respectively, and our report dated April 14, 2009 (which report expresses an unqualified opinion on the effectiveness of the Company's internal control over... -

Page 163

... 31.1 CERTIFICATION PURSUANT TO RULES 13a-14(a) AND 15d-14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, Michael R. Odell, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack... -

Page 164

...management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: April 15, 2009 by: /s/ RAYMOND L. ARTHUR Raymond L. Arthur Executive Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer... -

Page 165

... with this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack (the ''Company'') for the year ended January 31, 2009, as filed with the Securities and Exchange Commission on the date hereof (the ''Report''), I, Michael R. Odell, Principal Executive Officer of the Company, certify, pursuant... -

Page 166

... with this Annual Report on Form 10-K of The Pep Boys-Manny, Moe & Jack (the ''Company'') for the year ended January 31, 2009, as filed with the Securities and Exchange Commission on the date hereof (the ''Report''), I, Raymond L. Arthur, Executive Vice President and Chief Financial Officer of the... -

Page 167

..., Parts Sanjay Sood, Controller Robert H. Hotz Senior Managing Director, Houlihan Lokey Howard & Zukin Michael R. Odell Chief Executive Officer, Pep Boys Dr. Irvin D. Reid President Emeritis and Eugene Applebaum Professor, Community Relations, Wayne State University Jane Scaccetti, CPA CEO... -

Page 168

3111 West Allegheny Avenue • Philadelphia, PA 19132